The quantum computing industry is emerging as one of the most dynamic investment frontiers, driven by surging interest from both commercial and government sectors.

Market forecasts project the industry to grow from $1.16 billion in 2024 to $12.6 billion by 2032, at an impressive annual growth rate of 34.8%.

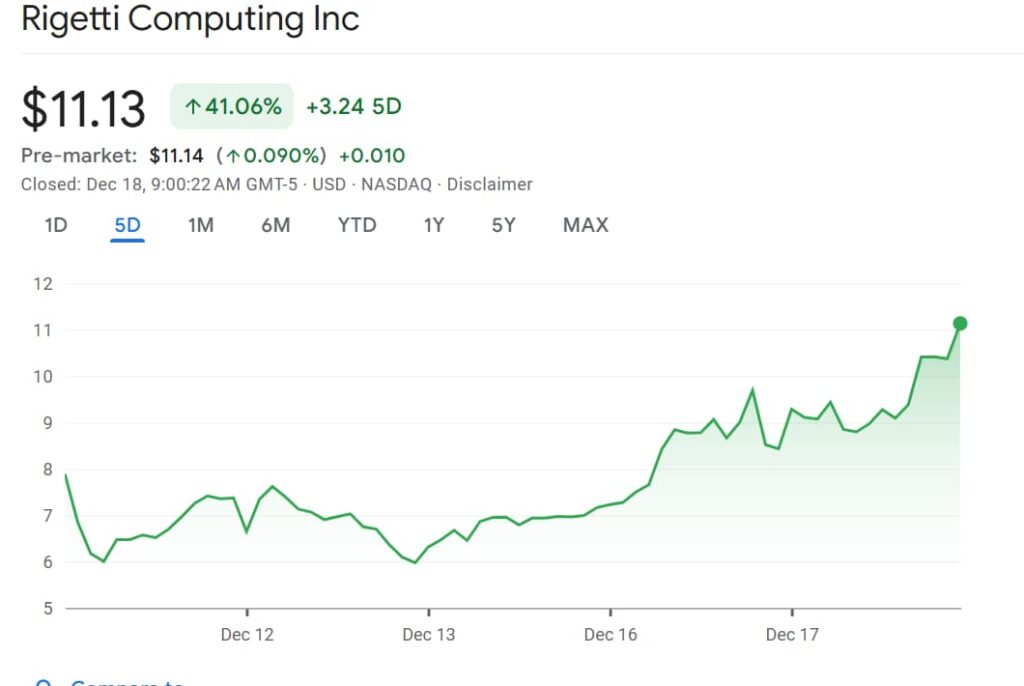

Against this backdrop, Rigetti Computing (NASDAQ: RGTI) has captured investor attention, with its stock surging over 700% in just one month to reach a 52-week high of $11.13.

Picks for you

As of the market close on December 17, Rigetti’s stock is up 41% over the past week and a staggering 1,035% year-to-date, solidifying its position as one of the most-watched companies in the quantum computing sector.

Factors propelling Rigetti’s growth

Rigetti’s rise can be traced back to the momentum initiated by Google’s unveiling of its Willow chip, which reignited investor interest in the quantum computing sector.

This momentum was further bolstered by a $2.7 billion U.S. government funding initiative aimed at accelerating quantum innovation in computing, sensing, and communications.

Moreover, Rigetti has established itself as a significant player in the industry through its proprietary Quantum Processing Unit (QPU) technology, with its current Novera QPU featuring 9 qubits as a foundation for future advancements.

The company’s Quantum Computing as a Service (QCaaS) platform further enhances its offerings, enabling seamless integration of quantum systems into cloud environments.

Rigetti’s roadmap further underscores its ambitious growth strategy. The company plans to unveil a 36-qubit system in 2025, aiming to achieve 99.5% fidelity, followed by a scalable 100-plus qubit system.

These developments align with sector-wide momentum driven by breakthroughs like Google’s Willow chip and Amazon’s (NASDAQ: AMZN) Quantum Embark program, which have amplified interest in quantum computing’s potential to solve complex, real-world challenges.

Risks and challenges

Despite its technological progress, Rigetti’s financials reflect the challenges of operating in an emerging industry. The company reported $2.4 million in revenue for Q3 2024, down from $3.1 million a year earlier.

However, Rigetti has taken steps to strengthen its financial foundation by raising $100 million through a direct share offering and settling and terminating its outstanding Loan and Security Agreement with Trinity Capital Inc., resolving approximately $10.5 million in debt using cash on hand.

However, Rigetti’s reliance on development contracts for revenue makes the stock a high-risk, high-reward investment. Short-seller Citron Research has also expressed concerns over Rigetti’s valuation, adding a layer of scrutiny to its rapid rise.

Despite these challenges, investor sentiment remains optimistic, reflecting confidence in Rigetti’s long-term potential.

Notably, analysts have likened Rigetti to the “Nvidia of the quantum computing space,” highlighting its strategic positioning in a rapidly evolving sector.

While the company faces hurdles in scaling its technology and achieving consistent revenue growth, its ambitious roadmap and role in driving sector-wide advancements suggest significant long-term potential.

For investors, Rigetti represents a bold opportunity in a sector poised for substantial growth, albeit with the risks inherent in a rapidly evolving industry.

Featured image from Shutterstock.