Ripple moved $85.50 million worth of 150 million XRP tokens this Friday morning for the company’s first September sale. The sell-off happens as the XRP price shows signs of a slight recovery month-to-date, creating some opposing selling pressure.

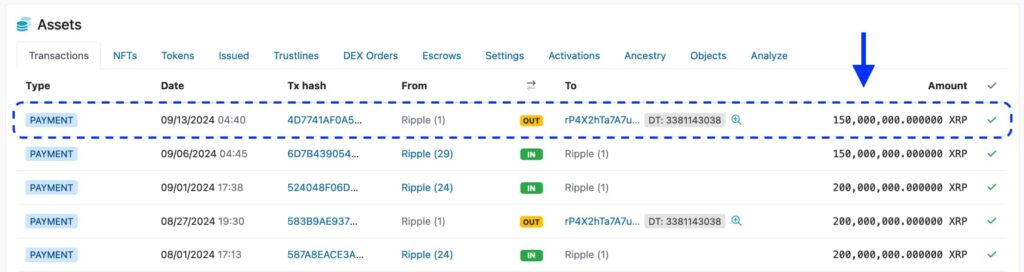

On September 13, the ‘Ripple (1)‘ address sent 150 million XRP to the ‘rP4X2h…‘ address, according to XRP Scan data. This is September’s first selling activity, with 200 million XRP remaining in the treasury account for the next few days.

Earlier this month, Ripple unlocked 1 billion XRP, re-locked 80%, and sent 200 million to ‘Ripple (1)’, as usual. Additionally, the company sent 150 million extra tokens from ‘Ripple (29)‘, preparing for a higher sell-off, with some precedent.

Ripple’s previous selling activities

XRP’s largest holder and core developer, Ripple, has previously added extra amounts to the usual 200 million monthly XRP dump. In June, for example, the company sold 400 million tokens for the largest selling activity to date, as Finbold reported.

So far, in 2024, Ripple moved 2.176 billion XRP tokens to unknown addresses, speculated as over-the-counter (OTC) deals. At current prices, this equals a $1.24 billion sell-off if all the on-chain activity originated from sales.

On August 27, Ripple sold the usual 200 million XRP minimum, worth around $120 million – a move that potentially affected the cryptocurrency’s price, crashing a few hours after the transaction.

XRP price analysis amid Ripple sell-off in September

As of this writing, XRP trades at $0.568, up 6.05% in the last seven days but still 2% down from August 28’s report. After the mentioned crash, Ripple’s token dropped to as low as $0.509 on September 6, following other cryptocurrencies.

This recent price drop is also alligned with an observed monthly chart pattern after most unlocks. Essentially, the market tries to price the significant supply inflation every month, when Ripple adds previously locked XRP tokens to the circulating supply.

The recent recovery happened in a positive context where Grayscale announced an XRP trust, fueling speculation. Moreover, the Securities and Exchange Commission (SEC) signaled a pivot in its classification of a “crypto security asset,” as highlighted by Stuart Alderoty, Chief Legal Officer at Ripple, this morning.

“So the SEC finally admits that 1/ ‘crypto asset security’ is a made up term and 2/ to prove a ‘crypto asset security’ is an investment contract, the SEC needs evidence of a bundle of ‘contracts, expectations, and understandings’? Think it’s time for @SECgov to admit it has become a twisted pretzel of contradictions.”

– Stuart Alderoty, Chief Legal Officer at Ripple, on an X post

As things develop, Ripple’s most recent sale can create some significant supply pressure. Nevertheless, positive developments can act as an upward contrarian force, fueling the demand and XRP’s price.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.