Lithium Americas (NYSE: LAC) stock soared over 90% on Wednesday, September 24, following the news that the Trump administration is seeking up to a 10% equity stake in the company.

The deal also reportedly includes renegotiated terms for the previous $2.3 billion Department of Energy (DoE) loan. The mining corporation had been scheduled to make its first loan draw earlier this month, but the plan was postponed as lithium prices remain questionable.

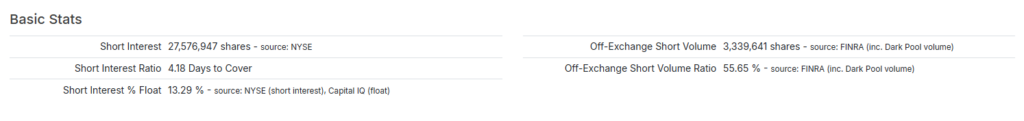

That said, the reports generated a lot of excitement among investors, given that Lithium Americas had 27.58 million shares shorted with 4.18 days to cover as of September 23, 2025, as per Fintel data.

That is, with 13.29% of the float shorted, high one-day spikes have increased the risk of a short squeeze, as short sellers rush to buy the stock and cover their losing positions. If that happens, the buying pressure could push the price even higher.

At the time of writing, LAC shares were trading at $5.85, up from the previous close of $3.07.

Lithium Americas stock rally

Lithium Americas has been largely flat before this week’s dramatic turn of events. While certainly staggering, the surge was perhaps not completely unexpected, given the government’s recent activity in securing stakes in firms such as Intel (NASDAQ: INTC) and rare earth miner MP Materials (NYSE: MP).

The latter purchase, together with the ongoing developments, simply underscores Washington’s desire to gain more control over critical raw material supply chains.

“President Trump supports this project. He wants it to succeed and also be fair to taxpayers. But there’s no such thing as free money,” a White House official told Reuters.

The company itself stands to benefit from the administration’s involvement, as it could not only accelerate its strategic positioning but also provide the necessary capital to bolster its operations at the Thacker Pass Lithium Mine in northern Nevada, North America’s largest known lithium deposit.

Furthermore, the project is strategically important to General Motors (NYSE: GM), Lithium Americas’ partner that holds a 38% stake, and which saw its own shares rise nearly 2.5% following the news.

Featured image via Shutterstock