Just days after American TV personality Jim Cramer praised FedEx Corporation (NYSE: FDX) as a “great stock to own,” the company’s shares took a nosedive, giving, once again, fuel to his critics who believe CNBC’s ‘Mad Money’ host is perpetually in the wrong.

Indeed, during an episode of his show on September 18, Cramer highlighted FedEx as one of the companies doing better than Wall Street realized, especially amid (now proven justified) expectations that the United States Federal Reserve would start cutting interest rates.

As he explained at the time, agreeing with Baird’s recent ‘buy’ recommendation if FedEx shares experience any declines, and shortly after applauding CEO Raj Subramaniam’s “remarkable job,” FDX stock was, in his view, an excellent play on the upcoming rate-cutting season:

“Baird told clients to buy FedEx stock on any weakness. I agree. This is a great stock to own as the Federal Reserve prepares to begin a rate-cutting cycle.”

FedEx stock price analysis

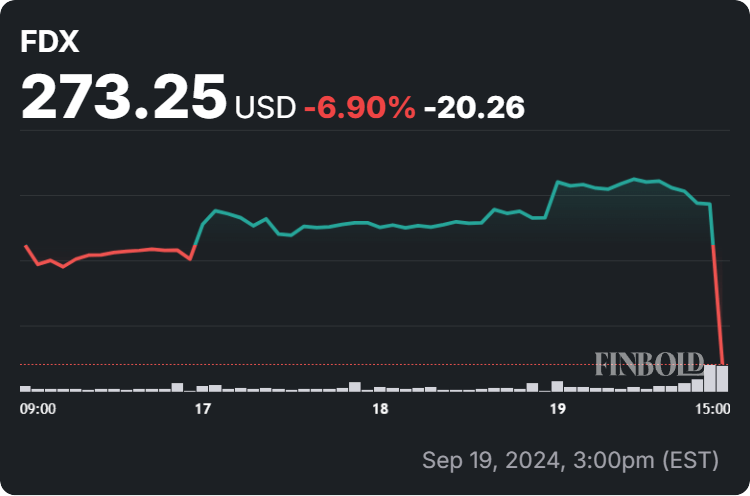

However, not long after Cramer’s bullish comments, FedEx stock dropped immensely, recording a decline of nearly 16% in a single day, as it nosedived from the area around $309 to the zone at about $258 and is currently trading at the price of $273.45 in pre-market, according to the latest charts.

At the same time, its current price reflects a dip of 13.13% on the day, declining 6.90% across the previous seven days, adding up to the 10.42% loss over the month and reducing its year-to-date (YTD) advances to a mere 3.52%, as per data retrieved on September 20.

Why is FDX stock down?

Notably, the FDX stock had a period of steady upward movement but then witnessed a decline that started building and then accelerated recently, culminating in a sharp single-day sell-off, possibly driven by the recent earnings report that fell well short of Wall Street expectations.

Specifically, the logistics company has cut its full-year guidance, narrowing its outlook for adjusted earnings per share to a range of $20.00 to $21.00, down from $20.00 to $22.00 originally, and reported weaker-than-expected fiscal first-quarter earnings.

Commenting on this, analysts at Barclays said that the “unfortunate reality for FedEx is one of the worst first quarter profitability outcomes outside of the 2009 recession,” while Morgan Stanley (NYSE: MS) said it suggested greater longer-term EPS risk than anticipated, downgrading FDX stock to “underweight” and slashing the price target to $200.

All things considered, FedEx stock seems to be in a pickle despite Cramer’s enthusiasm, and its bearish momentum might continue due to the recent poor results. On the other hand, this might be the low price he suggested as a chance to buy FDX stock. That said, doing one’s own research, including FedEx stock price prediction, FedEx news today and in the future, e.g., FDX earnings date, is critical when investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.