In the dynamic cryptocurrency landscape, each opened short position leaves liquidity pools behind, which can cause short squeezes. Therefore, traders can look for cryptocurrencies with an increased volume of shorts for potential pump opportunities.

The crypto market has shifted to a dominating bullish sentiment amid a notable rally. However, some cryptocurrencies are still attracting bearish short-sellers, which can soon become market makers’ targets.

Finbold gathered data from CoinGlass on February 27 to analyze the derivatives market. In particular, we found two potential cryptocurrencies for a short squeeze next week due to relevant liquidity pools upwards.

Essentially, short-sellers borrow a cryptocurrency to sell in the market. They profit by re-purchasing it at lower prices when they close the position – voluntarily or not.

Short squeeze alert for WorldCoin (WLD)

WorldCoin (WLD) is still attracting a significant number of short-sellers despite the market’s overall positive sentiment. Currently, the open interest for WLD derivatives is at $319.56 million for $30 of its $1.07 billion capitalization.

Meanwhile, traders opened $1.75 billion of short positions against the WorldCoin, for 51.35% of its 24-hour volume.

This action has left some liquidity above $9 per token. Thus, a potential short squeeze could pump the price over 15% from the $7.78 by press time.

Chainlink’s (LINK) pump potential

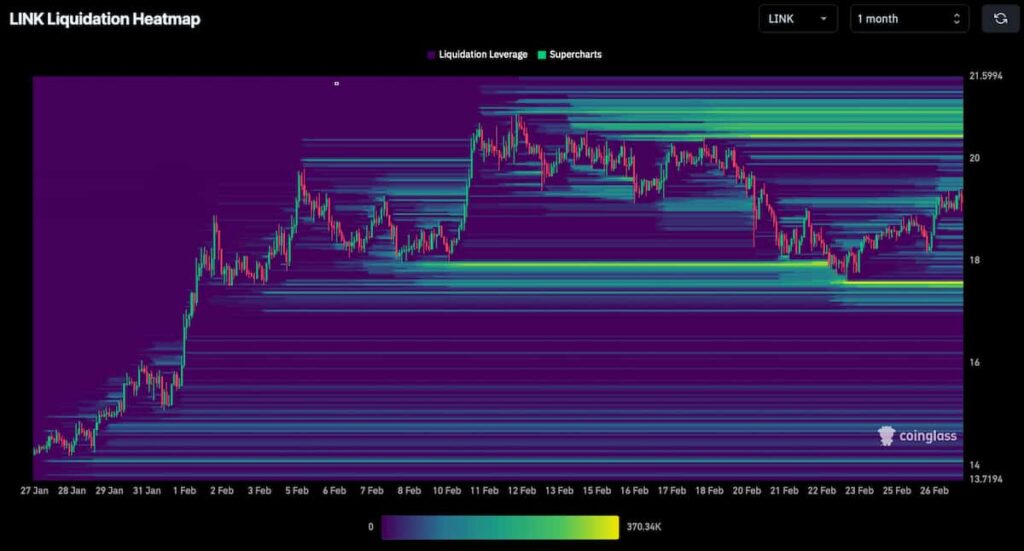

In the meantime, Chainlink (LINK) continues to show massive liquidity pools in the price range between $20 to $21. These liquidations are mostly evident on the monthly heatmap, now closer to the current levels at $19.

Nevertheless, traders are starting to shift their bets, creating relevant downside liquidity. The question is which of these pools market makers will target first.

On that note, Chainlink recently broke the $100 million TVS, according to Michaël van de Poppe, who believes “slow accumulation is probably a wise decision” on LINK.

Interestingly, the Bitcoin (BTC) leading a bull rally can be the extra fuel needed to trigger these short squeezes. Opening shorts is risky at this moment because the market can move quickly and liquidate traders for huge losses.

However, sentiments can shift as quickly as price, and investors must always trade cautiously and understand the reasons for a dominating short position, which might have a fundamental justification.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.