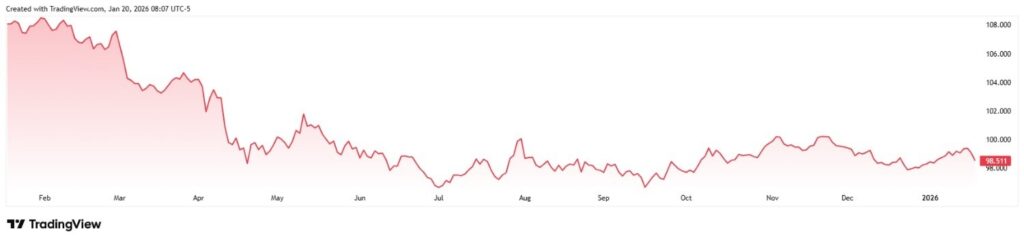

The U.S. Dollar Index (DXY) plunged below its 200-day moving average (MA) on January 20, showcasing the continued turmoil in the international currency markets.

The decline that took the DXY to its press time level of 98.511 has largely been triggered by the resurgence of ‘sell America’ sentiment driven by President Donald Trump’s escalating diplomatic clashes with adversaries and allies alike.

Why the DXY is plummeting

The latest important catalyst came over the last weekend as the commander-in-chief doubled down on his drive to acquire Greenland in what appears to be a lose-lose-lose situation.

Specifically, the U.S. pressuring NATO allies into surrendering sovereign territory bodes ill for the country’s soft power and international relations, the E.U. cannot resist America militarily – President Trump has refused to rule out an armed takeover of the island – and, should it give in, the E.U. is likely to face massive backlash at home.

Arguably, the biggest catalyst for the decline of the DXY has been the new escalation in the cross-Atlantic trade war, with the Trump Administration ordering the implementation of a 10% tariff against eight European countries starting on February 1, with a 25% increase on June 1, should the confrontation not be resolved by the date.

In return, the E.U. is threatening to suspend its trade deal with the U.S., is itself preparing a tariff package worth some $100 billion, and is reportedly mulling over the closure of American military bases on its soil.

Why the world might be turning on the American dollar

While the North Atlantic rupture has been the primary catalyst in recent trading – as also evident in the sudden Sunday upsurge in the price of ‘safe haven’ assets like gold and silver, and the plummet in the high-risk cryptocurrency market – it represents only the latest layer in global geopolitical uncertainty.

The U.S. has previously implemented new tariffs on countries trading with Iran, potentially further harming the relationship with one of its biggest trade partners, China, and potentially cooling many international actors from relying on the American currency.

USD loses ground against major global currencies

Looking at the relevant pairs of the DXY – the index represents USD weighed against a basket of foreign currencies that includes the Euro, Yen, Pound, Canadian Dollar, Krona, and Swiss Franc – the American dollar appears on a retreat against almost every other major national tender.

The Japanese Yen (JPY) is, in fact, the only major currency that hasn’t shot up against USD in recent trading, though it, arguably, is a signal of potential trouble to come as well, considering it came amidst a historic upsurge in bond yields in the island nation.

Lastly, it is worth pointing out that the latest DXY plummet below the 200-day MA failed to send the index into the red in 2026, and it is, in fact, 0.24% up in the year-to-date (YTD) chart. Similarly, at 98.511, it is notably above the December 2025 lows at approximately 97.88.

Featured image via Shutterstock