Throughout the course of the year, some of the most impressive returns in the stock market were achieved on the back of the artificial intelligence revolution. Semiconductor companies like Nvidia (NASDAQ: NVDA) or AI infrastructure providers like Palantir (NASDAQ: PLTR) have benefited greatly.

There are just a couple of issues — after such impressive moves to the upside, it’s an open question as to whether or not the current trajectory can be sustained. There simply might not be more room to grow, at least in the short term. For reference, Nvidia stock is up 180.55% on a year-to-date (YTD) basis — and Palantir stock has performed even better, having rallied by 300.12% since the beginning of the year.

While it might not appear like it at times, valuations do matter — and the stock market as a whole has never been as overvalued as it is now, so corrections to the downside are also possible.

To boot, investing significant amounts of money into just a couple of well-performing stocks also runs the risk of missing out on returns from other sources. Another problem is that these assets aren’t exactly suitable for regularly locking in profits — investors simply risk losing out on far too significant gains by selling early. A new selection of exchange-traded funds (ETFs), however, seeks to remedy all of those issues at once.

This ETF can provide exposure to PLTR stock gains — without directly owning it

The YieldMax PLTR Option Income Strategy ETF (NYSEARCA: PLTY) is the latest in an increasing line of YieldMax funds that seek to provide a recurring stream of revenue to investors via some of the stock market’s best-performing entrants.

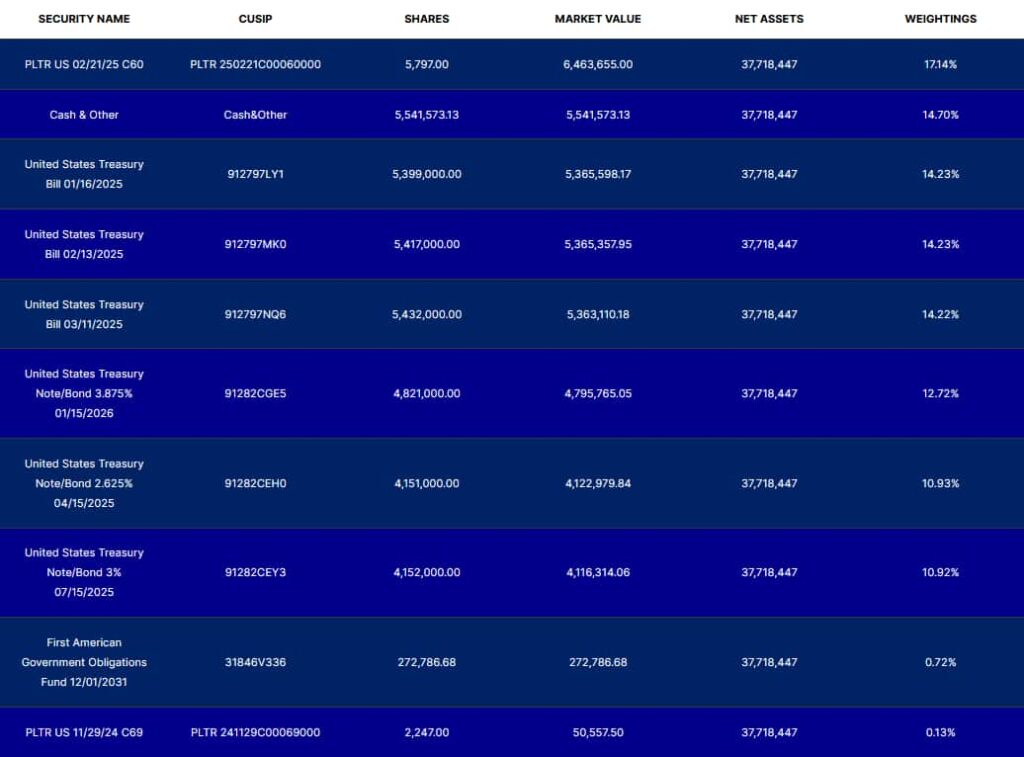

However, these ETFs don’t actually hold any equity in those companies — instead, a combination of options (primarily through writing calls) and fixed-income assets such as Treasury Bills is used to emulate the performance of the stock in question.

Although this strategy cannot provide the full extent of the returns, it is still a handy way to capture some of the growth on a regular basis. The PLTY ETF is YieldMax’s newest product, so it’s fair to note that its short track record isn’t really reliable — but readers should note that the company’s Nvidia ETF (NYSEARCA: NVDY), which as a longer track record, has performed admirably thus far.

How has PLTY performed since its founding?

The fund seeking to provide exposure to the gains of Palantir stock was launched on October 8. Since then, it has seen prices rise from $51.43 to $66.34 — an increase of 28.99%. While PLTR shares have gone up by 60.71% in that same timeframe, the different risk profile and ability to regularly lock in gains could be appealing to some — particularly income investors.

Since its launch, PLTY has had one distribution — amounting to $2.20 on November 8. At present, PLTY maintains a distribution rate of 43.62% — in simple terms, if the performance seen up to this point were to be continued for a full year, investors would receive 43.62% of their investment back in the form of dividends in that period. The fund also has a 0.99% gross expense ratio.

Featured image via Shutterstock