Lockheed Martin (NYSE: LMT), one of the most actively traded defense stocks among United States Congress members, has been hit with two major downgrades from Wall Street.

These revisions add to the company’s recent challenges as it faces increasing capital outflows.

Over the past three years, LMT stock has seen nearly 50 trades among politicians, with at least 10 lawmakers involved in the stock.

The most recent Congress trade occurred on February 18, when Republican Representative Scott Franklin purchased between $1,000 and $15,000 worth of shares.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

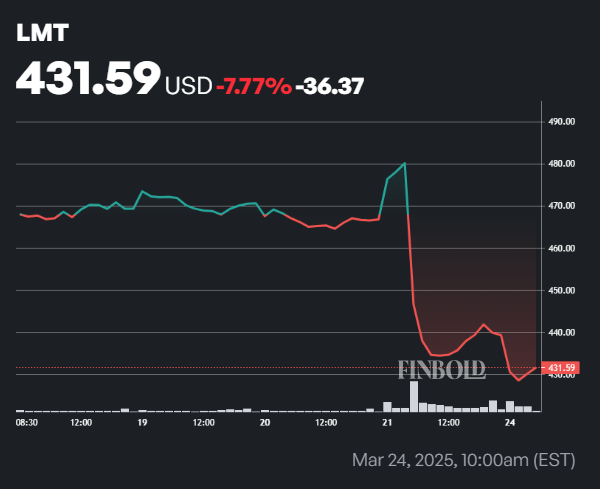

As of press time, LMT was down over 2%, trading at $429.70, marking a year-to-date decline of more than 10%. The stock’s overall sentiment remains bearish in the short and long term, as it continues to trade well below its 50-day simple moving average (SMA) of $461.43 and 200-day SMA of $512.87.

Analysts downgrade LMT stock

Regarding the stock’s trajectory, on March 24, Bank of America (BofA) analyst Ronald Epstein downgraded Lockheed from ‘Buy’ to ‘Neutral’, lowering the price target from $685 to $485. This reflects a 12.5x 2026 estimated EV/EBITDA multiple, aligning with historical averages.

Epstein cited concerns over Lockheed’s earnings quality, the loss of all sixth-generation manned tactical aircraft programs, and a lack of company-specific catalysts in the near term.

The BofA downgrade also reflects lowered topline growth expectations and delayed profitability ramp-ups within Lockheed’s Aeronautics division.

“We remain wary of Lockheed Martin’s recent quality of earnings, the loss of all 6th Gen manned tactical aircraft programs, and lack of company-specific catalysts in the near term,” Epstein said.

On the same day, Melius Research also weighed in, with analyst Robert Spingarn downgrading Lockheed Martin from Buy to Hold and cutting the price target from $603 to $483.

The downgrade was driven by Lockheed’s competitive losses and growing concerns over Europe’s push to reduce reliance on U.S. defense contractors, which could dampen the company’s export opportunities.

“At the same time, we are downgrading Lockheed to Hold due to competitive losses and growing concerns over Europe’s efforts to reduce reliance on U.S. defense contractors, which may limit Lockheed’s export opportunities,” the analyst said.

Spingarn stated that despite Lockheed’s $18 billion Next-Generation Interceptor missile defense win last year, recent contract losses to competitors like Northrop Grumman (NYSE: NOC), Raytheon (NYSE: RTX), and Textron (NYSE: TXT) signal increasing headwinds for the company’s future growth.

LMT stock price bullish take

Although some of Lockheed’s recent volatility began after the company lost the Next Generation Air Dominance (NGAD) contract to Boeing (NYSE: BA), a $20 billion program that will replace the F-22 Raptor, not all of Wall Street is pessimistic about the company.

Specifically, Truist Securities maintained a ‘Buy’ rating and a $579 price target in an investor note on March 24, citing the company’s strong fundamentals and long-term growth potential.

Analyst Michael Ciarmoli acknowledged that winning the NGAD contract could have contributed an estimated $4 to $5 billion in revenue for Lockheed Martin over the next two decades.

However, he emphasized that the company’s dominance in the aerospace and defense industry remains intact, supported by its F-35 program and other defense contracts.

While Boeing’s victory ends Lockheed’s exclusive role as the U.S. fighter aircraft contractor, Truist believes LMT still holds significant upside.

Featured image via Shutterstock