As the next summit of the BRICS (Brazil, Russia, India, China, and South Africa) nations approaches, Robert Kiyosaki, the author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ has reiterated his prognosis of doom for the United States dollar and praised Bitcoin (BTC) as an alternative.

Specifically, the renowned investor discussed the devaluation of the USD and the role of Bitcoin in today’s financial landscape with Miguel Munoz and Charlie Engler, co-founders of educational platforms Cultivate Crypto and Doghouse Crypto, respectively, in an episode of his podcast streamed on August 2.

Fake money vs. Bitcoin

According to Kiyosaki, “the reason why poor people are poor is because they don’t know real money from fake money (…), and the biggest fake thing is the US dollar.” He also admitted he was not always enthusiastic about Bitcoin and that now he wished he had bought more. As he explained:

“I own 60 BTC. I know nothing beyond that, I bought them at $6,000 each (…), and the reason I bought them is not because I’m a crypto expert. I’m a trader (…), and when Bitcoin first hit a high of about $20,000 and retraced back down to $100, I said, ‘ah, it’s gone,’ but when it kept coming back and hit $6,000, I said, ‘I think it’s here to stay.’”

Furthermore, he praised the crypto industry, particularly Bitcoin, as the “biggest hedge against criminal money,” stressing its importance following “one of the biggest changes in the world history” that he believes will take place on August 22 in Johannesburg, i.e., the next BRICS meeting.

In his view, during this summit, the BRICS nations, together with Saudi Arabia and possibly Mexico and Japan, are going to “get behind the cryptocurrency backed by gold,” in which case he assumes that the “US dollar is toast.”

De-dollarization

Indeed, Kiyosaki has recently shared his expectation that the BRICS summit in August will mark the beginning of the “de-dollarization” of the world, as “approximately 41 nations, possibly even France,” would “gang up” against the US fiat currency.

As the finance educator said earlier, investing in gold, silver, and the flagship decentralized finance (DeFi) asset was one way to protect oneself from the fallout of the incoming giant crash he believes will “put (the) nail in (the) coffin of fiat money,” Finbold reported.

Meanwhile, he has also asserted his belief that Bitcoin was the “best insurance against high corruption and incompetence” in the government that he believes is rising in the US as the country prepares for a “crash landing” and an “economic tsunami” as the USD loses its position as the global reserve currency.

At the same time, he has projected that the maiden digital asset would reach the price of $120,000 in 2024 as the US dollar “dies” following the BRICS summit in August and “trillions of US $ rush home, bringing “inflation through the roof” as Finbold reported on July 11.

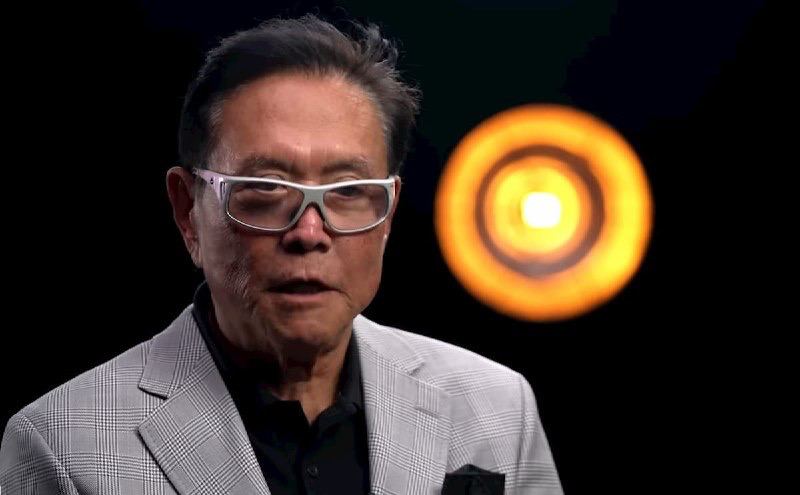

Featured image via Ben Shapiro’s YouTube.

Watch the entire video below:

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.