The cryptocurrency market has experienced heightened volatility amidst rising geopolitical tensions between Ukraine and Russia, leaving investors grappling with uncertainty.

While Bitcoin (BTC) managed to defy the broader market sell-off, edging up less than 1% to $92,003, just below its all-time high of $93,434, many other cryptocurrencies and crypto-related stocks have struggled to maintain momentum.

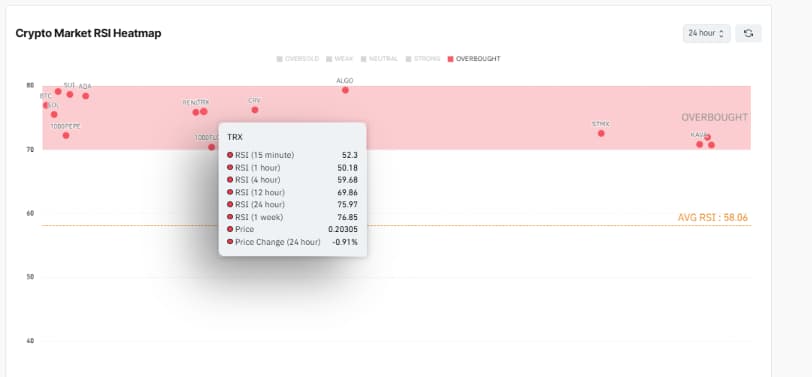

In this uncertain environment, several cryptocurrencies have emerged as overbought, as highlighted by CoinGlass’s 24-hour RSI heatmap.

With the average daily RSI currently at 58.06, signaling a neutral market, these overbought assets deviate significantly from the mean, presenting clear opportunities for short-term corrections.

In this context, Finbold has identified two cryptocurrencies exhibiting strong sell signals, supported by momentum indicators that suggest a retracement in their prices.

TRON (TRX)

TRON (TRX) is showing clear signs of being overbought, making it a strong sell candidate for traders looking to take advantage of potential price corrections.

The 24-hour RSI stands at 75.97, well above the overbought threshold of 70, signaling that the asset is likely overvalued. This is backed by the one-week RSI of 76.85, indicating that TRX has been overbought for an extended period.

Other technical indicators and bearish signals from the Stochastic %K and Commodity Channel Index confirm the likelihood of a pullback.

Additionally, the 24-hour price decline of 0.91% suggests that the correction may already be underway. Traders should consider this a strong opportunity to sell and lock in gains before further downward movement occurs.

StormX (STMX)

StormX (STMX) presents a strong case for a sell based on its overbought RSI and recent price action.

The 24-hour RSI stands at 72.55, firmly in the overbought zone, signaling that the asset is likely overvalued and due for a correction.

Over the past 24 hours, STMX has surged by 18.24%, a significant rally that often prompts profit-taking among traders, potentially leading to a pullback.

While the one-week RSI is at a more neutral 57.23, indicating broader trend stability, the short-term overextension makes it an ideal candidate for locking in profits.

For traders, this is a clear opportunity to capitalize on the recent gains before momentum shifts, reducing the risk of holding through a potential reversal.

In conclusion, both TRX and STMX are showing overbought conditions that could lead to a price correction.

However, it is important to note that an overbought RSI is not a definitive predictor of an immediate downturn, as such conditions can persist in prolonged bullish markets.

While the technical indicators signal caution, it’s essential to evaluate the broader market dynamics and underlying fundamentals of each cryptocurrency to make informed trading decisions.

Balancing technical insights with a fundamental understanding can help navigate the potential risks and opportunities effectively.

Featured image via Shutterstock