As the new trading week begins, Tesla (NASDAQ: TSLA) is looking to extend its recent rally, driven by key developments in the Chinese market.

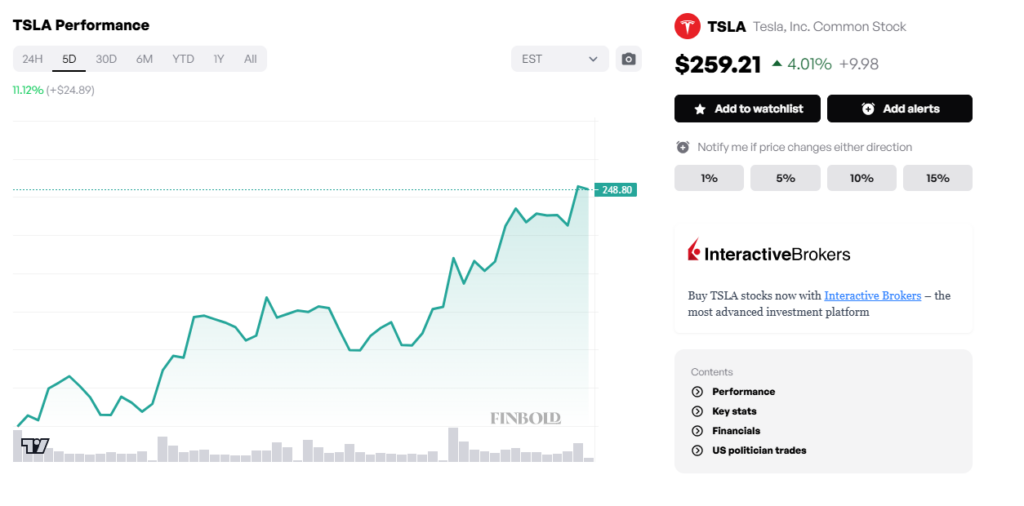

In pre-market trading on Monday, March 24, TSLA stock jumped 4% to $259, decisively breaking the $250 resistance after multiple failed attempts. This follows a strong close on March 21, when the stock surged over 5% to $248.

However, Tesla continues to grapple with challenges, including declining sales and mounting political backlash against CEO Elon Musk. These headwinds are reflected in its year-to-date performance, with the stock down nearly 35%.

Why Tesla stock is rallying

Tesla investors appear to be reacting to the latest developments in China, where the company has announced plans for its Full Self-Driving (FSD) technology, pending necessary approvals.

In this case, Tesla confirmed it will release its smart driving-assistance feature in China after completing regulatory approval. This comes after complaints emerged regarding a limited-time free trial of its FSD service, which had been temporarily paused.

The American EV giant initially noted that it would roll out the FSD free trial in China between March 17 and April 16. The company intends to launch the technology fully this year and is already working with local tech giant Baidu.

If approved, the self-driving system could help Tesla fight competition from local manufacturers and potentially boost sales in China. Tesla would have the upper hand, considering some domestic EV makers are still struggling with consumer trust issues.

What next for TSLA stock price

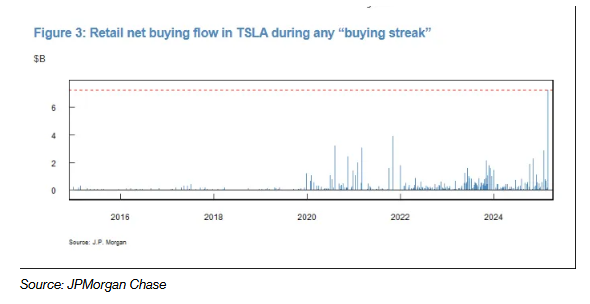

Looking ahead, Tesla investors hope the stock has found its bottom, creating room for a new rally with retail investors playing a central role in this move.

Tesla’s breakout past the $250 mark has been partly fueled by retailers, who pumped a record $8 billion into the stock over 13 days as of March 21, the largest buying streak in the company’s history.

Amid these uncertainties, Wall Street remains divided on Tesla’s next trajectory. Most analysts agree there is room for growth, provided the company weathers current headwinds.

As reported by Finbold, on March 18, RBC Capital’s Tom Narayan maintained an ‘Outperform’ rating but slashed TSLA’s price target from $440 to $320. The analyst dismissed concerns over Tesla’s declining sales, arguing that fears of consumer rejection are exaggerated.

However, on March 12, JPMorgan’s Ryan Brinkman shared a bearish outlook, cutting his price target from $135 to $120. He cited falling demand, consumer backlash against Musk, and rising Tesla boycotts as major risks.

Meanwhile, Morgan Stanley remains bullish on Tesla, with analyst Adam Jonas reaffirming the company as his top auto pick on March 20. He assigned an ‘Overweight’ rating and a $430 price target, citing Tesla’s potential in AI and robotics. The banking giant has a long-term target of $800.

Featured image via Shutterstock