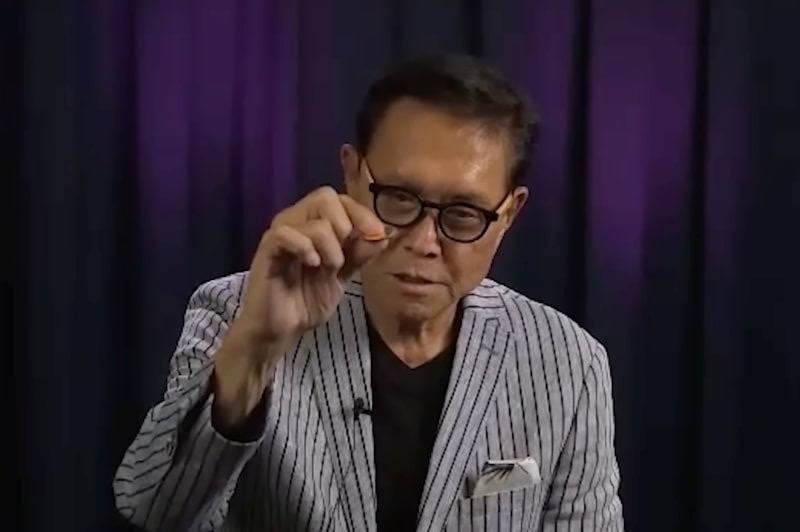

With Bitcoin (BTC) back on its bullish path and even more gains excepted after its April halving, Robert Kiyosaki, the famous investor and author of the bestselling personal finance book ‘Rich Dad Poor Dad,’ said he would be buying more of the maiden cryptocurrency in March.

Specifically, Kiyosaki explained that he was buying “10 more Bitcoin before April” when the halving is happening, adding that he expected the flagship decentralized finance (DeFi) asset to hit the price of $100,000 by September 2024, as per his X post on March 25.

Furthermore, as he pointed out:

“If you can’t afford a whole Bitcoin, you may want to consider buying 1/10 of a coin, via the new ETFs or Satoshis. (…) Almost everyone in the world can afford at least one silver coin or one Bitcoin Satoshi.”

Indeed, the finance educator was referring to the new spot Bitcoin exchange-traded funds, which the United States Securities and Exchange Commission (SEC) finally approved earlier this year, marking an important step for the crypto sector and its acceptance in the mainstream.

‘Poor’ save fiat currency, Bitcoin is ‘smart money’

Moreover, Kiyosaki advised heeding the words of Michael Saylor, the executive chairman of MicroStrategy and prominent Bitcoin advocate, and his views, particularly those shared in a recent interview with Yahoo Finance, in which he referred to people saving fiat currency as “poor.”

As for those who prefer to stay out of Bitcoin, the ‘Rich Dad Poor Dad’ author has a solution: “silver coins, preferably US silver eagles,” as it is “the most affordable for the most people” of the three “smart money” assets that, in his opinion, include Bitcoin, gold, and silver.

“Because the ‘smart money’ knows the US is the biggest debtor nation in the world; China’s property market is ‘toast;’ Japan has been in a depression since 1990; Germany is sliding into a depression, mom and pop consumer are living on credit cards; banks are in trouble; and the world is on the brink of war.”

Robert Kiyosaki’s Bitcoin price prediction

It is also worth mentioning that Robert Kiyosaki has earlier shared his Bitcoin price prediction according to which he saw the original crypto asset as changing hands at a price of $100,000 by June this year, indicating his exceptionally bullish sentiment around it.

However, he later increased his Bitcoin price target for 2024 to a whopping $300,000 in the context of the recent crypto sector rally that saw its largest asset by market capitalization soar to nearly $74,000 and surpass its previous all-time high (ATH) from 2021.

Meanwhile, the price of Bitcoin at press time stood at $66,872, recording a 2.49% gain on the day, dropping 1.29% across the previous week, and making an advance of 31.27% on its monthly chart, according to the most recent data retrieved by Finbold on March 25.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Featured image via The Rich Dad Channel YouTube