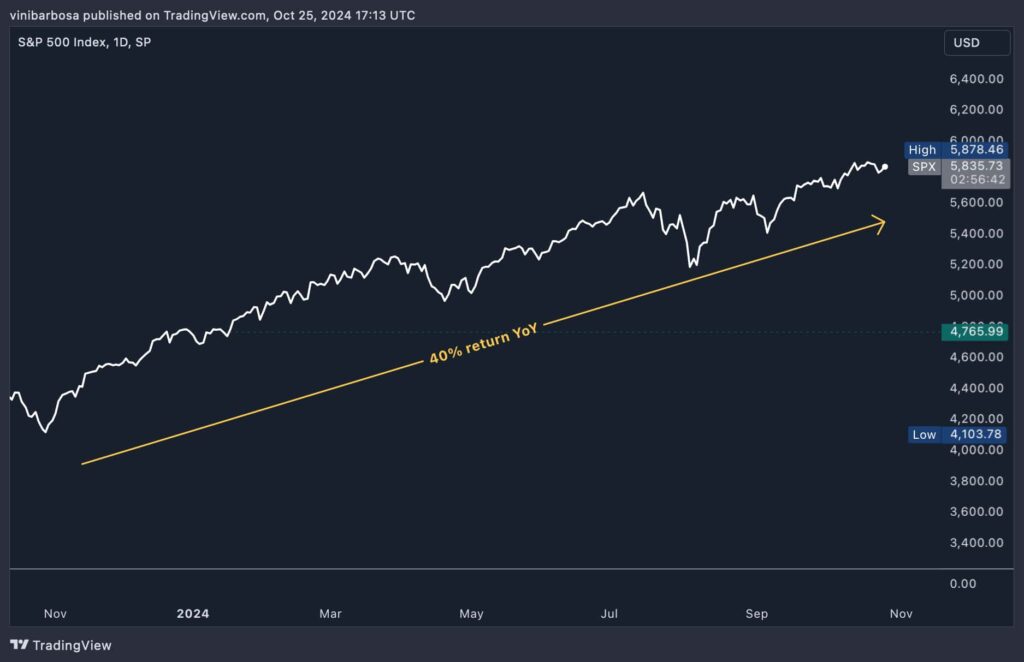

In a remarkable twist amid global uncertainties, the S&P 500 has soared by 40% over the past 12 months. This achievement marks the popular U.S. stock market index’s best annual performance since 1954. Moreover, the surge greatly exceeds the historical average annual return of around 10%.

On October 25, the S&P 500 index marked 5,835.73, having reached the 5,860 mark earlier today. Interestingly, a recent study covered by Finbold revealed that trading the after-hours of the S&P 500 was the best speculative strategy for the index besides buying and holding long-term.

S&P 500 unprecedented YoY gains amidst challenges

Despite numerous obstacles, the market has defied expectations and frustrated many S&P 500 stocks short-sellers. Delayed shifts in Federal Reserve policies, geopolitical conflicts, and election-year anxieties usually dampen market performance. However, according to The Kobeissi Letter, the index’s current year-over-year (YoY) surge has been unmatched over six decades.

Furthermore, the S&P 500’s market capitalization has reached a record $48.6 trillion. Over the past year, it added an unprecedented $14 trillion in value. That’s an average of $1.17 trillion in growth per month. Such rapid expansion over a 12-month period is unparalleled in market history.

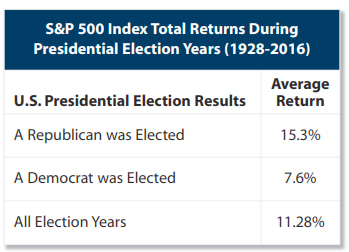

Moreover, the market’s performance during this election year challenges common misconceptions, The Kobeissi Letter explained. Historically, election years have been positive for stocks.

Data since 1928 shows the S&P 500 averages an 11.3% return during election years, outperforming the long-term average. Whether a Republican or Democrat wins, the market has tended to post gains, with slightly higher averages when a Republican candidate prevails.

Investor sentiment and the Presidential race

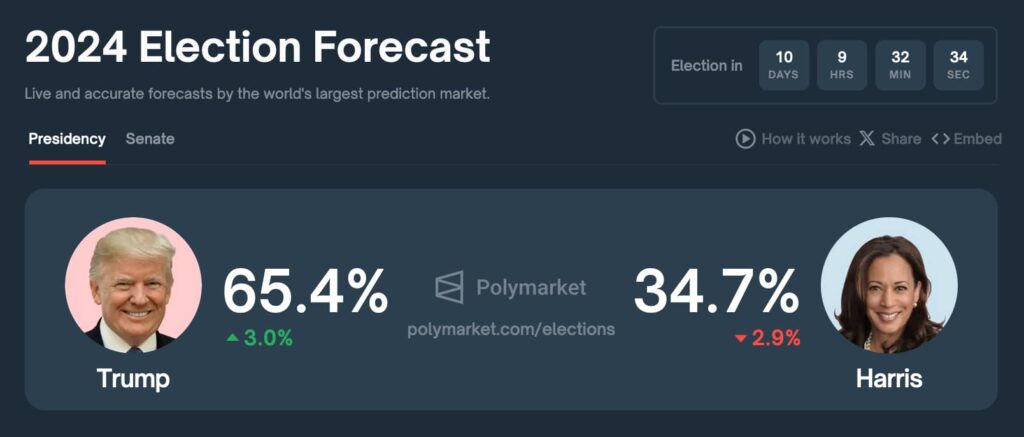

Currently, prediction markets like Polymarket show Donald Trump with a 65% chance of winning, while Kamala Harris holds a 34.7% probability. The contrasting economic policies proposed by the candidates add complexity for investors.

As Finbold reported in late September, institutional investors expressed mixed feelings about a potential Harris presidency. A Bloomberg survey of 340 institutional investors found that nearly 40% would reduce their equity risk if she wins. Concerns center around her proposed tax policies targeting corporations and the wealthy.

“Tax policy is a huge, huge concern for investors,” emphasized Yung-Yu Ma, chief investment strategist at BMO U.S. Wealth Management. Similarly, renowned hedge fund manager John Paulson cautioned about the potential market impact. “If Harris is elected, I’d pull my money from the market,” he stated. “I’d go into cash and gold because I think the uncertainty regarding the plans they outlined would create a lot of turbulence in the markets and likely lower them.”

On the other hand, historical data suggests the market often performs well regardless of which party wins. It’s investor sentiment and risk appetite that will likely drive prices into 2025. As The Kobeissi Letter pointed out, “Risk appetite will be another crucial variable to watch into 2025. Sentiment has been and will continue to be the predominant driver of price.”

What’s next for the S&P 500

Looking ahead, the unprecedented market rally raises questions about sustainability. With the S&P 500 adding $14 trillion in value over the past year, some analysts are cautious. Such growth rates may not be maintainable. Monitoring economic indicators, policy announcements, and global events will be crucial. Investors aiming to navigate these uncharted waters must stay vigilant.

On that note, the mere hope of a Federal Reserve policy shift has been sufficient to fuel market optimism. Even without concrete policy changes, sentiment has driven markets higher. Getting ahead of these trends has been important for savvy investors.

In conclusion, the S&P 500’s historic 12-month performance showcases market resilience. Amid economic uncertainties and political shifts, the market has defied conventional wisdom.. Investors seeking to capitalize on opportunities must also mitigate risks in an ever-evolving financial landscape.