As the stock market tumbled on Friday amid renewed trade tensions between the United States and China, rare earth equities leveraged the opportunity to post gains.

Notably, the benchmark S&P 500 index ended the day down 2.7%, wiping out about $1.5 trillion in market capitalization.

The sell-off followed President Donald Trump’s announcement of a 100% tariff on Chinese imports, effective November 1, in response to China’s expanded export restrictions on rare earth elements, which are critical for high-tech and defense industries.

Rare earth stocks ignore market downturn

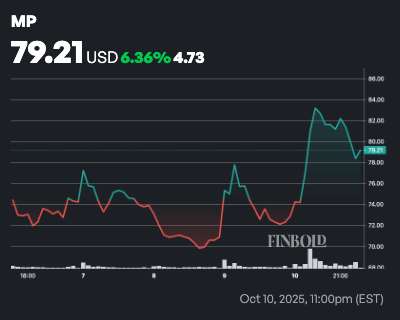

MP Materials (NYSE: MP), the largest rare earth producer in North America, rose about 8.4% to close at $78.34, reflecting increased investor focus on domestic critical mineral supply chains and regulatory support for rare earth processing.

Meanwhile, USA Rare Earth (NASDAQ: USAR), which is developing a U.S.-based supply chain for rare earth magnets, gained nearly 5%, closing at $32.61 as investors reacted to its strategic importance amid the trade tensions.

Finally, NioCorp Developments (NASDAQ: NB), advancing the Elk Creek Project in Nebraska with North America’s highest-grade niobium deposit and significant scandium capacity, rose over 5% to close at $10.39.

Implication of tariffs on rare earth stocks

The surge in these stocks came as investors reassessed the heavy U.S. reliance on China, which currently supplies about 70% of America’s rare earth imports.

This dependence has long been viewed as a national security risk, especially given rare earths’ essential role in producing electric vehicles, wind turbines, smartphones, and defense equipment.

Analysts noted that the new tariffs could disrupt U.S. manufacturers reliant on Chinese rare earth materials, potentially driving up production costs and pushing companies to secure alternative supply chains.

However, this same disruption could benefit domestic producers which stand to gain from accelerated government incentives and private investment aimed at reducing foreign dependence.

Featured image via Shutterstock