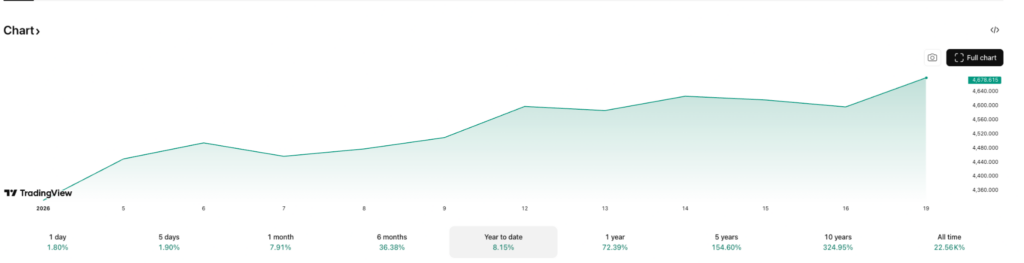

Gold’s rally has entered a new phase after reaching a fresh all-time high near $4,698 per ounce, prompting renewed long-term projections from renowned economist Steve Hanke.

In an X post on January 19, Hanke said he expects the current gold bull market to peak around $6,000 per ounce, framing the move as part of a broader monetary cycle rather than a short-term reaction to crisis events.

Hanke’s outlook builds on views he has expressed consistently in recent months, arguing that gold’s advance is being driven by structural monetary forces.

He has repeatedly pointed to disorder in global central banking, erosion of confidence in fiat currencies, and sustained weakness in the U.S. dollar as core drivers.

In his analysis, the applied economist and professor at Johns Hopkins University argued that markets remain overly focused on interest rate policy while underestimating the impact of money supply expansion, which he sees as the primary source of inflationary pressure and long-term currency debasement.

Gold surges to new all-time high

At the same time, recent market developments have reinforced gold’s momentum. Prices climbed again on Monday as geopolitical tensions escalated following U.S. President Donald Trump’s threat to impose new tariffs on several European countries amid a dispute linked to Greenland.

The prospect of retaliatory tariffs from the European Union has heightened uncertainty, pushing investors toward traditional safe-haven assets such as gold and silver.

Beyond geopolitics, multiple fundamentals continue to support higher prices. Expectations of U.S. interest rate cuts have increased, lowering the opportunity cost of holding non-yielding assets. Central banks have also been major buyers, adding hundreds of tonnes of gold to reserves as part of a broader diversification away from the dollar.

These forces follow a surge of more than 60% in gold prices last year, reflecting persistent demand tied to macroeconomic and policy uncertainty.

Featured image via Shutterstock