The wider market saw significant dips starting with mid-December — and short sellers have taken notice. Resurgent inflation worries, higher yields, an unexpectedly strong labor market, and decreasing odds of continued rate cuts culminated in the S&P 500 erasing roughly $2.5 trillion in value over the course of a month.

Those concerns have slightly cooled as of late — December’s Consumer Price Index (CPI) inflation data came in slightly better than expected — and strong earnings in the banking sector coupled with anticipated pro-business policies from the incoming Trump administration brought a resurgence of optimism.

However, every bull run has to end sooner or later — and with valuations at an all-time high, short-sellers are on the lookout — searching for stocks that could see significant pullbacks.

As we enter the second half of January, the bears have set their sights on the automotive sector — and electric vehicle (EV) producers in particular. Two stocks in the industry have seen a notable uptick in short selling activity — Tesla (NASDAQ: TSLA) and Lucid (NASDAQ: LCID).

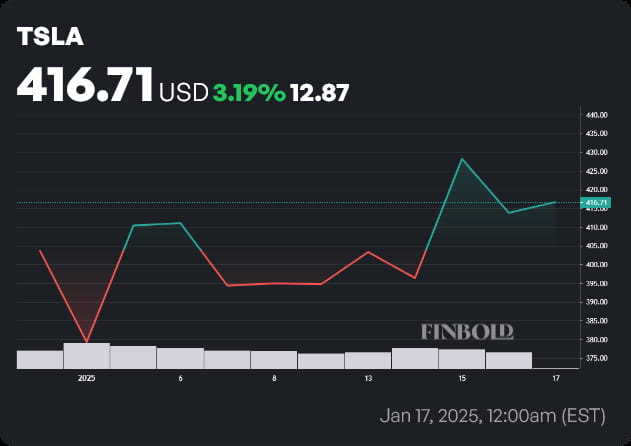

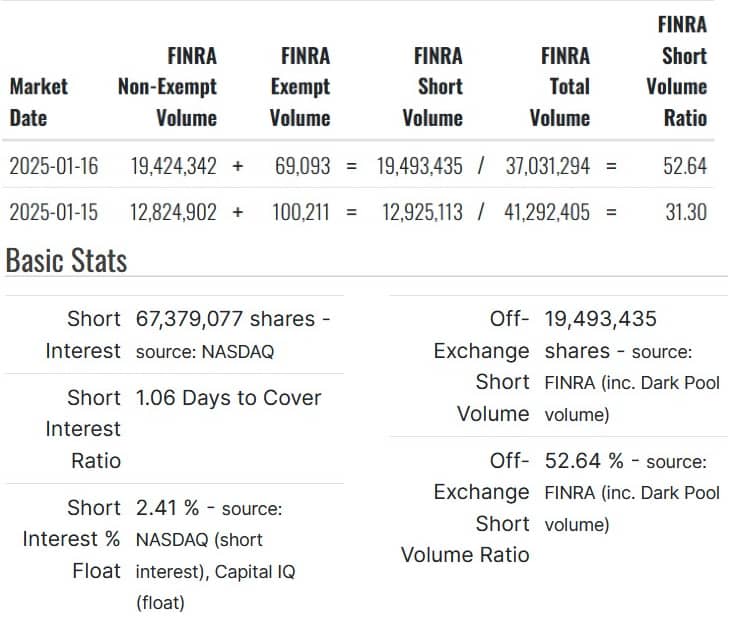

Tesla (NASDAQ: TSLA)

Tesla stock struggled to move to the upside in the first 3 quarters of 2024. Following that, a strong earnings call and co-founder Elon Musk’s close relationship with President-elect Trump led the stock to soar to new heights — with the price of a TSLA share reaching a new all-time high (ATH) of $479.86 on December 17.

The price of TSLA stock has receded to $416.53 at press time — since the start of the year, prices have slowly begun to recover, with the company marking a 3.19% gain on the year-to-date (YTD) price chart.

Tesla’s extremely high valuation, which has long been a point of contention, is still an issue for many. On average, Wall Street analysts consider the stock overvalued.

At present, the short volume ratio for Tesla stock stands at 52.64 — and it would take short-sellers slightly more than a day to cover their positions. Some 2.41% of Tesla’s share float has been sold short, according to data retrieved by Finbold from Fintel.

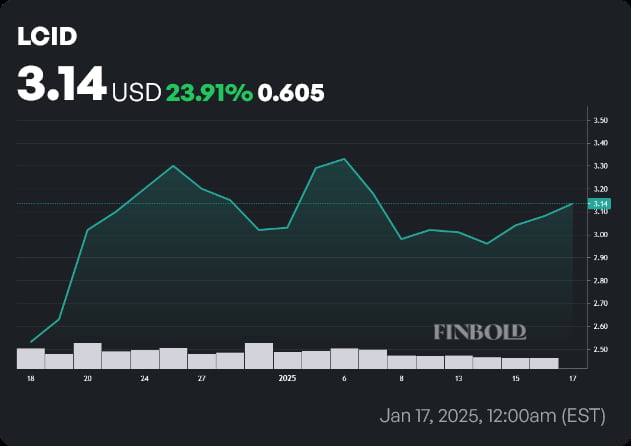

Lucid (NASDAQ: LCID)

As a producer of luxury electric vehicles, Lucid has a smaller total addressable market (TAM) than most of its competitors, who target a broader customer base. Over the course of 2024, Lucid stock lost 28% in value — owing to share dilution and failed delivery and production targets.

On the other hand, over the course of the last 30 days, the price of LCID shares has surged by 23.91%. This period saw the release of the company’s highly-anticipated Gravity SUV model, and its Q4 production and delivery figures, released on January 6 — both of which beat estimates and internal targets.

As positive as these latest developments are, this extremely volatile stock is not out of the woods yet — as previously covered by Finbold, its short volume ratio reached a high of 56 on January 14. Although it did dip below the 50 mark the next day, short-selling activity has resumed once more — the short volume ratio for Lucid stock currently stands at 51.10

In contrast with Tesla, 18.51% of Lucid’s share float has been sold short — providing a strong indicator of widespread bearish sentiment. Wall Street also sees downside in the cards for Lucid stock — but to a much lesser degree than it does with Tesla.

While both surges in short-selling activity are notable, there are no significant new developments to speak of with either stock — all in all, the odds of a short squeeze, in either case, remain highly unlikely.

Featured image via Shutterstock