Mt. Gox has moved almost $10 billion worth of Bitcoin (BTC) to a new wallet on May 28. This is a step to repay the company’s creditors after a bankruptcy filing 10 years ago, in April 2014. The cryptocurrency market expects a sell-off event and large capital flow in the following days.

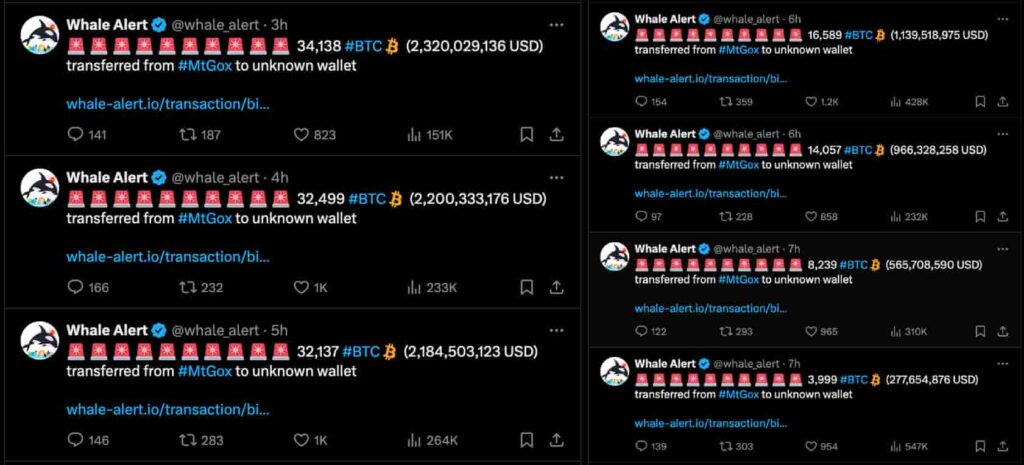

Notably, Mt. Gox activity started at 01:42 am UTC, as registered by the Whale Alert account (@whale_alert) on X. The first transaction sent 3,999 BTC from three known Mt. Gox addresses to a new Bitcoin wallet: ‘1JbezDVd9VsK9o1Ga9UqLydeuEvhKLAPs6‘.

As developed, six other transactions followed the first with larger amounts and from dozens of Mt. Gox-labeled addresses. In total, the new wallet received 141,658 BTC, worth $9.65 billion, and has already started redistributing.

Mt. Gox payments

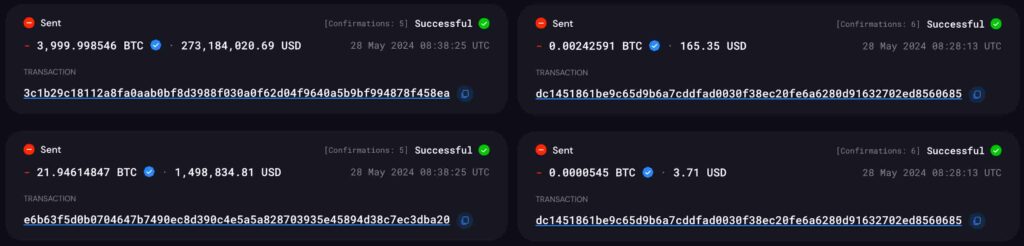

As of this writing, the recently opened account related to Mt. Gox has started making small payments, as seen on-chain. So far, it has made three transactions worth $169.06, $1.5 million, and $273.18 million.

In September 2023, Mt Gox’s trustee announced October 31, 2024, the new creditor payment deadline. Therefore, it is likely that these first three transactions are part of these repayments or meant to cover other expenses.

Bitcoin (BTC) price analysis as Mt. Gox moves its funds

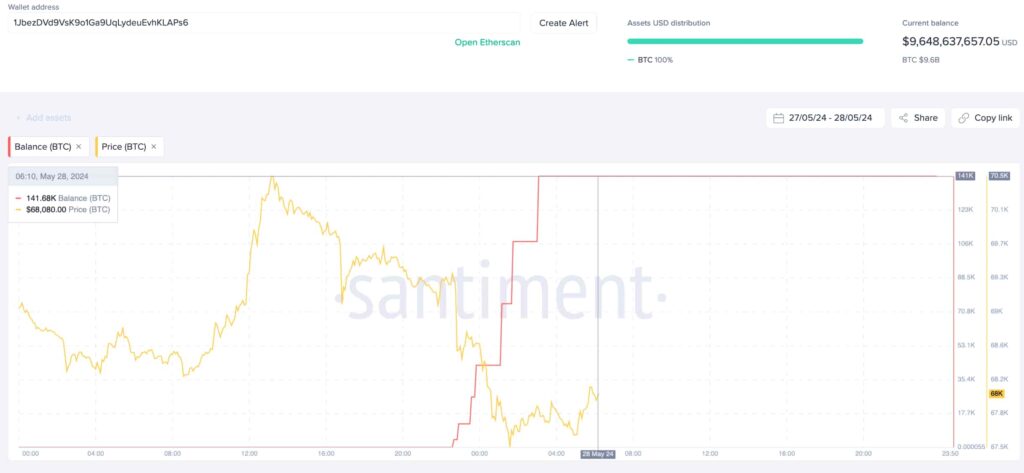

Interestingly, Finbold retrieved data from Santiment, crossing over the on-chain activity with Bitcoin’s price. BTC bounced back from a psychological resistance at $70,500 a few hours before the first Mt. Gox transaction.

It is possible that the retracement could have happened through insider trading in anticipation of the following activity.

As of this writing, Bitcoin trades at $68,000, slightly recovering from the $67,500 lows. Moreover, the new Mt. Gox wallet holds 141,680 BTC, worth $9.648 billion.

Essentially, this amounts to one-third of Bitcoin’s $30.77 billion 24-hour trading volume, evidencing its relevancy to the leading cryptocurrency. A sell-off would likely cause a huge price drop, which speculators are already trying to price in.

What happened with Mt. Gox in 2014?

Mt. Gox, a Tokyo-based Bitcoin exchange, was founded by Jed McCaleb and Mark Karpelès in 2010. Notably, Jed McCaleb is a co-founder and former CTO of both Ripple (XRP) and Stellar (XLM).

Mt. Gox quickly became the world’s largest Bitcoin exchange, handling over 70% of all Bitcoin transactions. Furthermore, it was one of the first cryptocurrency exchanges to achieve some relevancy in the early days.

However, in February 2014, Mt. Gox suspended trading and filed for bankruptcy protection. The company revealed that it had lost approximately 850,000 Bitcoins (worth $450 million at the time) due to hacking and theft. The incident shook the cryptocurrency world and raised concerns about the security of digital assets.

The fall of Mt. Gox significantly impacted the perception and regulation of cryptocurrencies. Mark Karpelès, the CEO of Mt. Gox, was later arrested and charged with embezzlement and data manipulation.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.