Advanced Micro Devices (NASDAQ: AMD) ranks among the key artificial intelligence (AI) stocks that have attracted interest in recent months while also facing competition from other players in the sector with the potential to offer profits for investors.

In fact, in 2024, AMD has rallied over 12%, with the stock targeting new highs backed by key bullish fundamentals. One notable fundamental is the upcoming release of the MI325 and MI350 accelerators, which are projected to compete with Nvidia’s (NASDAQ: NVDA) core products—a possible catalyst for growth.

Despite this outlook, Finbold has identified two stocks rivaling AMD that have the potential for growth in 2025, with the capacity to turn a $100 investment into $1,000.

Qualcomm (NASDAQ: QCOM)

Building on AI momentum, Qualcomm (NASDAQ: QCOM) has rallied over 20% year-to-date, with the stock showing further upward potential, mainly driven by its product lineup. For example, the company is expanding its GenAI use cases through the Snapdragon 8 Gen 3 Mobile Platform, designed to process up to 10 billion smartphone parameters.

To this end, an analyst at Baird sees additional potential for Qualcomm, citing the growing use of its AI products in high-end Chinese smartphones. The analyst predicts the stock could reach $200, as Finbold reported.

Qualcomm’s prospects are also bolstered by major clients like Microsoft (NASDAQ: MSFT), which plans to use its chips in its Surface Laptop and Surface Pro to handle various AI tasks without an internet connection. Besides the potential to drive more revenue, such partnerships can enhance investor confidence in QCOM.

Beyond smartphones, Qualcomm is also making strides in the Internet of Things (IoT) and automotive sectors, which accounted for 27% of its revenue in Q2 2024. With its foray into AI, analysts expect Qualcomm to achieve 10% revenue growth in 2025 and earnings to rise by 13.1%. This follows Q2 2024 revenue of $9.39 billion, an 11% year-over-year increase.

Qualcomm is also looking to expand its operations, with reports suggesting it has attempted to acquire struggling chipmaker Intel. Given Intel’s stature, the deal could be transformative for the industry despite its slower progress in the AI space.

However, the stock ended the latest trading session in the red after news of the possible Intel acquisition. As of press time, QCOM was valued at $168, down nearly 3% in the past 24 hours.

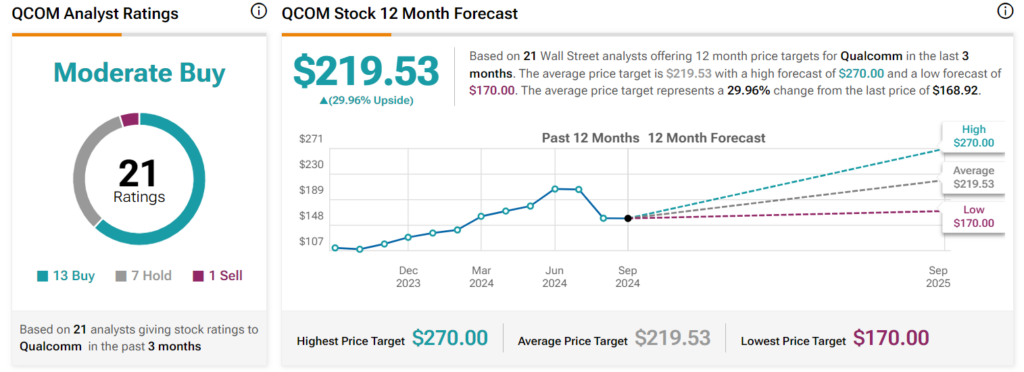

Despite this, the Wall Street consensus remains optimistic. According to 21 analysts on TipRanks, QCOM is expected to trade at an average price of $219 over the next 12 months, representing a nearly 30% upside. The stock could reach $270 on the high end, while the low forecast stands at $170.

Intel (NASDAQ: INTC)

Intel (NASDAQ: INTC) has had a rough 2024, with the stock recording a massive plunge of about 54% year-to-date as the company struggles to compete in the AI chip sector. However, in the short term, INTC is experiencing bullish momentum due to news of a possible takeover by Qualcomm.

At the close of the September 20 trading session, Intel was valued at $21, up over 3% for the day. In the past month, the stock has gained 8.6%.

For investors looking for an alternative to AMD, Intel offers a viable option based on key fundamentals, such as its ability to attract major business deals. For example, the U.S. government awarded the company a $3.5 billion contract to manufacture chips for the military.

Such deals could boost the company’s revenue after disappointing Q2 2024 returns. Revenue dropped 0.9% year-over-year to $12.83 billion, missing analysts’ estimates of $12.94 billion.

Intel is also trying to regain investor confidence as it focuses on its business restructuring plan, which includes a 15% workforce reduction and aims to cut expenditures by $10 billion. In this line, AvidThink analyst Roy Chua has suggested that the company go back to basics and focus on its core products while demonstrating its ability to remain innovative to investors.

Additionally, Intel hopes to catch up with its peers in the AI space after unveiling plans to build chip plants in the United States to reclaim its lost glory in semiconductor manufacturing.

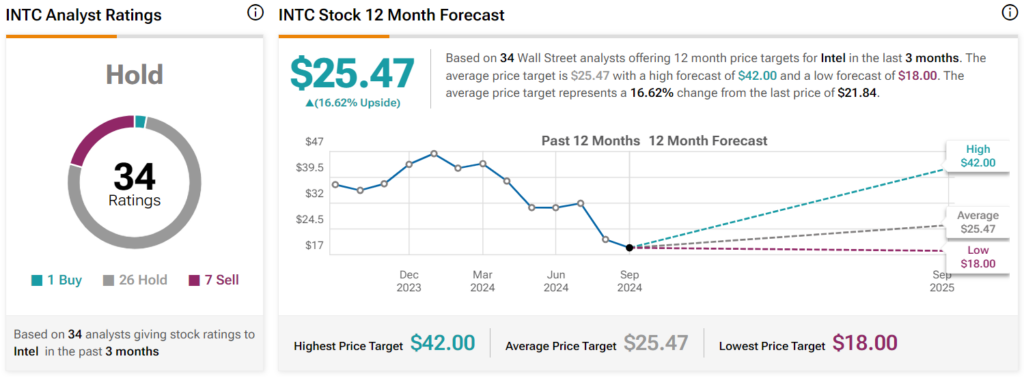

Aside from the internal company fundamentals, 34 Wall Street analysts remain bullish on Intel over the next 12 months, forecasting an average price of $25. According to these experts, INTC could hit a high of $42 in a bullish scenario, while the low forecast is set at $18.

With all factors considered, AMD remains a strong player in AI, but competitors like Qualcomm and Intel are also positioning themselves as viable alternatives for investors. Despite the opportunity, investors should be aware of the stocks’ ability to be influenced by the overall stock market trajectory.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.