Trump Media & Technology Group (NASDAQ: DJT), the operator of Truth Social, saw yet another remarkable short-term surge.

DJT stock price rallied by 9.5% over the course of October 22, just two weeks ahead of Election Day. At press time, Trump Media shares were trading at $34.39 — bolstering monthly returns to a total of 183.05%.

These volatile moves are nothing new for DJT. The company’s stock price is largely a reflection of the Republican candidate’s chances of reelection, there is little doubt that enterprising traders have already secured copious profits from these wild swings.

That volatility is not going away — instead, it will just continue increasing as we draw closer to November 5.

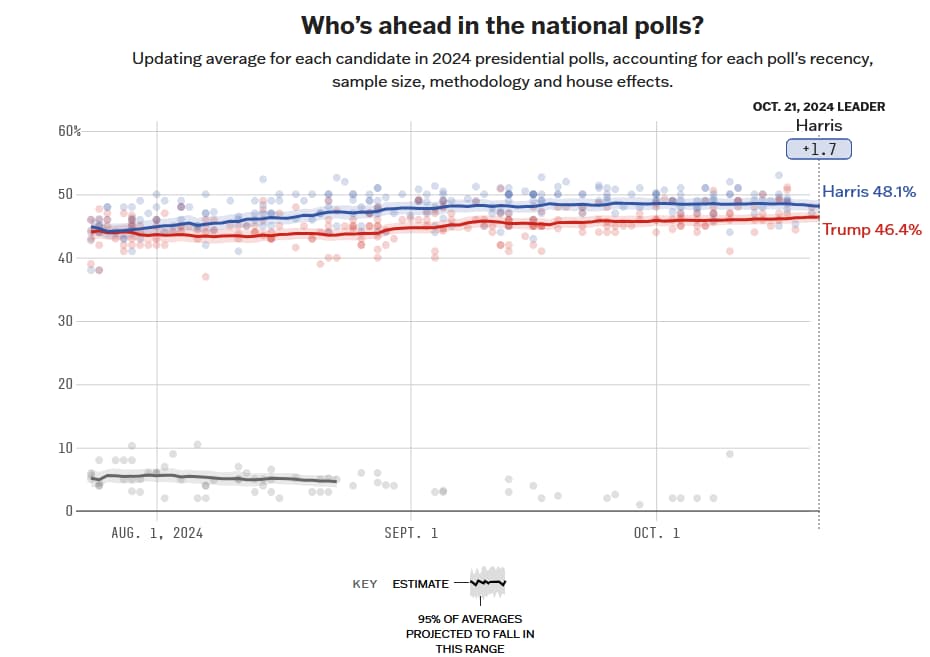

With national polls showing a neck-and-neck race between the billionaire and incumbent Vice President Kamala Harris, readers with a strong risk tolerance could stand to profit from well-timed trades — although the long-term prospect of DJT stock is another matter entirely.

Election polling and media coverage drive interest in DJT stock

Per Finbold’s previous coverage, the latest polling data from Nate Silver’s model and FiveThirtyEight suggest that while Harris maintains a small lead in national polling, the former President has made significant strides, particularly in key swing states.

In fact, the momentum of Trump’s campaign, if maintained, would see the GOP candidate regain a slight lead even in national polls just in time for Election Day.

While the real estate mogul seemingly remains resistant to consequences stemming from his many gaffes and off-the-cuff remarks, Harris’ latest media blitz was seen as relatively underwhelming. In stark contrast, the Vice President hasn’t been able to shake off accusations of vagueness — and her proposed policy proposals are seen as lacking substance by an increasing proportion of the voting base.

Harris’ latest moves in media included a combative Fox News interview —Trump has gravitated toward less mainstream outlets, which include a well-publicized shift at McDonalds and various podcast appearances. The continued support of Tesla (NASDAQ: TSLA) CEO Elon Musk is likely another key factor energizing the conservative figurehead’s base.

The Republican candidate’s strategy might reach a smaller proportion of the population, there is little doubt that focusing on online media is better in terms of engagement.

