Newborn Nine is how the ETF expert Eric Balchunas calls 9 of the 10 recently approved Bitcoin ETFs. These are competitors of the pioneer Grayscale Bitcoin Trust (GBTC), experiencing a capital outflow partially distributed to the Newborn.

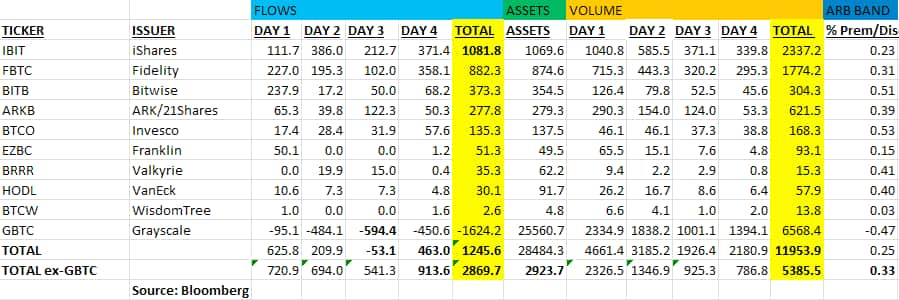

Notably, GBTC has lost a total of $1.62 billion worth of spot Bitcoin shares in the first four days. In the meantime, the Newborn Nine had an inflow of $2.87 billion, resulting in a $1.24 billion net flow to Bitcoin ETFs after the historic approval on January 10.

Eric Balchunas shared this data from Bloomberg on X (formerly Twitter) on January 18. In the post, Balchunas further explained inflows happen amid increased demand for ETF shares. This requires Authorized Participants (AP) to make more shares and purchase the corresponding amount of Bitcoin (BTC).

Interestingly, BlackRock’s iShares Bitcoin Trust (IBIT) is the largest fund, excluding Grayscale, with $1.08 billion in total inflows. Fidelity’s FBTC holds the second position among the Newborn Nine with over $800 million in inflows, while Bitwise’s BITB is the third with $373 million.

Grayscale’s Bitcoin ETF (GBTC) outflows

Moreover, Eric Balchunas addressed Grayscale’s outflows as “normal stuff” now that the Newborn Nine offers more competitive conditions to investors. He expects continuation in the outflowing trend from GBTC to the others.

In a recent interview, Michael Sonnenshein, CEO of Grayscale Investments, says he is not surprised by these outflows. However, Sonnenshein defends his funds’ highest fees in the market due to paving the path for the others.

“As an investor, when you are choosing among these products, fees are a consideration, the asset manager, the issuer, is a consideration, but so should size, liquidity, and, again, that track record.”

— Michael Sonnenshein

Grayscale’s CEO also mentioned the importance of looking at volume instead of flows, which GBTC leads thrice over BlackRock’s IBIT. In total, over $11.93 billion was traded in Bitcoin ETFs in the first four days. GBTC dominates the Newborn Nine with $6.56 billion in volume alone.

All things considered, the cryptocurrency market, the stock market, and financial entities look forward to seeing further developments. Bitcoin is currently in price discovery mode, facing this new adoption case by traditional finance.