Trump Media (NASDAQ: DJT) has seen a continued, impressive surge as the former President and Republican candidate’s odds of securing a second term in the White House seem to be increasing.

As we enter into the final stretch before Election Day, DJT shares are trading at $47.36 — having marked a 21.59% gain on the daily chart, the stock is now up almost 300% in a little over a month. As an added bullish catalyst, this is the first time that DJT stock price has surpassed the July high seen after the first failed attempt on the former President’s life.

While completely divorced from fundamentals, and, essentially a bet on which way the upcoming election will go, at present, there is little doubt that the significant volatility of DJT stock will continue to attract short-term investors. This, in turn, increases the odds that the shares of the media company will close above $50 in short order in a continuation of this high-flying rally — prices have already reached as high $53 in premarket trading.

Trump Media stock soars on blockbuster rally and polling data

On Sunday, October 27, the real-estate mogul and presidential candidate took part in a massive campaign rally in Madison Square Garden, New York, which saw 40,000 attendees — 20,000 inside the venue, and just as many outside of it.

The rally also saw a boisterous claim by Trump that he would secure victory in New York, but polling data suggests that this is an unlikely outcome.

Still, the rally was largely seen as a show of force — featuring an ensemble cast of key allies such as former presidential candidate Robert F. Kennedy Jr, Tesla (NASDAQ: TSLA) CEO Elon Musk, former mayor of New York Rudy Giuliani, and media personality Tucker Carlson.

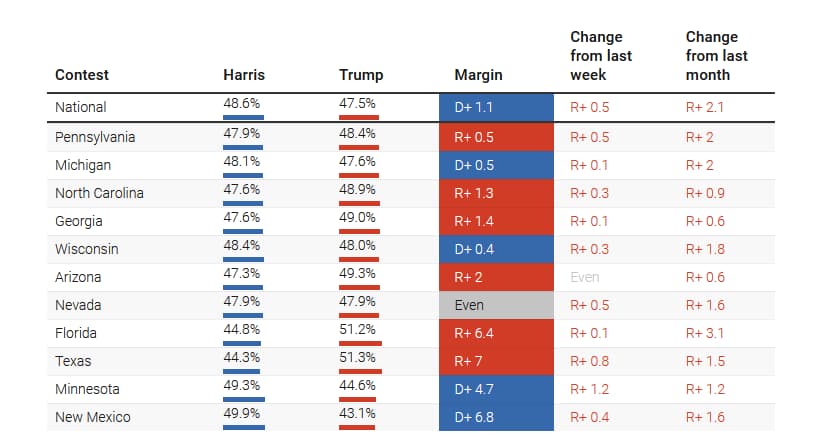

Although notable, the rhetoric of the GOP candidate, inflammatory as it is, doesn’t seem to have affected national polls. At press time, Trump is polling 0.5% ahead of Kamala Harris in Pennsylvania — in Nevada, another key battleground state, polls are dead even — and Harris’ leads in Michigan and Wisconsin have shrunk to just 0.5% and 0.4%.

DJT stock momentum going into Election Day

At the time of publication, the only situation that could, hypothetically speaking, cut the DJT rally short is profit-taking on a large scale. With such a tight race at hand, the volatility is seemingly too enticing to investors, whether they believe Harris or Trump will win — Trump Media is also widely shorted.

Prospective traders should note that the stock’s 193% price increase over the last thirty days represents a high degree of risk for a long position. However, the stock could very well see an even bigger increase in volatility going forward, as witnessed by the popularity of prediction markets and Robinhood’s recent entry into the space.

Finally, with increased scrutiny surrounding ballot counting following the controversies seen with the 2020 election, chances are that the final result will be delivered later than it usually is.

In 2020, it was declared four days after the election — if repeated or surpassed, this period would be a perfect setting for a frenzy of wild speculation. This could see DJT share prices reach new all-time highs, surpassing the stock’s previous $97.54 peak on a feverish wave of FOMO — the only question that remains is whether or not this is sustainable after November 5.

Featured image:

mundissima, Stafford, United Kingdom — October 24, 2021. Digital Image. Shutterstock