Trump is also scheduled to be a guest on the biggest podcast in the world, The Joe Rogan Experience, on Friday, October 25

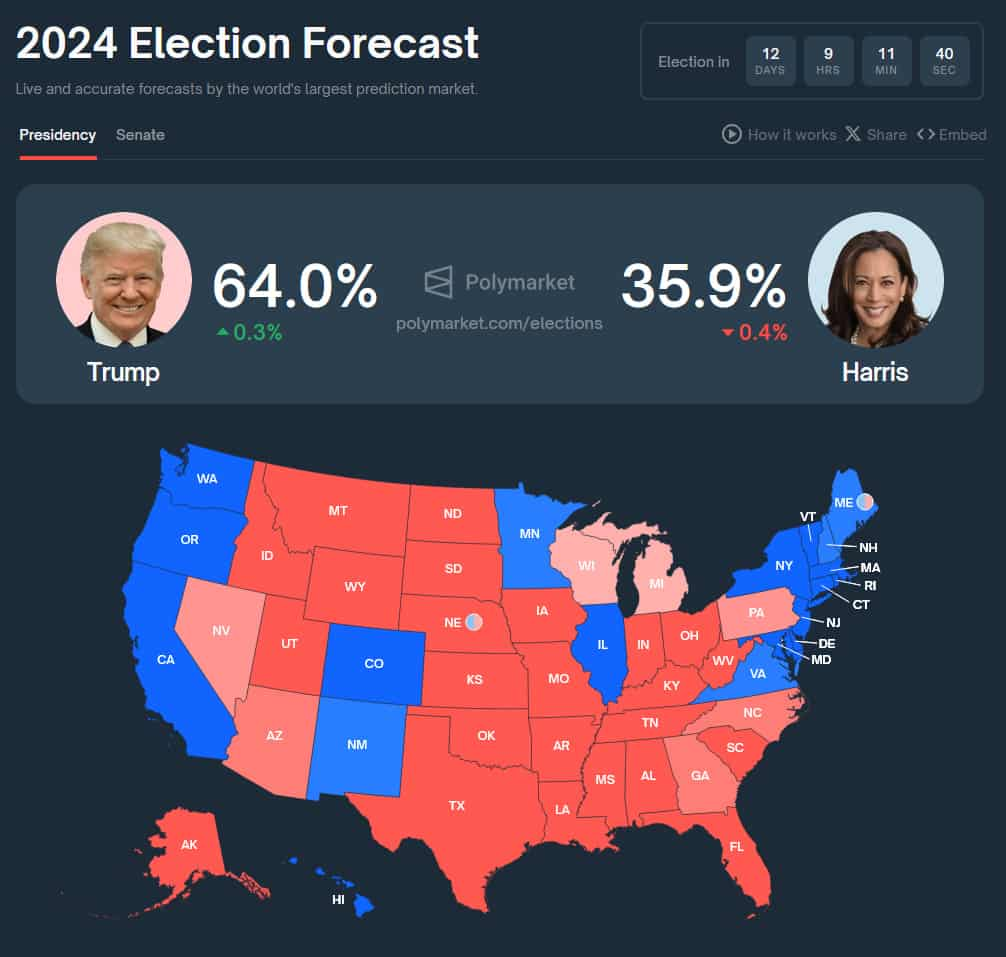

Prediction markets favor Trump; Volatility remains a factor

On October 21, Finbold covered the state of prediction markets, focusing on two key platforms — Polymarket and Kalshi. At the time, Trump had a commanding 23% lead over Harris per Polymarket, which has since expanded to 28.1% at the time of publication.

A recent report from the Wall Street Journal alleges that the odds seen on Polymarket are the result of intentional manipulation, stemming from $30 in bets placed by just four accounts.

Similar allegations have not been made regarding the odds given by domestic platform Kalshi, however — the billionaire’s lead in this prediction market has expanded from 17% to 20% in the same timeframe.

Barring a dramatic (and unlikely) shift, it seems inevitable that traders and investors who believe that a second Trump presidency is in the cards will continue to drive up the price of Trump Media stock.

Although opportunities are certainly present, traders should be mindful of whether or not they have the stomach to hold the stock through the volatility — just recently, on October 15, DJT stock crashed by 10% in the span of a couple of hours, igniting speculation that the former President sold off his holdings. Since no filings were made in the required timeframe, the cause of the sudden drop in DJT price remains unexplained.