The “Uptober” is coming to an end while bringing some indicators that suggest a bull market could be starting. In this scenario, Ripple sold over $100 million of 200 million XRP amid a shy recovery of the token’s price while disclosing a $10 million donation to Kamala Harris.

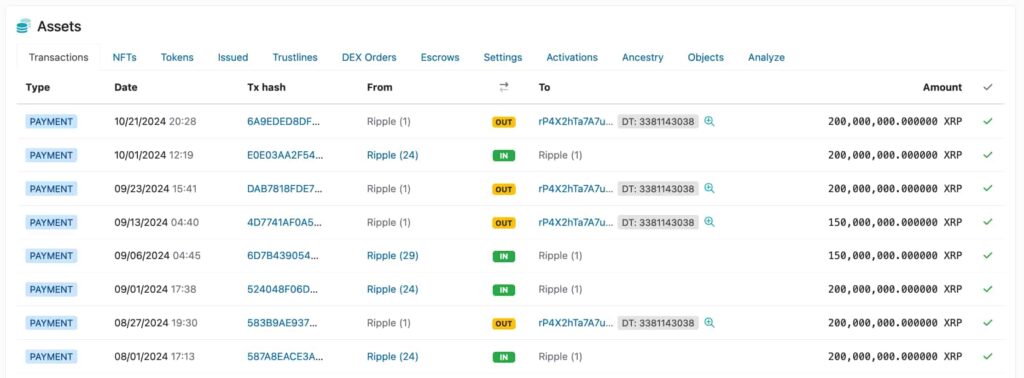

On October 21, Ripple spent all the 200 million XRP reserved in its treasury account for this month’s sales. The amount was sent to the unknown address ‘rP4X2hTa7A7udDbE6wczXvPz7XZ63sKxv3,’ which is Ripple’s usual destination for its monthly transactions.

While Ripple has not disclosed this sale, in particular, the company has already disclosed its selling model on many occasions. According to sources, its XRP sales go through an On-Demand Liquidity (ODL) model, selling at market price to willing customers.

As seen and reported in previous months, Ripple usually sends the monthly unlocked and reserved XRP tokens from ‘Ripple (1)‘ to the ‘rP4X2h(…)’ address, which relays part or the full amount to other unknown addresses in a few hops before reaching to centralized exchange (CEX) addresses likely sold in the open market.

XRP price analysis

Notably, XRP has been trading in a shy uptrend since October started, or “Uptober,” given this month’s historical positive performance. Ripple’s token crashed from $0.65’s local top on September 29 to as low as $0.514 on October 3.

Now, XRP trades at $0.541, up 5.25% from this local bottom in a notable but slow-paced upward trajectory. In the last 30 days, the tokens accumulated 9.05% losses, with the most significant drop happening after Ripple’s 1 billion XRP unlock on October 1, as Finbold warned.

Interestingly, Ripple’s 200 million XRP sale happened right after the last spike seen on the chart. Whether caused by the company’s relatively massive sales compared to other chains, XRP has underperformed the crypto market.

Another chain suffering from a recent poor price action is Sui Network (SUI), facing strong selling pressure after unlocking $100 million in SUI and registering an ‘Overbought’ Relative Strength Index (RSI) in different time frames, as Finbold reported.

Ripple’s and XRP’s political context

Besides having higher supply inflation and insider selling activities than most cryptocurrencies, Ripple also positions differently in the political spectrum. Essentially, the company has publicly declared political support for Kamala Harris while the industry mostly sides with Donald Trump.

On October 21, a few hours before the onchain sale of $108 million worth of XRP, Chris Larsen, Ripple co-founder and CEO, disclosed a $10 million donation to Harris’s campaign in the presidential race.

“It’s time for the Democrats to have a new approach to tech innovation, including crypto. I believe Kamala Harris will ensure that American technology dominates the world, which is why I’m donating $10M in XRP in support of her.”

– Chris Larsen

It is possible that the recent sale was part of this donation, diluting XRP investors’ holdings in support of Harris. It is notable that despite the Democrat candidate recently joining Trump in the battle for crypto votes, her proposals – like capital gain taxes – are usually seen as a threat to the industry and innovation in the blockchain space.

Moving forward, Ripple could still add to October’s sell pressure. This was done in previous months with 400 million and 350 million XRP sales. Moreover, the company will unlock another 1 billion tokens on November 1, restarting the monthly cycle all over again.