One of Warren Buffett’s favorite stocks, Liberty Media Corporation (NASDAQ: LSXMA, LLVYK), recently announced a merger with Sirius XM Holdings (NASDAQ: SIRI) on August 23.

Starting September 10, the company will trade under New Sirius and ticker SIRI on the Nasdaq.

It seems that the Berkshire Hathaway (NYSE: BRK.A) CEO was privy to the move, as his most recent 13F holdings report, dated August 14, shows a sizable increase in all his positions that will be affected by the merger.

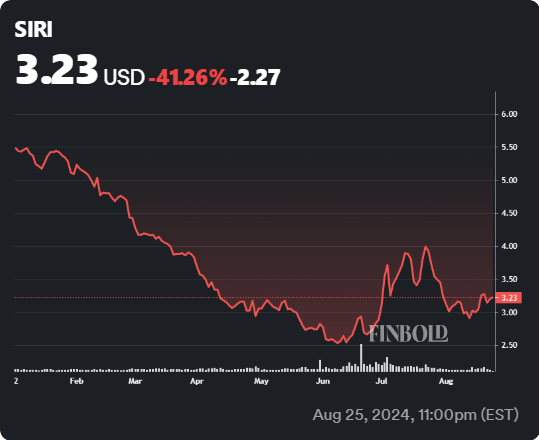

SIRI stock price chart

SIRI shares closed trading on August 23 at $2.30 per share after rising 1.91% in the latest trading session while also showing a progress of 1.56% in the pre-market trading.

Despite this, SIRI shares have decreased 41.71% on a year-to-date (YTD) price chart, falling from a $5.49 valuation on January 2 to the current price as of August 23. This could have motivated Buffett to add to his stock holdings in the past quarters.

Buffett added to his Liberty and Sirius stock positions

Namely, the Oracle of Omaha used the period up to June 30 to significantly reinforce his position in the media companies that have announced the merger.

As the updated portfolio reveals, Buffett added to his SIRI position the most, adding 96,196,301 shares for a 262.24% uptick in its portfolio size, accounting for 0.09% afterward.

The legendary investor also increased his LSXMA and LSXMK holdings by purchasing 2,426,595 and 4,516,609 shares, for an increase of 7.41% and 6.90%, respectively.

If the merger proceeds as planned, each outstanding share of Liberty Sirius XM common stock will be exchanged for the shares in the new company, meaning that Buffett’s holdings in Liberty Sirius will transfer into Sirius XM’s position at a redemption price yet to be determined.

This merger aims to combine the efforts and infrastructure of two media companies, increasing subscription and viewership base.

It remains to be seen whether Buffett has used the period from June 30 to August 23 to further bolster his holdings in these two companies, all of which will be revealed in the Q3 holdings report.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.