A stock rarely traded by United States politicians is experiencing massive short-term gains after a Congress member made a bet on the company.

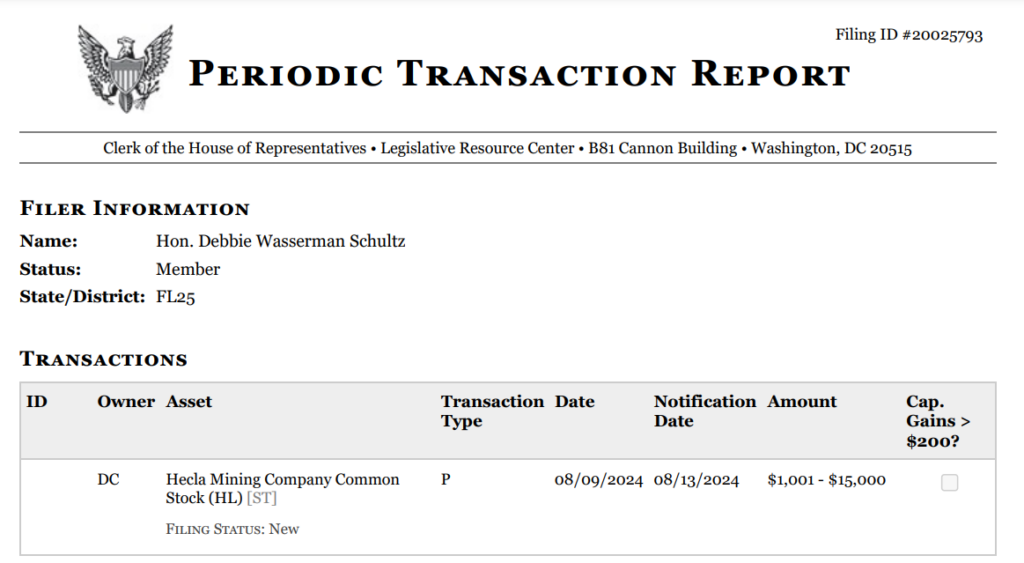

Following months of trading inactivity, Representative Debbie Wasserman Schultz from Florida purchased shares in Hecla Mining Company (NYSE: HL), a gold and silver mining firm.

Since the August 9 transaction, HL has rallied by 29%. At the time of the trade, the stock was valued at $5.04 and closed at $6.51 on September 12.

The purchase and the significant gains could raise questions about the potential use of insider information, given that HL has generally maintained a low profile among politicians. Schultz’s Environment, Manufacturing, and Critical Minerals Subcommittee membership further fuels suspicion.

Meanwhile, apart from her purchase of the mining equity, Schultz’s other trading activities have largely focused on the technology sector. She has made over 100 trades, totaling about $1.71 million in volume.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Why HL is rallying

HL’s surge could be attributed to market conditions, particularly its focus on mining precious metals. For example, silver prices and global demand have increased in recent months, raising investor interest in companies involved in extraction.

At the same time, amid prevailing fears of a possible recession, the price of gold has also surged, given that investors consider the metal a hedge against challenging economic times.

Additionally, the HL rally comes against impressive financial results that saw Hecla Mining surpass investor estimates. For Q2 2024, the company’s revenue was $245.7 million, a growth of 38% year-over-year. The figure surpassed analyst estimates by 16%.

During the quarter, the company also produced 4.5 million ounces of silver, rising 3.7% YoY and 43% from the previous quarter. Gold production also grew by 2% to 37,324 ounces from Q1 2024. The company has issued bullish guidance for 2024, aiming to produce 17 million ounces of silver.

Concerns over political stock purchases

Elsewhere, such a spike in stock after a political purchase raises questions about whether she had access to privileged information. This comes when several lawmakers are scrutinized for violating existing Congressional trading laws.

For instance, as reported by Finbold, Representative John James filed dozens of trades almost one year after the transactions were initiated. This move violated the 45 days stipulated by the STOCK Act (Stop Trading on Congressional Knowledge Act).

Finally, accusations regarding Congress members’ involvement in the equities market come as a bipartisan proposal to ban lawmakers from trading stocks is being considered. According to the proposed law, members of Congress would be barred from buying and selling stocks. The same restraint is also expected to be extended to their spouses if the draft becomes law.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.