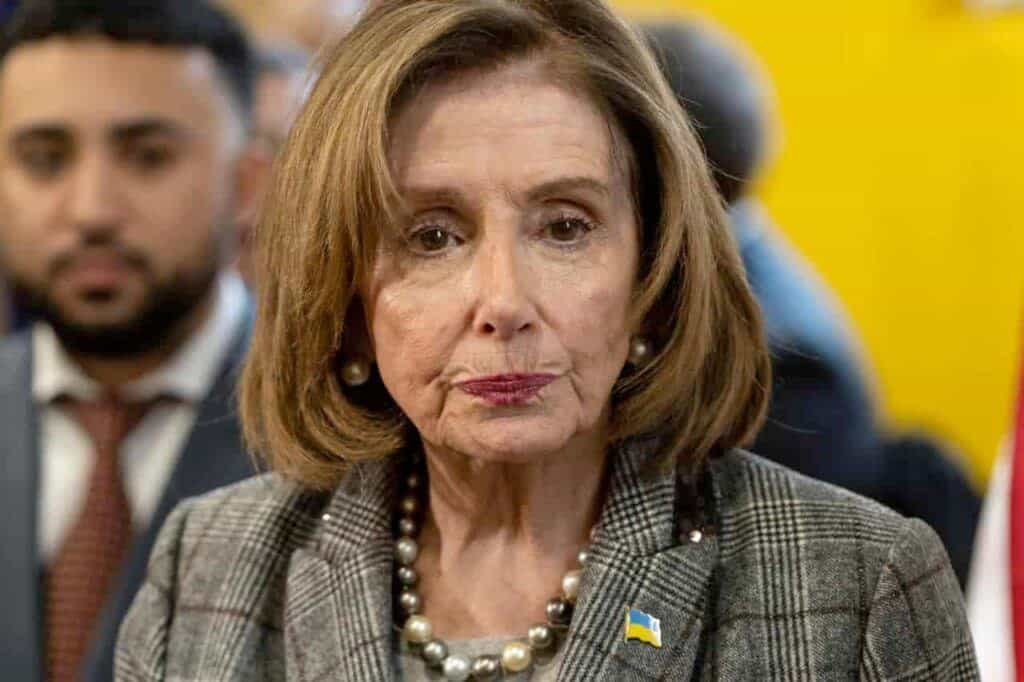

Despite what Nancy Pelosi’s reputation as Congress’ prime trader might suggest, the Former Speaker has been known to make poor stock market investments at times.

Perhaps the most high-profile example of the Representative making a losing bet in 2024 is her initial purchase of Palo Alto Networks (NASDAQ: PANW) stock. Indeed, unlike those who may have copy-traded the PANW investment, her initial batch of shares actually put her some 23% into the red.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Still, according to the filings available at press time on September 19, Pelosi still holds the entire Palo Alto Networks position and may, therefore, still profit from the February 12 purchase.

The same can’t be said about her Tesla (NASDAQ: TSLA) investment, as she had cleared much of her position in the electric vehicle (EV) maker – at no small loss – by late June 2024.

Here’s how much Nancy Pelosi is down on Tesla

Nancy Pelosi originally purchased up to $6 million worth of TSLA stock in two batches in 2020 and 2022 through options contracts.

At the time of the first purchase – made on December 22, 2020, and worth up to $1 million – Tesla shares were worth approximately $230.

At the time of the second purchase – possibly worth as much as $5 million and dated to March 17, 2022 – TSLA stock was trading for about $300.

Considering the high Tesla valuations at the time Nancy Pelosi made the purchases, it is mostly safe to say she has lost a significant amount of money due to the timing of the sales.

For example, the Former Speaker may have received as little as $650,000 when she sold 5,000 Tesla shares on December 20, 2022, as TSLA stock was trading at approximately $130 at that time.

Profits also likely eluded the Representative when she sold 2,500 shares on June 24, 2024, as Tesla stock was worth approximately $182.

The 2024 sale is interesting in particular as a copy trader who may have used a signal from a Congressional trading radar would have sold on the date the sale was reported – July 2 – at a far higher price of about $231.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Finally, it is worth pointing out that despite the major differences between the purchase and sale prices, it is difficult to gauge the exact losses given the shares were acquired through call options.

Could Nancy Pelosi still turn a profit on her Tesla stock bet

Finally, though Former Speaker Pelosi has not held on to her entire Tesla stake, she may, like with her Palo Alto stock investment, turn a profit.

Such an outcome would be possible, provided TSLA stock manages to reclaim or even rise above its old highs – a scenario not entirely out of reach according to the many Tesla bulls present among investors and analysts.

Tesla might see particularly strong growth in the coming years should its upcoming ‘Robotaxi’ event prove a success and should it accelerate the development and rollout of its self-driving technology.

The announced commercial availability of Tesla’s humanoid robot in 2025 would also do much to solidify the EV maker’s transition into an artificial intelligence (AI) and technology firm.

Still, the advancements that could help TSLA shares rocket in the coming years a manner similar to Nvidia’s (NASDAQ: NVDA) trajectory since 2022 are neither guaranteed, nor universally accepted.

Gordon Johnson, a market expert and prominent Tesla bear, for example, believes TSLA stock’s old highs were a product of unique circumstances created by the global supply chain disruptions during the COVID-19 pandemic and that the EV maker will never again reclaim similar stock market highs.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.