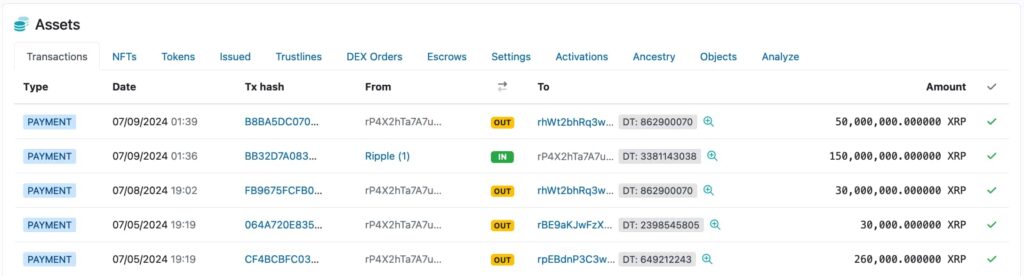

Ripple, the XRP Ledger (XRP) developer and largest holder, spent 150 million XRP from this month’s reserves on July 9. The sale is worth $64.5 million, $13.5 million less than the same activity last month, as reported by Finbold.

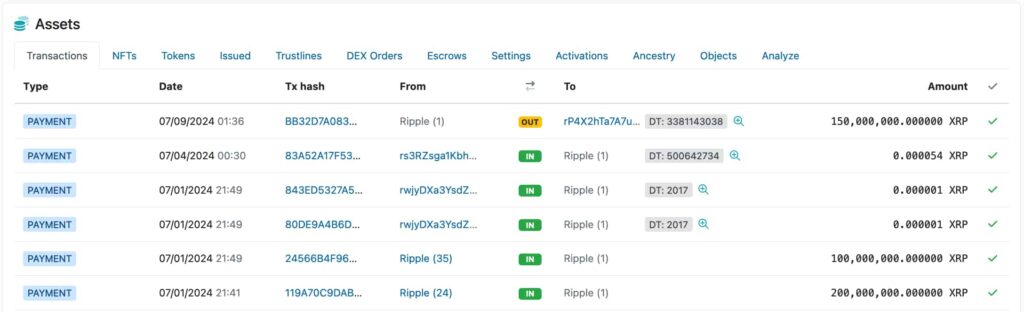

On July 1, the company released 1 billion XRP from the initial distribution, locked in monthly escrows until 2027. Ripple then sent 200 million XRP to its treasury account and relocked the remaining 800 million in new escrows.

Additionally, the ‘Ripple (35)‘ account sent an extra 100 million tokens to the sell-off reserves, totaling 300 million XRP.

As usual, the selling activity resulted from the treasury account, labeled ‘Ripple (1),’ sending tokens to the unlabeled account ‘rP4X2hTa‘. This action causes XRP supply inflation—by putting tokens that have never circulated before into circulation for the first time.

So far, 100 million tokens still remain in the ‘rP4X2hTa’ account. However, 50 million are already left to ‘rhWt2bhR‘, another usual intermediary address, before landing in cryptocurrency exchanges, as has happened in previous months.

XRP price analysis amid Ripple sell-offs

It is noteworthy how Ripple sales directly impact XRP’s price, considering the supply pressure they create on the spot market. Historically, XRP suffered a local crash most of the time Ripple sold its tokens.

Year-to-date, only five of the 14 sell-off days had positive price action: February 5, 11, April 14, May 13, and 20. All nine other days were of local crashes, evidencing the importance of monitoring the company’s activities.

Moreover, XRP had a negative monthly performance in four of the first six months of 2024. So far, Ripple has sold 1.676 billion XRP this year, inflating the supply by 3.10%.

As of this writing, XRP trades at $0.43, down 30% year-to-date and 17% from June 7’s selling activity.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.