The United States economy continues to face uncertainty, with several metrics, such as stubborn inflation, painting a grim picture.

Indeed, the depletion of household savings is emerging as a new concern, with Americans increasingly withdrawing their reserves. This factor will likely impact the economy, considering savings serve as a key support for consumer spending.

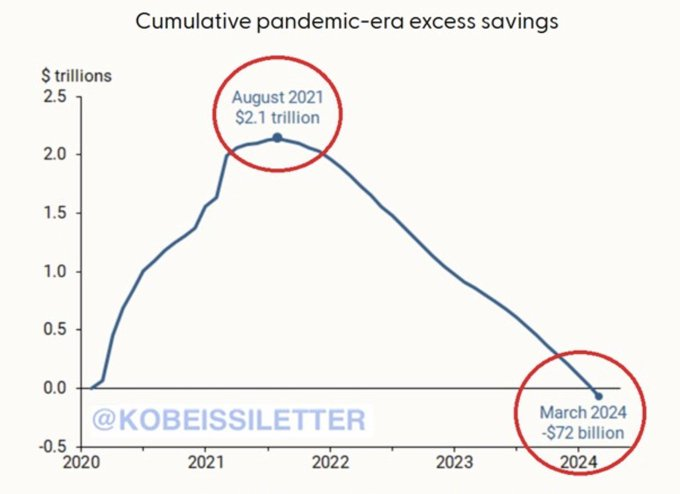

In this regard, data provided by capital market commentary platform The Kobeissi Letter, in an X post on May 11, pointed out that since August 2021, a staggering $2.1 trillion of excess savings have been drained from the nation’s financial reservoirs.

Notably, the withdrawals are at an alarming rate, considering that Americans are taking out approximately $70 billion per month.

“$2.1 TRILLION of excess savings have been wiped out of the US economy since August 2021. <…> Savings are now considered a luxury,” the platform noted.

The data noted that by March 2024, the situation had reached a dire state, with excess savings plummeting to a deficit of -$72 billion. Concurrently, credit card debt has soared to a record high of $1.1 trillion, marking an increase of $330 billion over the same period.

Implications of high savings withdrawals

The platform noted that following the onset of the pandemic in March 2020, the U.S. government injected approximately $4 trillion in stimulus measures, leading to a period of unprecedented savings accumulation.

Generally, the data points to a troubling reality: American households are exhausting their savings and increasingly relying on credit to sustain their financial well-being.

It’s worth noting that the ramifications of the savings depletion may extend beyond individual households to the broader economy. Diminished savings hinder investment potential, limit future consumption, and exacerbate income inequality.

Moreover, relying on credit to bridge the savings gap can lead to unsustainable debt burdens, further exacerbating financial instability.

The ongoing savings depletion could also dash hopes of a soft landing, particularly as the focus shifts to the Federal Reserve’s next monetary policy. This is occurring as the stock market shows signs of rallying.

Analysts had previously suggested that the cash reserves accumulated during the pandemic could help economies avoid recessions. However, with inflation remaining stubbornly high, these cushions are shrinking.