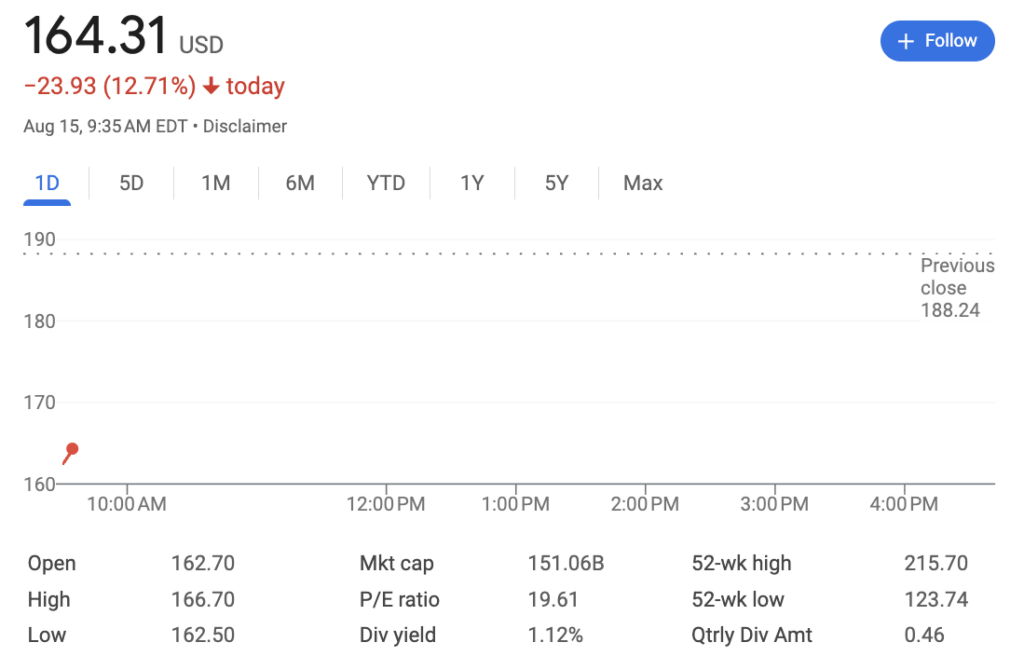

Applied Materials (NASDAQ: AMAT) shares plunged on Friday, trading at $164.31 as of market open, a 12.71% drop from Thursday’s close of $188.24.

Why AMAT stock is down

The company beat expectations in its fiscal third quarter, reporting revenue at $7.30 billion, up 8% year-over-year, and adjusted earnings at $2.48 per share, both above consensus. Gross margin reached 48.8%, with all three business segments topping forecasts.

Still, the stock sank as management issued conservative guidance for the fourth quarter, forecasting revenue of roughly $6.70 billion, below analysts’ average estimate of $7.33 billion. Adjusted EPS was expected at $2.11, also missing the $2.39 consensus

CFO Brice Hill highlighted sluggish Chinese demand and uneven orders, while CEO Gary Dickerson flagged increased macroeconomic and trade-policy uncertainty, particularly around export licenses to China.

Wall Street’s take on AMAT stock

The outlook triggered a wave of analyst downgrades.

Bank of America downgraded AMAT to Neutral from Buy, trimming its price target to $180. The firm noted company-specific headwinds, including weak visibility around demand and China-related pressure.

Summit Insights downgraded the stock to Hold from Buy. It cited risks associated with U.S. export restrictions driving pull-in orders in China, leading to excess capacity that may take several quarters to digest.

Stifel kept a Buy rating but reduced its price target to $180 from $195. Analyst Brian Chin said long-term fundamentals remain sound but near-term guidance calls for a more conservative valuation, noting expectations have already reset after peers gave cautious 2026 spending outlooks.

Goldman Sachs, however, reaffirmed a Buy with a $215 target, noting that while the near-term outlook is soft, Applied still benefits from healthy fundamentals and strong positioning in etch and deposition technologies. Barclays also reaffirmed its Equal Weight rating and a $170 target.

Featured image via Shutterstock.