Singapore, Singapore, March 26th, 2025, Chainwire

In 2024, StaFi introduced a burn mechanism as part of its broader initiative to enhance the long-term sustainability of the protocol. Building on this foundation, a new proposal seeks to reduce the fixed inflation rate, aiming to improve overall network stability. The proposal outlines a phased approach to lowering FIS inflation, with the objective of aligning StaFi’s tokenomics with its transition toward an AI-powered Liquid Staking as a Service (LSaaS) framework.

Inflation Reduction Plan

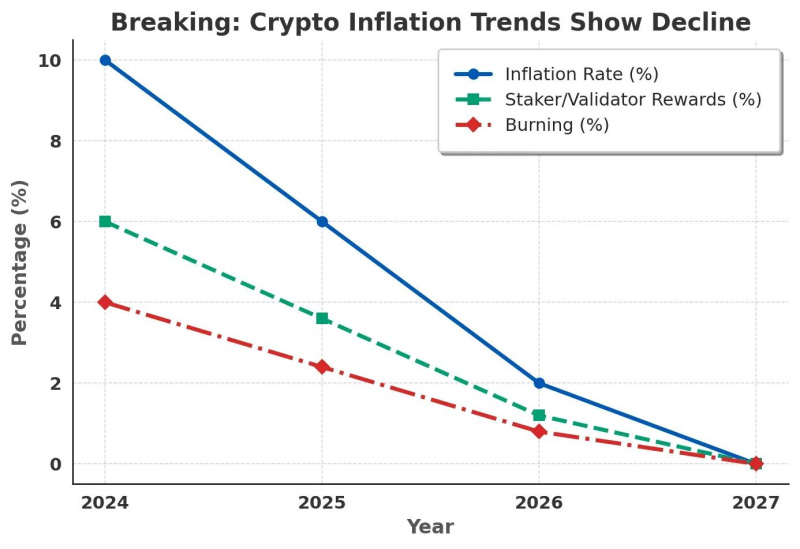

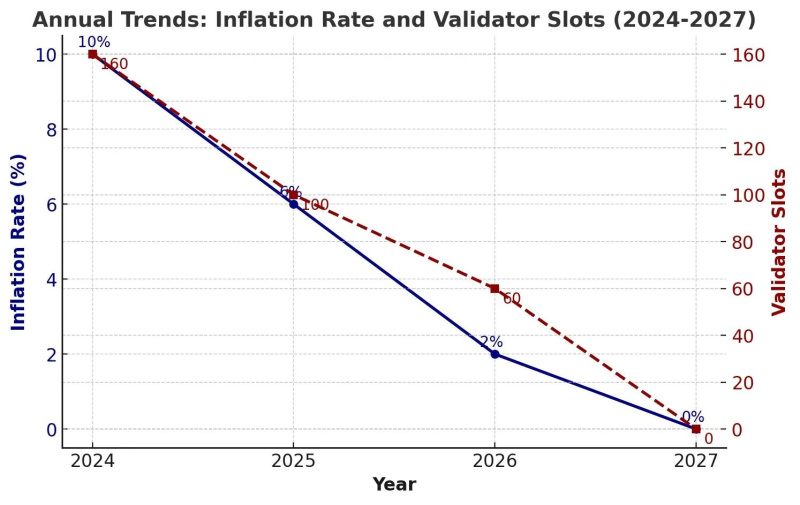

Under this proposal, StaFiChain’s current 10% inflation rate will be reduced by 4% annually starting in 2025, gradually bringing the inflation rate down to 6% in 2025, 2% in 2026, and ultimately reaching 0% by 2027.

This gradual reduction ensures sufficient time for StaFiChain’s appchain ecosystem to adapt to LSaaS adoption, fostering a more diverse and sustainable token economy. Additionally, it aligns with StaFiChain’s rebranding efforts.

This gradual reduction ensures sufficient time for StaFiChain’s appchain ecosystem to adapt to LSaaS adoption, fostering a more diverse and sustainable token economy. Additionally, it aligns with StaFiChain’s rebranding efforts.

Benefits

Reducing inflation results in lower token issuance, which contributes to a more controlled token supply. This change aligns with StaFi’s broader strategy to support long-term protocol sustainability.

Implementation Strategy

Reducing inflation directly impacts validator rewards. With 160 active validators on StaFiChain, their payouts will decrease by approximately 40% if this proposal is implemented. To maintain security, the number of validator slots should be reduced in alignment with the inflation reduction timeline.

By 2027, StaFiChain will either be operated by a single foundation or fully transitioned into an infrastructure model. At that stage, FIS will migrate to an ERC-20 standard or other popular token standard, unlocking new utilities for token holders.

By 2027, StaFiChain will either be operated by a single foundation or fully transitioned into an infrastructure model. At that stage, FIS will migrate to an ERC-20 standard or other popular token standard, unlocking new utilities for token holders.

Key Objectives

This proposal not only reduces inflation but also accelerates StaFi’s transition to an AI-powered LSaaS. StaFi must evolve to remain competitive, requiring efforts in market education, partnerships, technology upgrades, and industry alignment.

Revenue Generation

- TVL is no longer the primary focus; revenue is the key driver for the company.

- LSaaS will generate revenue through a new SubDAO working model.

- A detailed discussion on the DAO-SubDAO structure is forthcoming.

Adoption & Developer Engagement

- LSaaS, as an infrastructure solution, requires active developer engagement.

- The current market and developer community must be educated on LSaaS benefits.

- StaFi must remain financially viable while navigating this transition.

Future Roadmap

- Step 1: Burn Mechanism – Activated

- Step 2: Inflation Reduction – Pending Vote

- Step 3: FIS Value Enhancement – Coming Soon

The value-enhancement plan will be driven by the SubDAO model, providing long-term benefits for FIS holders. Users can stay tuned for more details at StaFi’s X.

Outlook and Strategic Direction

The current market remains volatile, with liquidity patterns continuing to fluctuate. Amid these conditions, StaFi maintains its strategic focus on evolving into a sustainable AI-powered Liquid Staking as a Service (LSaaS) ecosystem, prioritizing long-term infrastructure development and protocol resilience.

About StaFi Protocol

StaFi is a leading Liquid Staking infrastructure provider and protocol for PoS chains. Its Liquid Staking as a Service (LSaaS) framework enables developers to create Liquid Staking Tokens (LSTs) and Liquid Re-staking Tokens (LRTs) across ecosystems like ETH, EVM, BTC, CosmWasm, and SOL.

By issuing rTokens (e.g., rETH, rBNB), StaFi unlocks the liquidity of staked assets, allowing users to earn staking rewards while retaining the flexibility to engage in DeFi. With support for major blockchains such as Ethereum, Solana, Polygon, BNB Chain, and Cosmos, StaFi bridges liquidity and security in Proof-of-Stake networks.

Users can read more about StaFi 2.0.

Website | rToken App | LSaaS | X | Telegram | Discord | Medium | Forum | Mirror

Contact

BD @StaFi Protocol

Weymi

StaFi Protocol

[email protected]