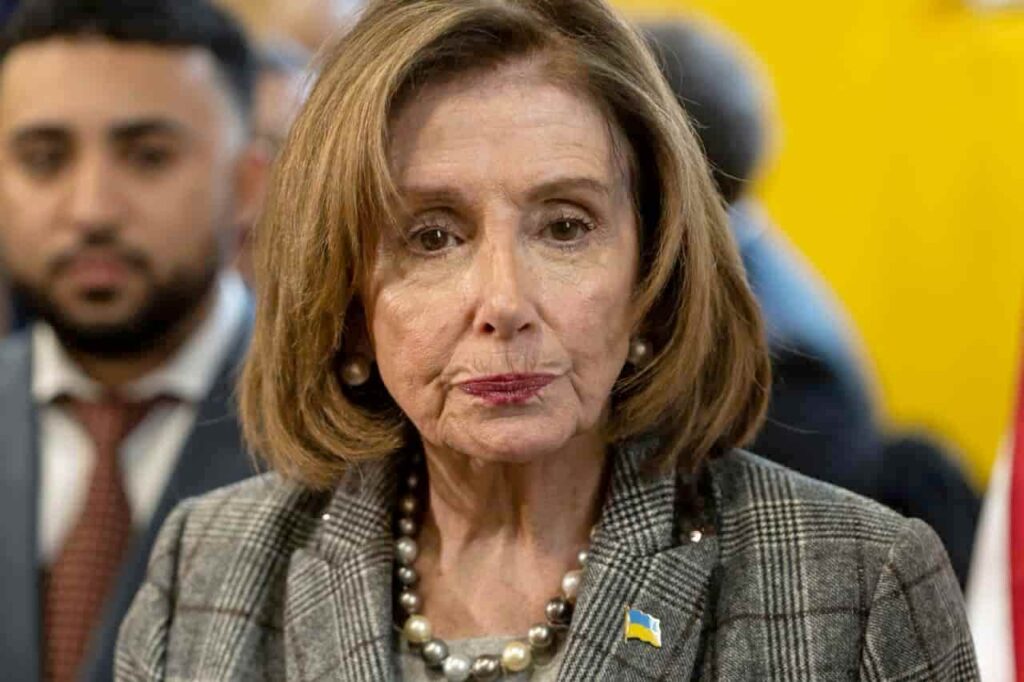

Nancy Pelosi’s net worth has surpassed $250 million after gaining over $10 million in May alone. However, the U.S. politician currently holds losses with Palo Alto Network (NASDAQ: PANW) shares acquired in February.

In particular, Pelosi’s current unrealized losses with the Palo Alto stock is a combination of two trades from February 2024. Finbold retrieved data from Quiver Quantitative on May 21, an analytics platform that monitors U.S. politician stocks trading.

The first trade occurred on February 12, after the stock reached a local top of $376.9 on February 9. As it developed, PANW dipped aggressively from February 20 to February 21, revisiting prices last seen in November 2023. Yet, the stock price is still down 16% even after a relevant correction in the past three months.

Notably, Nancy Pelosi demonstrated high conviction on her Palo Alto stock bet, literally buying the dip on February 21—a decision that rendered her over 19% gains so far on this purchase alone. She disclosed both trades on February 23, two days after the second entry point.

Nevertheless, the first and losing purchase was within a range between $500,001 and $1 million, as disclosed. Meanwhile, the winning PANW trade ranged between $100,001 and $250,000—for one-fifth to one-fourth of the first.

Why did PANW stock dip after Nancy Pelosi’s purchase?

Palo Alto Networks stock dipped sharply on February 22 despite Nancy Pelosi’s purchase. The company cut its annual billing forecast due to softer client spending and steep promotions.

Therefore, Palo Alto Networks’ shares fell more than 26% in early trading, erasing nearly $30 billion in market value. The company’s plan to offer up to six months of free services to customers switching to its platform contributed to the billings guidance cut.

Cybersecurity firms combine offerings into unified platforms to cater to customers tired of buying from different vendors. The company’s business with the U.S. federal government also slowed down, a trend expected to continue until mid-2024. At least 18 brokerages lowered their price targets on the stock, pulling down the median view to $340.

Despite the dip, Pelosi’s purchase of up to $1 million in PANW shares on February 12 demonstrates her confidence in the company’s long-term prospects.

Now, stock investors curiously watch the stock performance and related news to the company, considering Nancy Pelosi’s highly positive history with stock bets, often suspected of insider trading due to her influence in the United States.

It is worth noting that these two PANW trades expire on January 17, 2025. Additionally, they both have a strike price of $200, which suggests the U.S. politician does not expect Palo Alto Networks stock to fall below that level.