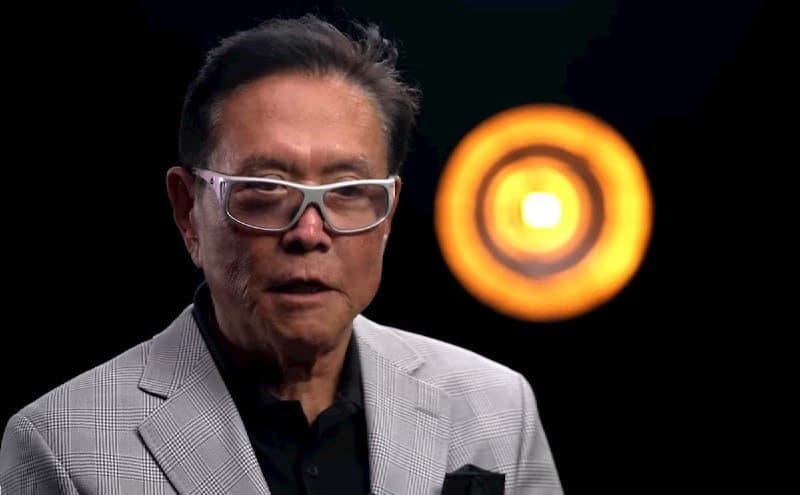

Renowned financial educator and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has expressed an unexpected perspective on the potential crash of Bitcoin (BTC).

Notably, Kiyosaki ranks among the notable backers of Bitcoin, maintaining that the asset can record significant gains in the future despite a section of the market stressing that the cryptocurrency has the potential to plunge to zero.

In this line, in an X (formerly Twitter) post on February 24, Kiyosaki addressed the common question he receives about the possible consequences of a Bitcoin crash, drawing parallels with other precious assets like gold and silver.

Kiyosaki shared his thoughts on the hypothetical scenario of a Bitcoin crash, stating that he would be happy and ready to purchase more of the maiden cryptocurrency once the market turmoil settles. He emphasized his steadfast confidence in the resilience of Bitcoin to rally again in the event it loses its value.

The financial educator further explained his viewpoint by framing market crashes as opportunities for savvy investors. According to him, all market crashes are essentially assets going on “sale,” a sentiment reflected in his concluding statement.

“I am often asked “What happens if Bitcoin crashes?” My reply is the same for Bitcoin, gold, or silver. My reply is “I would be happy and I would buy more, once the crashing stops.” All market crashes are, are assets going on and “sale” is my favorite four letter word,” Kiyosaki said.

Kiyosaki’s bet on Bitcoin

This perspective aligns with Kiyosaki’s long-standing belief in financial education and seizing opportunities during market fluctuations.

It is worth noting that Kiyosaki has maintained that Bitcoin is slated for an all-time high in 2023, citing driving factors such as the diminishing value of the United States dollar. For instance, as reported by Finbold, the author believes that Bitcoin will likely trade at $100,000 by June 2024.

This comes as the investor continues to caution about a possible collapse of the stock market while maintaining that assets such as Bitcoin, gold, and silver are the best bets in such an event, stressing their resilience.

Additionally, Kiyosaki has blamed the Federal Reserve for the current economic situation while urging investors not to focus on the institution. Instead, Kiyosaki has, in the past, advocated for continued investment in Bitcoin and precious metals.