As the cryptocurrency community still awaits the conclusion of the courtroom standoff between the United States Securities and Exchange Commission (SEC) and blockchain company Ripple, legal experts have highlighted what seems to be the regulatory watchdog’s unequal approach.

Specifically, law professor J. W. Verret pointed out that the “SEC typically collects 11% of unregistered sales claims, but in Ripple case, they want 300%,” adding that “this is what abuse of power looks like,” as he explained in a post on his X profile BlockProf shared on April 3.

Disproportionate Ripple SEC request

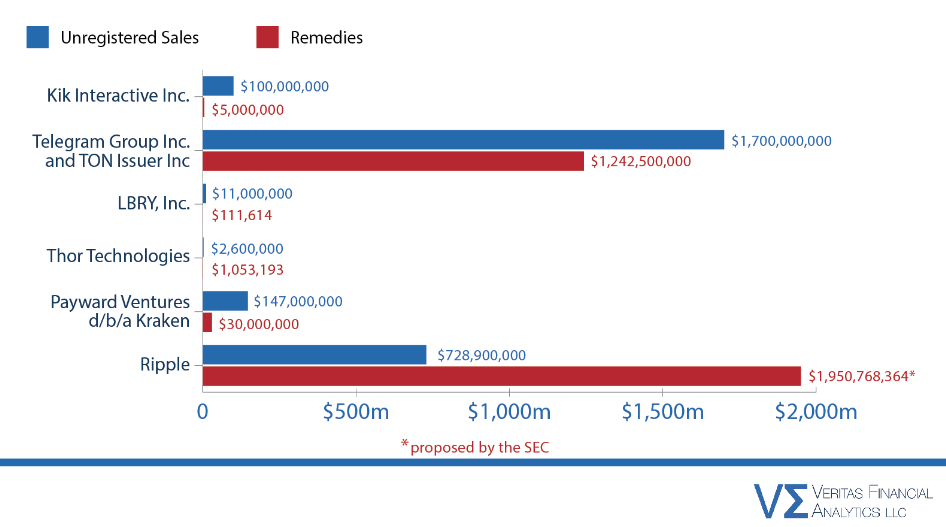

Furthermore, Verret posted a graphic showing the disproportionate amount in legal remedies that the regulator was demanding from Ripple, juxtaposed with what it had collected in other cases, including against Telegram, Kik Interactive, decentralized video-sharing platform LBRY, and crypto exchange Kraken.

Indeed, as the illustration demonstrates, the instant messaging platform Telegram had to pay $1.24 billion in remedies for the $1.7 billion that the court found was unregistered sales. LBRY had to pay only 1%, Kik’s share was a mere 5%, while Kraken paid 20.41%.

On the other hand, the remedies that the SEC has requested in the Ripple case amount to a whopping $2 billion in fines and penalties, which is around 275% more than the $729 million in institutional XRP sales that the court declared were unregistered securities, as Finbold reported on March 26.

At the same time, another legal expert and popular commentator on the Ripple case, Bill Morgan, echoed Verret’s sentiment that such demands were “very abusive,” adding that the “SEC must loathe Ripple for fighting so hard and hold up its plan to control crypto for 3.5 years.”

Meanwhile, the XRP token that has been at the center of the prolonged legal battle was possibly feeling some of the effect of the unfavorable Ripple news, as at press time it was changing hands at $0.5778, recording a decline of 2.46% on the day, adding up to the 7.21% drop across the previous week, and losing 9.63% loss over the past month, as per data on April 4.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.