Following a 10-for-1 split of Super Micro Computer Inc. (NASDAQ: SMCI) stock that arrives at a tumultuous time for the company facing allegations and an investigation of potential wrongdoings, investors are wondering what the future holds for one of the semiconductor industry’s heavyweights.

Indeed, the stock split, a common corporate action introduced to make shares more affordable, saw SMCI stock holders go from having, for instance, 100 stocks at $416.51 per share at the close on September 30 to possessing 1,000 SMCI stocks at a split-adjusted price of $41.65 on October 1.

At the same time, it coincides with a lower adjusted gross profit margin for the fiscal Q4, a delayed fiscal 2024 annual report, short-seller Hindenburg Research alleging “glaring accounting red flags, evidence of undisclosed related party transactions,” and more, as well as a reported Justice Department probe.

SMCI stock forecast

Amid the recent stock split and other developments, several Wall Street experts updated their SMCI stock price target and ratings, including the investment analysts at StockNews.com, who upgraded their SMCI score from a ‘sell’ to a ‘hold’ in a research note on October 1.

Earlier, in a note shared on September 18, Needham’s analyst Quinn Bolton pointed out, while expressing his company’s ‘buy’ rating and a $600 price target (now $60, taking into account the recent 10-for-1 stock split) on SMCI shares, that:

“As a first mover in the design of GPU-based compute systems and liquid-cooled rack level solutions, we view Super Micro as a significant beneficiary from growing investment in AI infrastructure and forecast a revenue compound annual growth rate (CAGR) in excess of 55% from fiscal 2021 to fiscal 2026. (…) Super Micro is currently involved in the deployment of some of the largest AI clusters in the world and entered fiscal 2025 with record high backlog.”

On the other hand, in late August, the investment analytics team at CFRA Research reiterated the company’s ‘hold’ rating and reduced their SMCI stock forecast from $7.29 to $4.54, while Wells Fargo (NYSE: WFC) decreased it from $6.50 to $3.75, giving it an ‘equal weight’ rating.

Altogether, the consensus of 21 Wall Street analysts is that SMCI shares are currently a ‘buy,’ based on eight of them suggesting a ‘strong buy,’ one arguing for a ‘buy,’ 11 advising to ‘hold,’ with no ‘sell’ calls, and with one ‘strong sell’ recommendation, as per TradingView data.

At the same time, their average price target for SMCI shares stands at $69.13, which indicates a potential increase of about 72% from their price at press time, with the highest prediction amounting to $130 (+223%), and the lowest price target at $25.50 (-37%).

SMCI shares price analysis

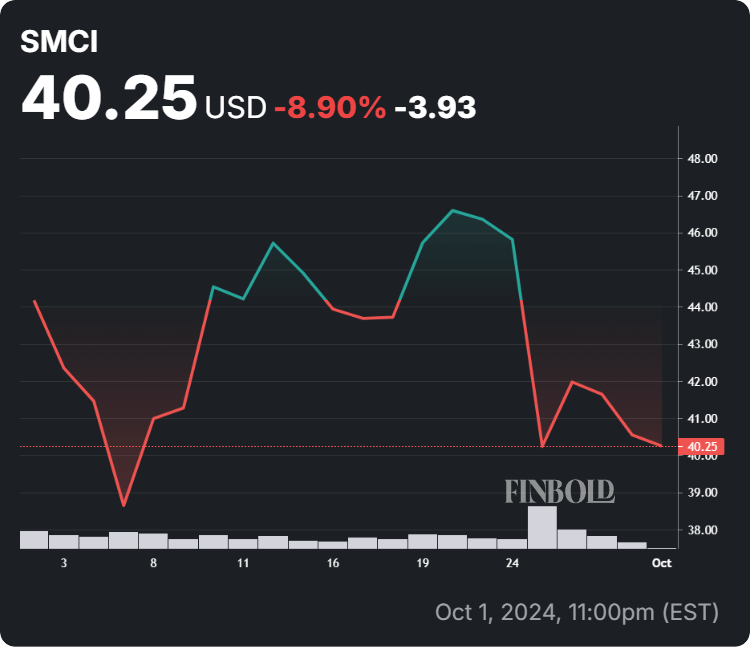

For the time being, the price of SMCI shares stands at $40.25, reflecting a decline of 4.89% on the day, adding to the 15.42% dip across the past week, as well as the accumulated loss of 8.90% over the month while retaining a positive change of 40.99% year-to-date (YTD), as per data on October 2.

Overall, despite recent challenges, analysts seem confident that SMCI shares still have room for growth. However, keeping up with any relevant SMCI news, like the recent SMCI stock split, and others, including future SMCI earnings date, experts’ SMCI stock forecast, and the like, is critical when investing.