Although the benchmark S&P 500’s biggest names tend to dominate investor attention, the index also features lesser-known stocks with significant growth potential.

Being part of this prestigious index is often viewed as a bullish indicator, but these stocks also boast strong fundamentals that support their growth prospects.

With this in mind, Finbold has identified the following two under-the-radar S&P 500 stocks worth considering.

Synopsys (NASDAQ: SNPS)

After a disastrous run in the past year, Synopsys‘ (NASDAQ: SNPS) share price is showing strength in 2025, banking on its core semiconductor design business. Specifically, SNPS dropped nearly 5% over the last year, but the stock is up 8% year-to-date, closing the previous trading session at $528.

For starters, Synopsys remains a strong investment option due to its solid financial performance. During the quarter ending October 24, the firm reported revenue of $1.64 billion, reflecting 11% year-over-year growth. Earnings per share came in at $7.15, an increase of over 200%, beating analyst estimates by 3%.

Additionally, Synopsys is set for potential expansion with its $35 billion acquisition of engineering simulation and 3D design software firm Ansys (NASDAQ: ANSS), expected to close in early 2025, pending regulatory approvals.

The companies sold Ansys’ PowerArtist business to Keysight Technologies (NYSE: KEYS) to advance the deal and secure Phase 1 regulatory approvals.

Beyond this, Synopsys is poised to benefit from the increasing complexity of semiconductor design, driven by artificial intelligence (AI), machine learning, and IoT, all of which fuel demand for its Electronic Design Automation tools.

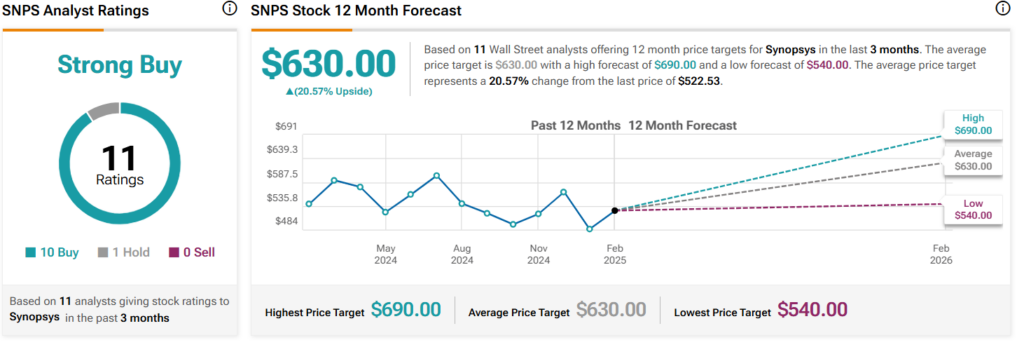

Wall Street is also bullish on SNPS, with analysts at TipRanks setting a 12-month consensus average price target of $630, representing a 20% upside. Based on evaluations from 11 analysts, price targets range from a low of $540 to a high of $690. The stock holds an overall rating of ‘Strong Buy.’

Hologic (NASDAQ: HOLX)

Medical technology firm Hologic (NASDAQ: HOLX) is another attractive investment option. Despite operating in the shadows of larger healthcare giants, the firm has built a strong portfolio, particularly in breast health and diagnostics.

For instance, Hologic’s molecular diagnostics division is crucial in public health crises by providing efficient testing solutions.

With an aging population and increasing focus on early disease detection and personalized medicine, Hologic has significant potential, making it a compelling choice for investors looking for a stake in healthcare.

Additionally, partnerships and collaborations are likely to benefit Hologic. One notable collaboration was with the Centers for Disease Control and Prevention (CDC) to develop analyte-specific reagents (ASRs) for detecting H5N1 bird flu. To this end, Hologic can scale up testing rapidly if an outbreak emerges.

On the other hand, Hologic’s stock has faced losses in recent months, and such strategic collaborations might be key to reversing the trend.

Regarding HOLX’s stock price movement, the equity ended the last session at $64.27, down 0.6%, while its year-to-date performance remains in the red at 10%.

Over at TipRanks, 16 Wall Street analysts project the stock could rally over 30% to an average price target of $83.54 within the next 12 months. Forecasts range from a low of $75 to a high of $90.

Synopsys and Hologic offer strong growth potential, but investors should be mindful of broader market headwinds and sector-specific risks, such as regulatory hurdles and economic uncertainty.

Featured image via Shutterstock