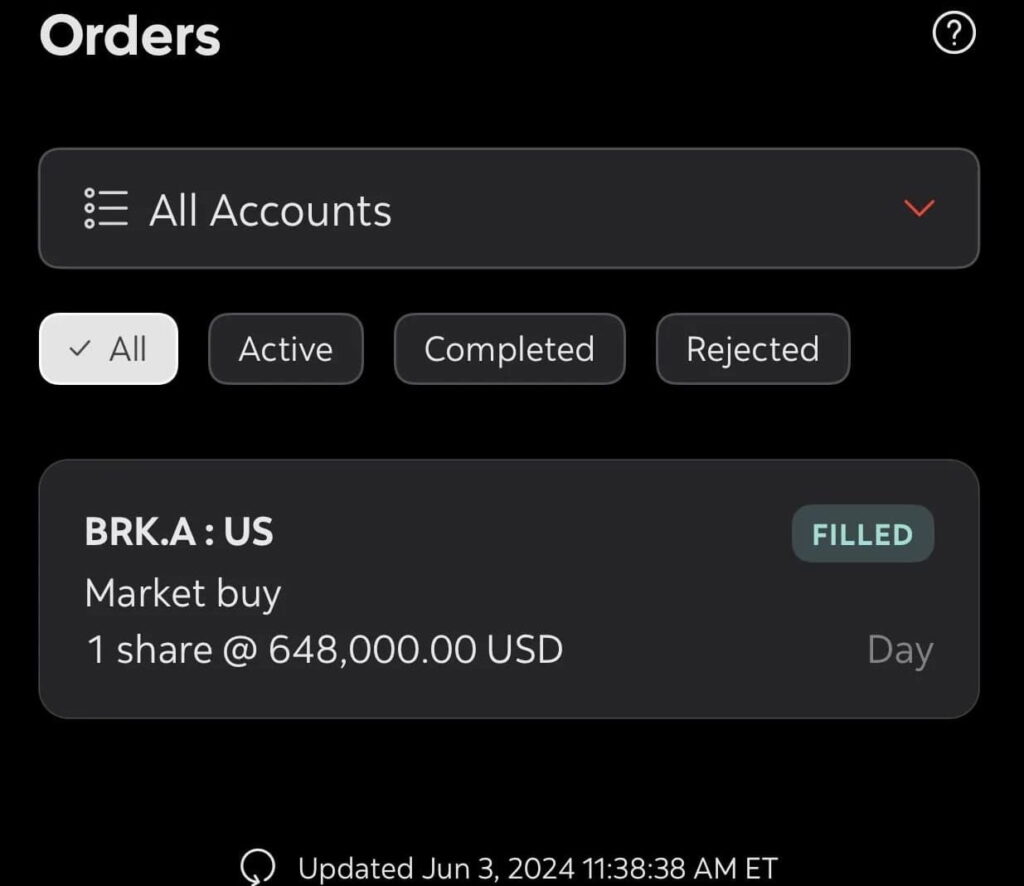

In an unexpected turn of events, a stock trader accidentally spent $648,000 on a single share of Berkshire Hathaway‘s Class A stock (BRK.A) instead of the intended $186. The NYSE reverted this accident, which occurred due to a technical glitch.

This happened as the stock trader tried to exploit a glitch within the New York Stock Exchange (NYSE) system. The glitch occurred when BRK.A appeared to plunge 99.97% to $186, leading the trader to place a market order. However, the broker filled his order at $648,000 with margin, leaving the trader with a massive margin debt.

The trader, who posted about the incident on the Wall Street Bets subreddit, explained that the purchase was made within their Tax-Free Savings Account (TFSA), which typically doesn’t allow margin trading. Despite this, the broker’s system malfunction allowed the transaction to go through, resulting in the trader becoming an unexpected BRK.A holder.

Nevertheless, the trader’s account reverted to its pre-trade state the following morning, suggesting that the broker may have intervened to rectify the situation.

NYSE glitch involving BRK.A that affected the stock trader

The New York Stock Exchange attributed the glitch to a “technical issue with industry-wide price bands” that triggered trading halts for up to 40 symbols listed on NYSE Group exchanges.

The issue, which the Consolidated Tape Association (CTA) believes may have been related to a new software release, was resolved by relying on a secondary data center operating on an older version of the software.

Interestingly, NYSE announced that it would cancel all “erroneous” trades for Berkshire Hathaway between 9:50 am and 9:51 am ET at or below $603,718.30.

The incident affected other stocks as well, such as Chipotle, Barrick Gold, and NuScale Power, with some experiencing temporary price drops of up to 98.5%. Despite the glitch, the broader stock market remained largely unaffected, moving mostly lower due to economic growth concerns. The Securities and Exchange Commission (SEC) is monitoring the issue and engaging with market participants to investigate the matter further.

As CNN Business reported, Joe Saluzzi, co-founder of Themis Trading and a market structure expert, expressed skepticism about NYSE’s explanation. Saluzzi stated that it didn’t make sense given the sudden and drastic price drop observed in Berkshire Hathaway’s stock.

“I’m not buying that explanation. That doesn’t make any sense to me.”

– Joe Saluzzi

The incident has raised questions about the robustness of trading systems and the potential for technical glitches to cause significant financial consequences for individual traders.

As the investigation continues, the stock trading community awaits further clarification on the cause of the glitch and the measures being taken to prevent similar incidents in the future. Meanwhile, the unfortunate trader who accidentally spent $648,000 on a single share of BRK.A serves as a reminder of the risks associated with trading during market disruptions and the importance of robust risk management strategies.