After Q2 delivery numbers for Tesla (NASDAQ: TSLA) surpassed analysts’ expectations, the electric vehicle (EV) maker’s stocks have surged over 10% on their daily chart and recorded the highest price in almost six months, leading investors to wonder what it means for their future price.

Indeed, TSLA shares have closed the previous trading at a price of $231.26, with a positive gain of 10.20% on the day, a 24.01% weekly advance, a growth of 31.18% in the past month, and an increase of 3.32% in pre-market – towards a price of $235.77.

Tesla stock prediction 2025

In this context, Wedbush analyst Dan Ives has increased the price target on Tesla stock from $275 to $300 for the next 12 months, citing the belief that the “Tesla demand story has made a significant turn for the positive heading into 2H/2025,” as well as stressing the company’s artificial intelligence (AI) efforts:

“Tesla AI story could be worth $1 trillion+ and is the most undervalued AI name in our view.”

At the same time, Tesla’s performance has improved from the first quarter despite a year-on-year decline in Q2 deliveries, which Ives assessed as a positive sign, adding up to his previous argument that the worst may be behind Tesla after the Q2 deliveries beat estimates.

On the other hand, Wells Fargo (NYSE: WFC) analyst Colin Langan has argued that Tesla stock could decline, adding TSLA shares to his Q3 ‘Tactical Ideas List’ with a ‘sell’ rating and a $120 price target, citing weakness across all of Tesla’s key markets and increased competition in China.

As it happens, it seems that analysts sharing Langan’s views are in the majority, considering that the average Tesla stock price prediction 2025, derived from Wall Street’s finance experts views shared over the last three months, at the moment stands at $182.82, which would suggest a 22.46% drop from its current values.

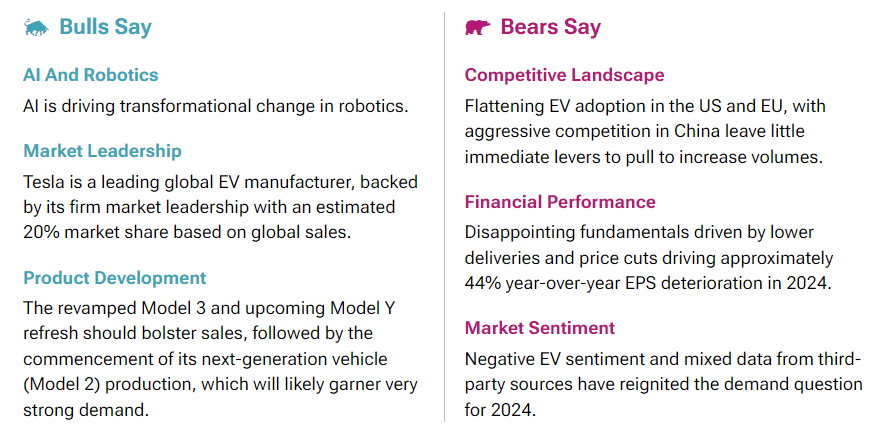

Tesla stock price analysis: Bulls vs. bears

It is worth noting that analysts bullish on the Tesla stock price have also highlighted the company’s revamped Model 3 and upcoming Model Y that could boost its sales, as well as the commencement of the next-generation Model 2, as a possible trigger for a higer demand.

Meanwhile, bears maintain that Tesla’s decreasing EV adoption in the United States and the European Union, combined with “disappointing fundamentals” and negative EV sentiment, could drive the price down toward the lower end of the TSLA stock price target spectrum.

All things considered, it is difficult to make any definite TSLA price predictions, especially since analysts disagree wildly on its future trends, suggesting prices anywhere between a low of $22.86 and a high of $310, so doing one’s own research when investing is critical.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.