A striking analysis by economist Gabriel Zucman, published in The New York Times, reveals that in 2018, U.S. billionaires paid a lower effective tax rate than the working class, marking a historic shift in tax burdens and igniting calls for urgent tax reforms.

Zucman’s analysis underscores the need to rethink the tax strategy as billionaires increasingly generate income through investment avenues rather than traditional salaries, deepening the tax disparity with middle and lower-income earners.

One of the primary reasons the superrich face lower effective tax rates is their income structure, which is predominantly derived from wealth, such as dividends and capital gains, rather than traditional salaries.

This was exemplified by Jeff Bezos, who, despite a modest salary of $81,840 in 2019, leverages his substantial Amazon (NASDAQ: AMZN) stock holdings, which are not taxed unless sold.

Furthermore, tycoons like Bezos, Warren Buffett, and Elon Musk often utilize their shares as collateral for loans, thus accessing significant funds without incurring tax liabilities.

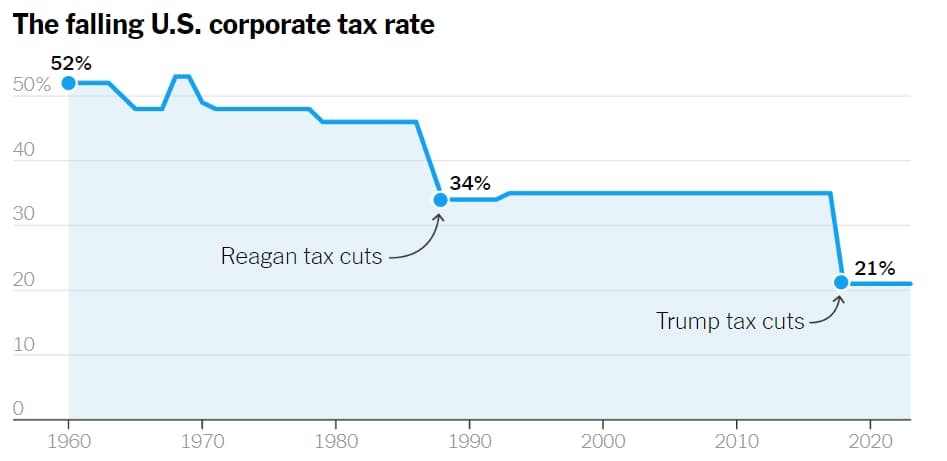

The situation in the U.S. reflects broader international trends. Over the decades, corporate and estate taxes, which traditionally impacted the wealthiest, have been significantly reduced.

For instance, in 2018, the United States cut its maximum corporate tax rate to 21 percent from 34 percent, and the estate tax has almost disappeared in America, diminishing the tax burden on profits that largely benefit the ultra-rich.

Global response and push for fair taxation

This phenomenon is not limited to the U.S.; it reflects a broader international issue where the wealthy exploit tax regulations to their advantage.

For instance, in European countries like Italy and France, the ultrawealthy enjoy considerably lower tax rates. This trend is consistent globally, as seen in countries like the Netherlands, where the average taxpayer contributed 45% of their earnings in 2016, while billionaires paid just 17%.

The widening gap in tax contributions has spurred international efforts, including a 2021 agreement by over 130 countries to set a global minimum corporate tax rate of 15%, ensuring that large multinational companies pay a baseline amount of tax regardless of where they park their profits.

There are also growing calls for a wealth tax on billionaires, proposing they pay taxes on a portion of their overall wealth each year—a move that could significantly bolster public finances.

Countries such as Brazil, chairing this year’s Group of 20 summit, along with France, Germany, South Africa, and Spain, have recently expressed support for a minimum tax on billionaires.

In the United States, President Biden has proposed a similar billionaire tax, aiming not just to raise revenue but to rectify a tax system that currently permits significant disparities, threatening economic balance and undermining democratic values.

As debates intensify, the focus sharpens on creating a tax regime that better reflects the economic contributions and benefits derived by the wealthiest, promoting a fairer and more equitable society.