Part of Berkshire Hathaway (NYSE: BRK.A) CEO Warren Buffett’s extraordinary success lies in his unmatched ability to pinpoint stocks with significant long-term growth potential.

Known as the ‘Oracle of Omaha,’ Buffett has built his legacy on value investing, prioritizing companies with solid fundamentals, attractive valuations, and enduring economic moats.

For investors looking for affordable yet high-potential opportunities, two stocks trading under $100 from Berkshire Hathaway’s portfolio stand out. These picks offer a compelling case for a ‘buy-and-hold’ strategy, combining strong growth potential with lasting competitive advantages that could drive value well beyond 2025.

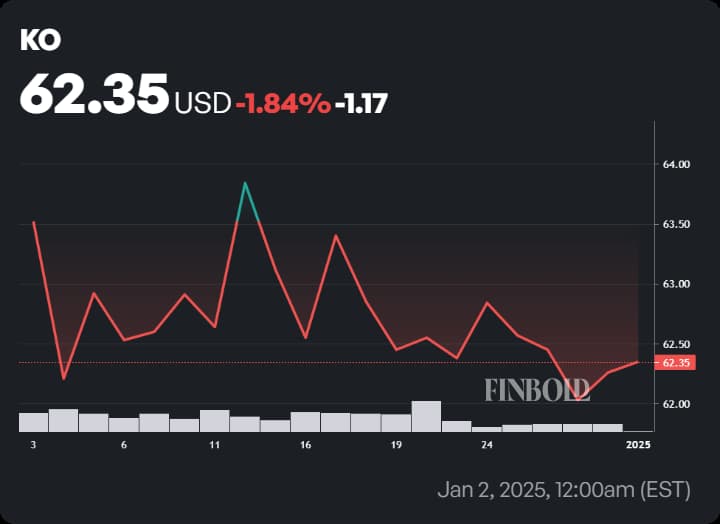

Coca-Cola (NYSE: KO)

Coca-Cola (NYSE: KO) remains one of the most prominent holdings in Warren Buffett’s Berkshire Hathaway portfolio, ranking as the fourth-largest holding with 400 million shares.

Known for its strong global brand, extensive market presence, and diverse product offerings, Coca-Cola seamlessly adapts to evolving consumer preferences.

The company’s financial performance further highlights its appeal. In Q3 2024, Coca-Cola reported revenues of $11.9 billion, surpassing analyst expectations of $11.61 billion.

Coca-Cola is a Dividend King, with an impressive 63 consecutive years of dividend growth, further enhanced by its quarterly payout of $0.485 and a dividend yield of 3.12%.

In Q1 2024 alone, Warren Buffett earned $194 million in dividends from the stock, underlining its reliability as an income-generating asset, as reported by Finbold.

Currently trading at $62.37, Coca-Cola is experiencing short-term bearish momentum with a nearly 2% decline over the past month. However, with an annual dividend of $1.94 and a shareholder yield of 3.56%, the company continues to deliver consistent returns, cementing its position as a cornerstone of stability in Buffett’s portfolio.

Sirius XM Holdings Inc. (NASDAQ: SIRI)

Currently trading at $22.90, Sirius XM Holdings Inc. (NASDAQ: SIRI) is shaping up to be a strong rebound candidate for 2025, making it a compelling pick for investors.

Despite a challenging 2024, during which the stock fell nearly 58%, the company’s core business remains resilient. With a subscriber base of 33.16 million as of Q3 2024, according to Statista, Sirius XM continues to dominate the satellite radio space, providing a solid foundation for recovery.

To regain momentum, Sirius XM has outlined a strategic direction, focusing on its core automotive subscriber segment, where most users engage with its service.

By making Sirius trials a default feature in vehicles, the company aims to enhance user retention in this key market.

Additionally, Sirius XM plans to enhance shareholder value by retiring a portion of its debt and continuing its stock buyback program. With an annual dividend of $1.08 per share and an attractive yield of 4.74%, Sirius XM remains an appealing choice for income-focused investors.

Although market conditions may impact their performance, the inclusion of these stocks in Warren Buffett’s portfolio reflects their strong long-term potential.

For investors seeking stability, consistent income, and growth opportunities, mimicking Buffett’s strategy could prove to be a wise and rewarding decision for the long term.

Featured image via Shutterstock