Shares of Trump Media and Technology Group rallied to a $43.80 high in the early hours of trading on October 31 before suddenly plummeting to $34.82, marking a sharp drop of 20%.

Soon after, at 10:04 a.m. ET trading was halted — the second time this has happened to Trump Media stock in October, following a similar incident on October 15.

This latest development has brought DJT stock price losses up to 34.73% within two days, although shares are still up 102.52% on a year-to-date (YTD) basis.

Election uncertainty surrounds DJT stock — are traders taking profits?

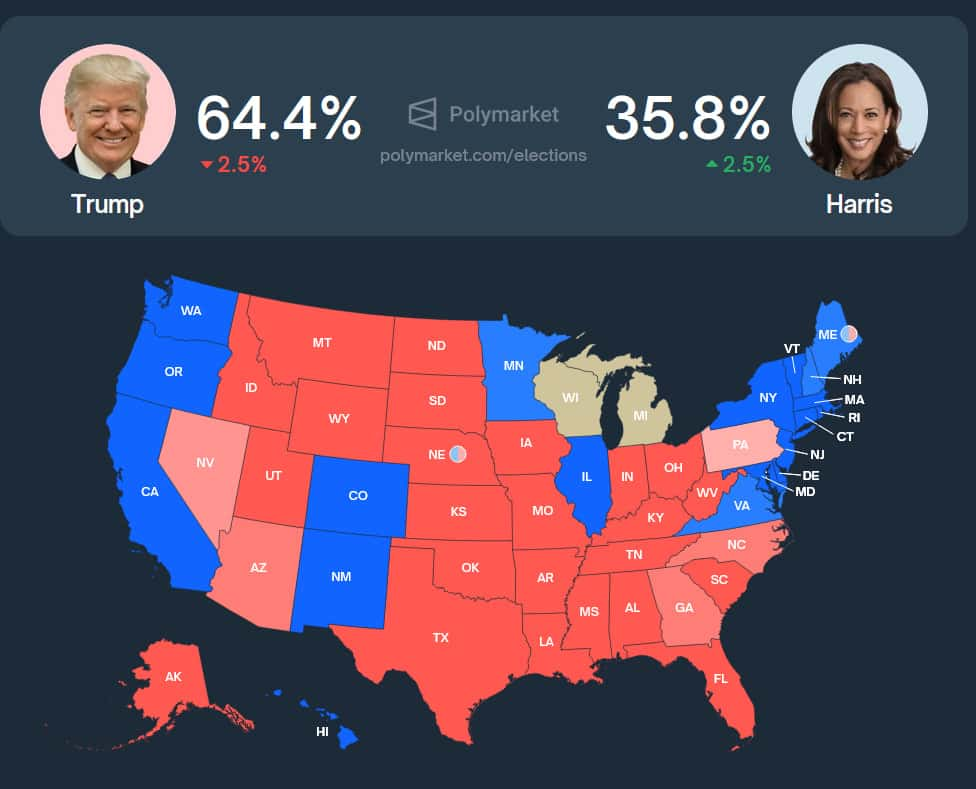

The DJT stock price freefall comes just days before the 2024 presidential election is set to take place. As is extensively covered, the race is an incredibly close one — with major pollsters, FiveThirtyEight, and Nate Silver’s model projecting even odds of success for former President Donald Trump and incumbent Vice President Kamala Harris.

It should be noted that the latest polling data from previous weeks suggests that, at least in key swing states, the momentum has shifted in the billionaire’s favor.

The performance of DJT shares is chiefly driven by the perception of how likely a repeat Trump presidency is. Several events could have served as bearish catalysts. In terms of media coverage, the clear contrast between Harris’ closing argument speech at the Ellipse in Washington, which saw some 75,000 people in attendance, and the Republican candidate’s comparatively lackluster rally in Georgia is a strong contender.

There are, however, different explanations — after the wild volatility DJT stock has experienced leading up to the election, traders could simply be engaging in profit-taking — cashing in on what is essentially a meme stock, as DJT’s current high valuation is unlikely to hold, even in the case that the GOP candidate wins.

Another theory that is repeated whenever DJT shares see a decrease in price is that the real-estate mogul has decided to sell off a portion of his holdings — at present, he has kept his promise not to do so. If this is the case, Trump has two business days to report the trade.

Prediction markets show an uptick for Harris

Finally, it’s possible that traders going long on Trump Media shares became spooked by the odds given by two key prediction market platforms — Polymarket and Kalshi.

When Finbold last covered these platforms, Trump had a 22.8% lead per Polymarket — and although it had expanded to 28% at the time of publication, the platform is currently investigating whether or not the odds were intentionally manipulated.

Kalshi, on the other hand, has had no such accusations levied against it — and on Kalshi, Trump’s lead has decreased from 30.4% down to 18% in the span of just two days.

While it has been an entertaining experience following the company’s fortunes, political polarization notwithstanding, DJT stock is simply too volatile and risky to invest in or trade — even if you believe Trump is headed for the White House again, there are plenty of better investments on the horizon — if you happen to be holding, consider locking in your gains while you still can.

Featured image:

Rokas Tenys, Vilnius, Lithuania — November 7, 2021. Digital Image. Shutterstock.