Amidst significant legal battles and sanctions, Tornado Cash, a well-known crypto-mixing service, has witnessed a notable rise in deposit volumes in the first half of 2024.

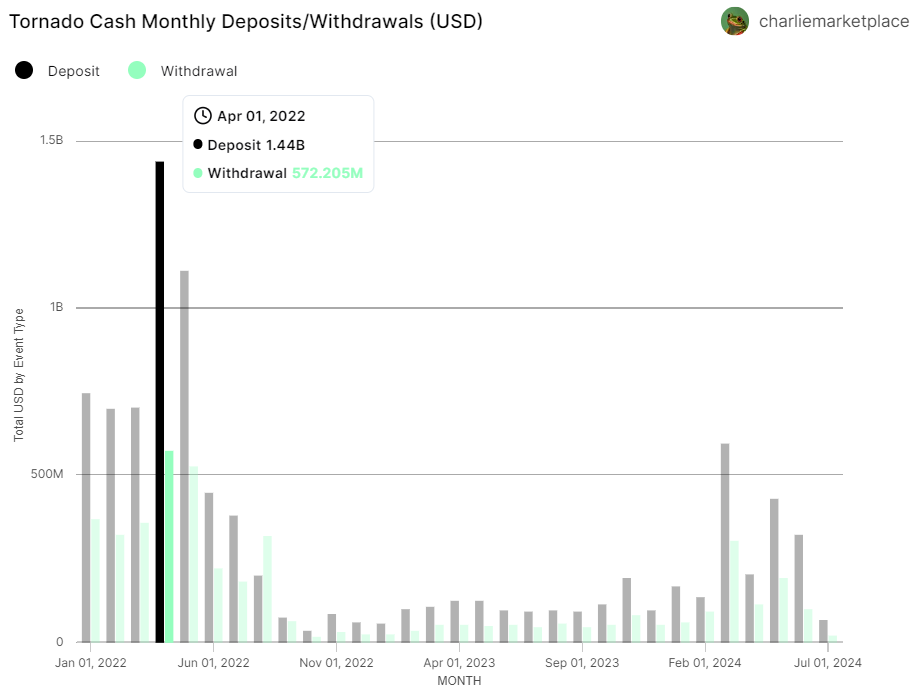

According to data from blockchain analytics firm Flipside Crypto, Tornado Cash accumulated around $1.9 billion in deposits over the past six months, marking a 50% increase compared to the total deposits for the entirety of 2023.

This surge highlights the ongoing demand for privacy-centric financial tools within the cryptocurrency ecosystem.

In August 2022, the Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash after discovering that the North Korean hacking group Lazarus used the protocol to launder approximately $455 million in illicit funds.

Consequently, these sanctions led to any wallet interacting with Tornado Cash being blacklisted, complicating the process for users to convert their crypto into fiat currency through legally compliant exchanges.

Despite these hurdles, Tornado Cash remains a favored platform for cybercriminals seeking to obscure the origins of their ill-gotten gains.

Moreover, recent data from blockchain analytics firm Arkham Intelligence reveals that the hacker behind the $100 million Poloniex exchange exploit transferred $76 million to Tornado Cash since May 2024.

Additionally, the HECO Bridge and Orbit Chain exploits resulted in $166 million and $48 million, respectively, being funneled through the mixer in the first half of the year.

More recently, one of the confirmed wallet addresses used in the $235 million hack of Indian crypto exchange WazirX on July 18 was funded via a Tornado Cash deposit.

Legal repercussions for founders

The protocol’s founders have faced significant legal repercussions. For instance, Alexey Pertsev was sentenced to over five years in a Dutch prison for money laundering charges in 2023.

Similarly, Roman Storm was arrested in the United States in August on similar charges, pleaded not guilty, and was released on a $2 million bond, subsequently filing a motion to dismiss all charges.

A broader trend towards privacy-enhancing technologies

Tornado Cash’s revival highlights the demand for privacy-focused financial tools within the crypto industry, even amid stringent regulatory crackdowns.

According to Chainalysis, other mixing services like Wasabi Wallet and JoinMarket have also seen growth, reflecting a broader trend toward the use of privacy-enhancing technologies.

As authorities continue to grapple with the enforcement of sanctions and regulations, the crypto community’s appetite for anonymity and privacy shows no signs of waning.