United States Representative Josh Gottheimer from New Jersey, one of Congress’ most active stock market investors, has disclosed a potentially controversial trade involving his former employer, Microsoft (NASDAQ: MSFT).

According to filings, Gottheimer reported up to $40 million worth of trades in Microsoft stock options in a series of transactions in December 2024, disclosed on January 14, 2025. Each transaction ranged between $1,000,001 and $5,000,000.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

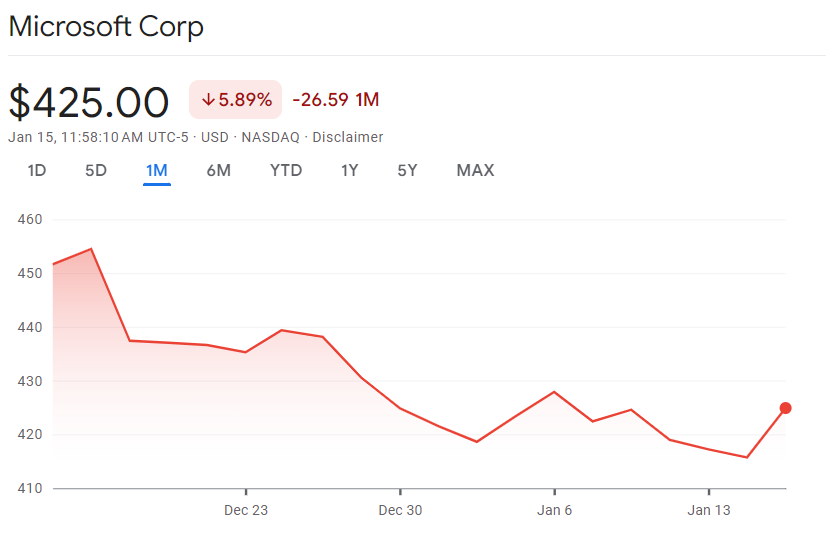

As of press time, MSFT was trading at $425, rallying over 2% since the last market close. Over the past month, the stock has experienced volatility, dropping nearly 6%.

The Congress trades involved call options—financial contracts granting the holder the right, but not the obligation, to purchase shares at a predetermined price before a specific expiration date.

Investors often use call options to speculate on stock price increases or hedge against potential losses. Notably, Gottheimer made a similar transaction involving Microsoft in early December, valued at approximately $6 million.

Overall, call options have emerged as a preferred strategy for Congress members, with Finbold reporting in May 2024 that the approach had surged by over 200% among U.S. politicians.

This transaction will likely raise questions due to Gottheimer’s prior ties to Microsoft. While there is no evidence of wrongdoing, the scale of the trade and its connection to his former employer could raise suspicions.

Gottheimer’s other trades

Beyond the Microsoft trade, Gottheimer disclosed other transactions, primarily dominated by sales. Notable equities sold included semiconductor giant Nvidia (NASDAQ: NVDA), Coca-Cola (NYSE: KO), and Uber (NYSE: UBER).

In general, Gottheimer has faced scrutiny in the past for his stock market activity. For instance, as previously reported by Finbold, he made strategic semiconductor trades before the sector surged, driven by advancements in artificial intelligence.

His trading prowess is also notable, considering that in September 2024, his portfolio delivered a 29.09% return over 12 months, outperforming investor Michael Burry’s 21% gain and surpassing Nancy Pelosi’s 26% return, largely fueled by his Nvidia investments.

Amid such disclosures, attention is turning to the legitimacy of lawmakers trading stocks. Efforts are underway to tighten regulations, with U.S. Representatives Dusty Johnson, Chip Roy, and Seth Magaziner reintroducing the bipartisan TRUST in Congress Act.

The legislation seeks to ban Members of Congress, their spouses, and dependents from trading individual stocks while in office. The move has gained traction, receiving support from President Joe Biden.

Featured image via Shutterstock