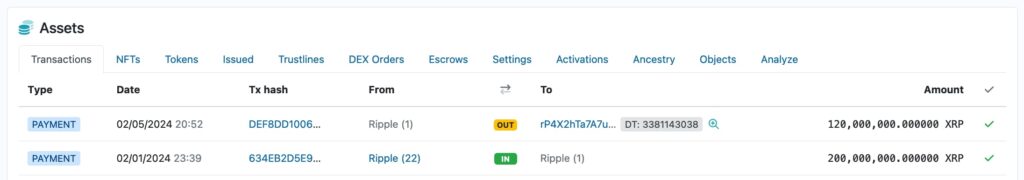

Ripple reserved 200 million XRP ($100 million) for its treasury following February’s 1 billion tokens unlock. On February 5, the company first moved to sell over half of this month’s supply inflation, according to onchain data.

Notably, the sell-off followed a similar pattern to movements observed in the past. However, it started with a transaction worth $60 million in 120 million XRP tokens, the highest initial monthly payment since February 2023.

‘Ripple (1)’, Ripple’s known treasury account, sent the tokens to ‘rP4X2…sKxv3’ just five days after unlocking them. This is the same address where the company sent its sell-offs in previous months.

As of writing, Ripple still holds 80 million XRP from February’s unlock.

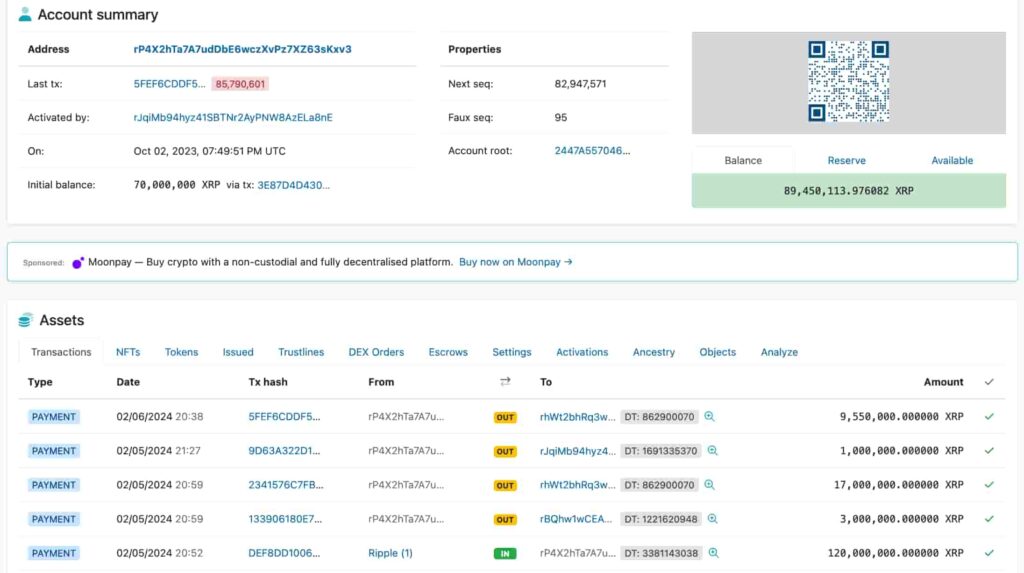

What happened to Ripple’s 120 million XRP paid to ‘rP4X2…sKxv3’?

After receiving Ripple’s payment, ‘rP4X2…sKxv3’ transacted with three other accounts. It first sent 3 million XRP to ‘rBQhw…vZkN5’ and 17 million to ‘rhWt2…E32hk’ at 8:59 pm (UTC). Later on the same day, ‘rJqiM…La8nE’ received 1 million XRP.

On February 6, ‘rhWt2…E32hk’ received another 9.55 million XRP, for a total of 26.55 million XRP. The original receiver still has 89.45 million XRP ready to dump on cryptocurrency exchanges, worth nearly $45 million.

These tokens could become selling pressure in the markets at any moment, impacting XRP’s price.

It is important to understand that Ripple usually liquidates their holdings in strategic moments. Essentially, the sell-offs represent a relevant weight of the token’s 24-hour trading volume, capable of influencing short-term price action.

Recently, the institution’s Co-founder and Executive Chairman, Chris Larsen, lost $112 million worth of XRP due to a hack. The token’s price reacted negatively to the expectation of a sell-off, which had a similar nominal value to this month’s reserves.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.