The leading cryptocurrency in the world, Bitcoin (BTC) has made impressive strides when it comes to adoption. Whereas in 2024, BTC is available via exchange-traded funds (ETFs), serves as a store of value and hedge against inflation, and enjoys widespread mainstream popularity, in the last decade, it was quite obscure.

Though unsavory, Bitcoin’s utility as a means of transfer for nefarious purposes is well-documented. This fact has been used (with little success) as an argument against the pioneering digital asset — but BTC has, in fact, been used for everything from the international drug trade to contract killings.

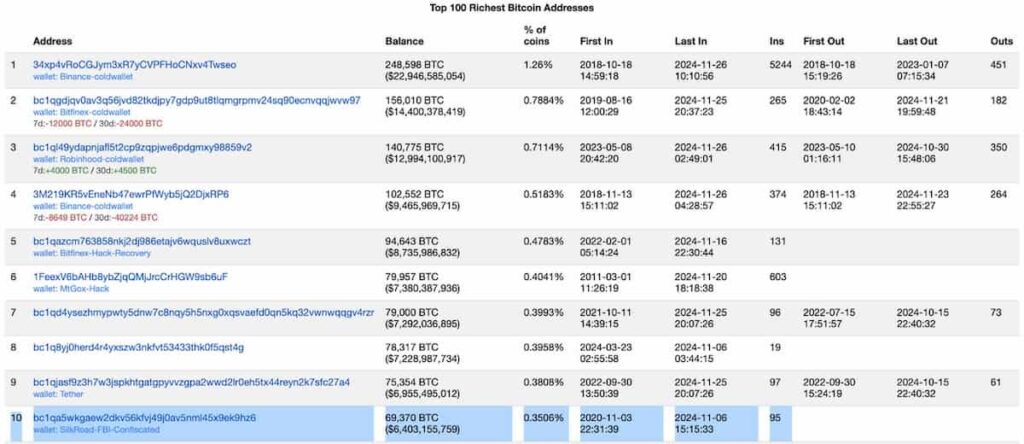

A major blow against such unethical and illegal uses was made on November 3, 2020, when the United States Department of Justice (DOJ) and Internal Revenue Service Criminal Investigation (IRS-CI) unit seized 69,370 Bitcoins associated with the dark web marketplace Silk Road. As an interesting aside, one of the IRS agents presiding over the case was Tigran Gambaryan — who later moved on to become a Binance executive.

Up to this point, this significant hoard has been kept in storage — although the Supreme Court has recently allowed the Treasury Department, which has taken custody of the assets, to sell them off.

Such a surge of liquidity on the sell side would doubtlessly serve to bring prices down — although no exact schedule for the sale has been set. In a slightly ironic twist, the tendency of governments to move slowly and inefficiently could stand to significantly benefit the United States — as the value of the seized Bitcoins has risen substantially since the confiscation.

At the moment of seizure, one BTC was worth just $14,000

On November 3, 2020, one Bitcoin was trading at roughly $14,000 — bringing the value of the seized assets to approximately $971,180,000. A company called Battle Born Investments appealed the decision to sell the Silk Road Bitcoin — after a series of appeals, they lost that legal battle on October 7, 2024.

What they did manage to do, however, is to delay the sale for a tad longer than 4 years— at press time, BTC prices have surged to $94,640. This equates to a 576% increase within that timeframe.

To put matters into slightly more comprehensible terms, the value of those 69,370 Bitcoins has increased to $6,565,176,800 — the difference is a staggering $5,593,996,800 compared to November 3, 2020.

It remains to be seen whether or not the Silk Road Bitcoin hoard, which represents 0.3506% of the total BTC supply will ever hit the market — President-elect Donald Trump has previously vowed to stop the sale of seized cryptocurrencies, and plans instead to earmark them as reserve assets.

Featured image via Shutterstock