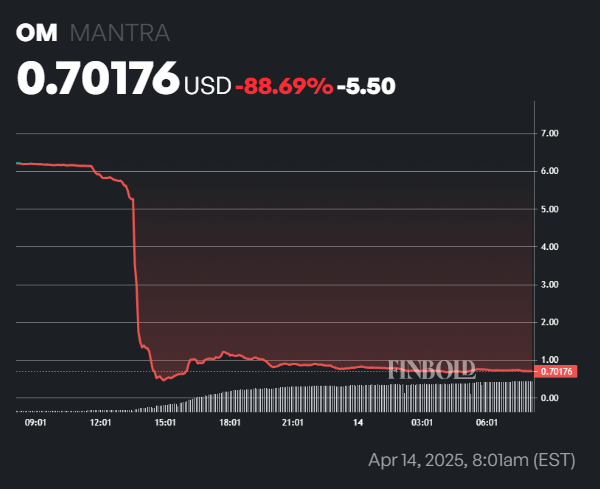

The OM token from MANTRA DAO crashed over 90% early Monday, wiping out $5.36 billion, with the latest on-chain data suggesting insider transactions may have contributed to the free fall.

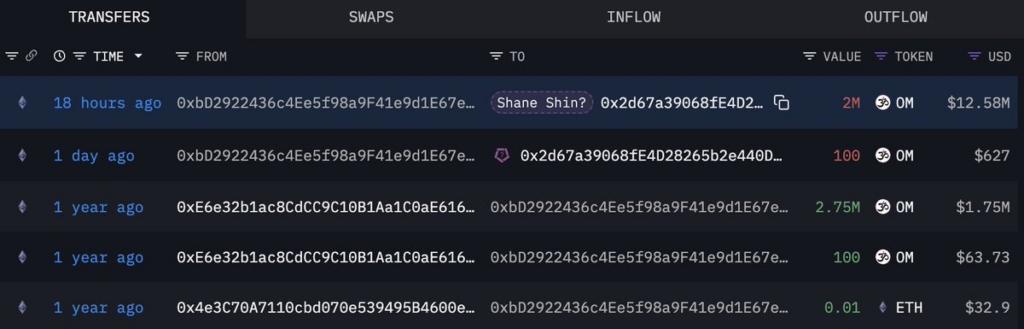

Specifically, just five hours before the crash, a wallet that had been dormant for over a year transferred 2 million OM, then worth $12.58 million, to another wallet potentially linked to venture capitalist Shane Shin, according to the latest on-chain data retrieved by Finbold from Lookonchain on April 14.

It’s worth noting that Shin, a venture capitalist at Shorooq Partners, has previously promoted MANTRA. However, there is no evidence of wrongdoing on his part.

At the same time, data from crypto intelligence platform Arkham revealed that 17 wallets offloaded 43.6 million OM tokens, valued at roughly $227 million and about 4.7% of the circulating supply, just before the crash. Two of these wallets were reportedly tied to Laser Digital, a strategic investor in MANTRA Chain.

OM crash blame game

While the MANTRA DAO team blamed centralized exchanges for “reckless forced closures” during low-liquidity Sunday evening trading, many in the crypto community remain unconvinced.

Founder John Patrick Mullin insisted, “There was no rug pull,” instead calling for better oversight of exchange practices that “can hurt projects and investors alike.”

As things stand, competing narratives are emerging. For instance, executives at exchanges like OKX and Binance have hinted that insider selling may have triggered the sell-off, challenging MANTRA’s explanation.

Interestingly, this isn’t the first time MANTRA DAO has come under scrutiny. In 2021, crypto analyst Colin Wu raised concerns about the project’s ties to gambling platform 21Pink and its misleading investment claims from the now-defunct FTX exchange.

OM price analysis

Meanwhile, the sell-off has further worsened OM’s price trajectory, as the token was already navigating a volatile market. OM was trading at $0.72 at press time, plunging 88% in the last 24 hours.

The token’s market cap stood at $6.06 billion on April 13 before crashing to $710 million at press time.

Featured image via Shutterstock