The most publicized and notable stock market meltdown of 2024, at least thus far, has been the tale of Super Micro Computer Inc (NASDAQ: SMCI). The semiconductor company, which had at one point rallied by as much as 316% in 2024 has been on a steady yet steep decline.

At this point in time, however, Supermicro could be facing an existential threat — after a damning report from noted short-selling activist group Hindenburg Research, the company has consistently delayed the filing of important documents with the Securities and Exchange Commission (SEC).

The company has still not managed to submit forms that were due in August — and since the final deadline is set for November 16, there isn’t much time left. Now, the company has yet again stoked investor fears, as it has stated that it will not be able to meet that deadline — thus massively increasing the chances of delisting from the NASDAQ.

At press time, SMCI stock was trading at $21.19 — bringing monthly losses up to 55.29%, and year-to-date (YTD) losses up to 25.70%.

SMCI risks delisting with no solutions in sight

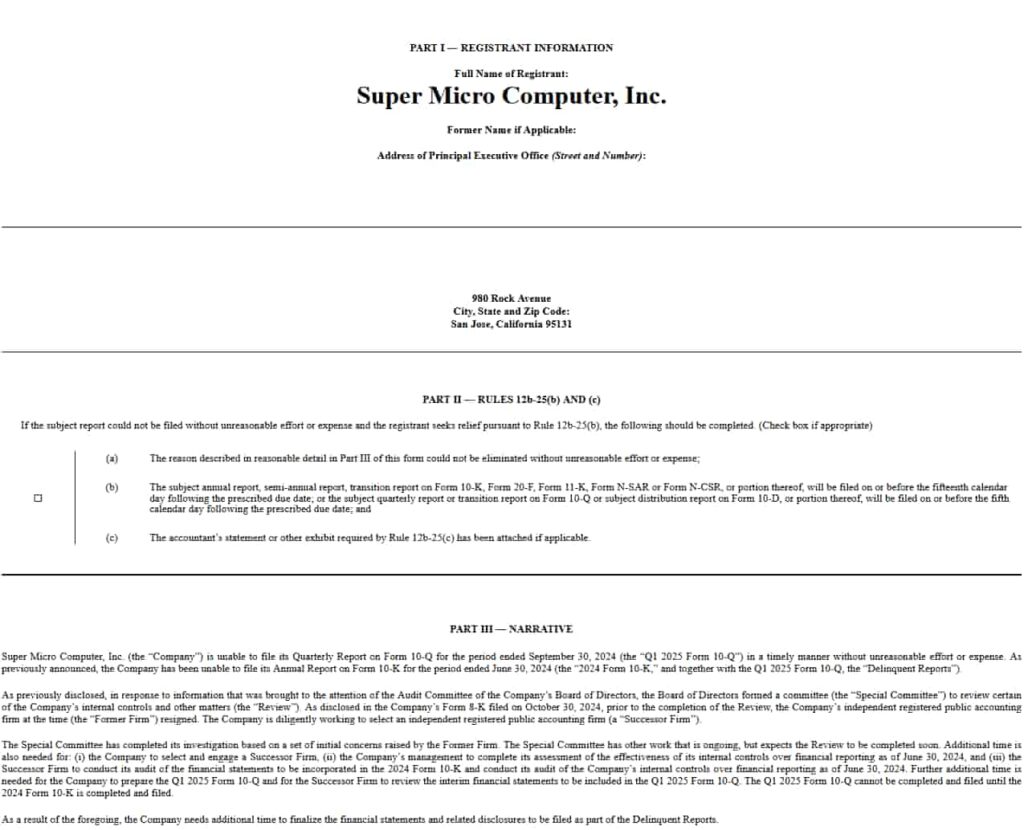

On November 13, the server maker filed a Form NT 10-Q, in which it states that it is unable to file its 10-Q and 10-K reports ‘in a timely manner without unreasonable effort or expense’. As such, SMCI is requesting additional time to get its affairs in order.

However, even if that request were to be granted, the odds aren’t in Super Micro Computer’s favor.

The company’s previous auditor, Ernst & Young (EY) resigned on October 24, which soon led to a 30% SMCI stock price crash. EY stated the following:

Resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management, and after concluding we can no longer provide the Audit Services in accordance with applicable law or professional obligations.

For a business of Supermicro’s size, only the ‘big four’ accounting firms — Deloitte, EY, PricewaterhouseCoopers (PwC), and Klynveld Peat Marwick Goerdeler (KPMG) have the necessary scale to conduct a thorough audit. Since EY’s findings caused it to resign, it’s unlikely that any of its peers would step in — and Super Micro Computer has had no luck in finding a replacement auditor thus far.

Is Supermicro stock destined to fail?

At present, the odds of SMCI being booted from the NASDAQ appear increasingly likely — particularly as this is not the first instance of the company being delisted. In 2018, the business was delisted after an SEC probe regarding revenue recognition practices — it took two years for the company to regain its public listing.

Form NT filings generally cause significant downward pressure on stock prices. As noted by NYU Stern Accounting Professor Eli Bartov and co-author Yaniv Konchitchki of the University of California, Berkeley, missing the late filing deadline is penalized even more harshly by the market.

So, what are the possible ramifications? SMCI will most likely be delisted — this, in turn, would cause the $1.7 billion that the business has in convertible notes to become an instantaneous problem, since bondholders can exercise the right to be paid early if a stock is delisted. Per data from September, Super Micro Computer still has $2.1 billion in cash — but if this were to play out, the now-delisted company would find itself with an empty war chest.

The stock could continue to be traded on over-the-counter (OTC) markets, but lack of access, liquidity issues, and difficulties with raising capital would paint a grim picture for future prospects. Alternatively, the company might go private — although noted partner Nvidia (NASDAQ: NVDA) has started to shift orders away from SMCI, most of the company’s semiconductor peers have neither commented on the alleged issues nor canceled previous partnerships.

In all likelihood, SMCI can survive, if barely, as a business — but not as a worthwhile publicly traded stock. At present, the semiconductor company is simply too radioactive to touch.

Featured image via Shutterstock