Summary

⚈ Trump’s May 13 executive order targets up to 80% reductions in drug costs, directly impacting companies like AbbVie.

⚈ The trades took place during broader market volatility tied to tariff-related fallout, adding to the controversy.

Barely a month before President Donald Trump revealed his plans to cut prescription drug prices, two politicians suspiciously sold their shares in pharmaceutical giant AbbVie (NYSE: ABBV).

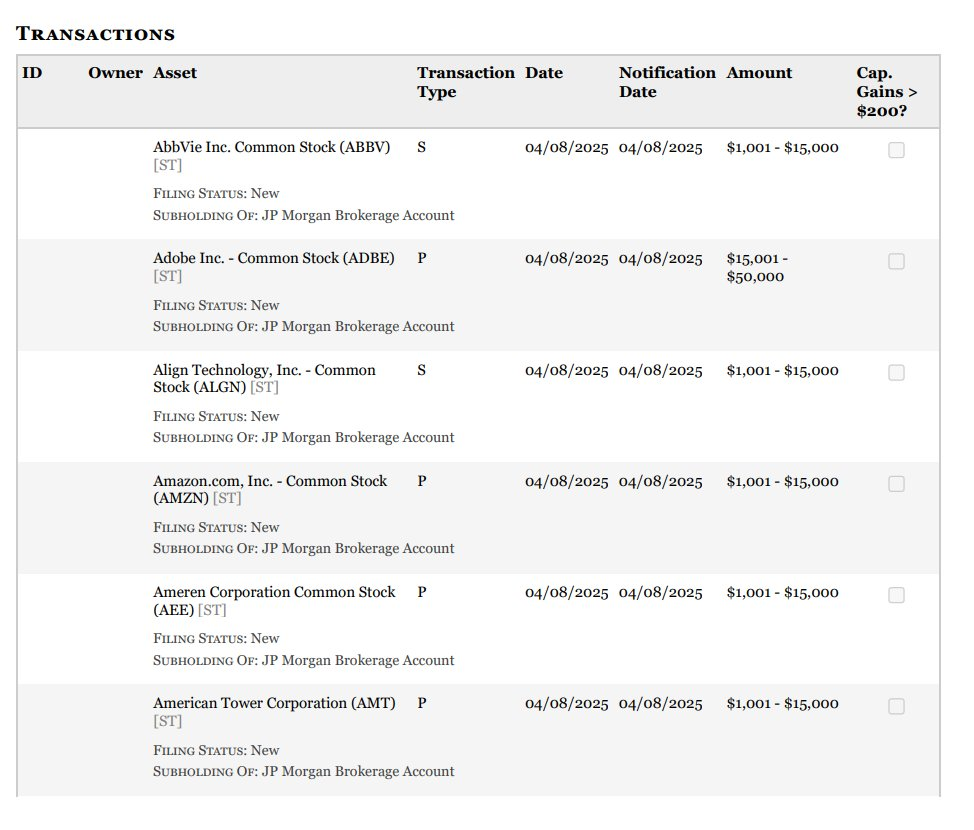

To this end, Republican Representative Robert Bresnahan disclosed the sale of ABBV shares valued between $1,001 and $15,000. The trade, which took place on April 8, was filed on May 8, notably just three days before President Trump’s announcement.

Meanwhile, his colleague from Indiana, Jefferson Shreve, offloaded a much larger stake on April 17, with sales ranging from $50,001 to $100,000. This Congress trade was also filed on May 8.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Suspicion around Congress transaction

Although there is no evidence of wrongdoing on the lawmakers’ part, the timing of the sales raises suspicion of potential insider knowledge, as they may have been privy to discussions likely to impact the stock market.

Adding to concerns is the fact that the trades also occurred amid tariff-induced market volatility following the April 2 ‘Liberation Day’ fallout.

On May 11, Trump announced plans to sign an executive order on May 13 to cut drug prices by 30% to 80% through a “most favored nation” policy, ensuring the U.S. pays the lowest global price. He also accused drug companies of exploiting consumers and dismissed high research and development costs.

In this context, if the executive order is implemented without opposition, it will likely significantly impact the revenue of companies like AbbVie, which rely heavily on the U.S. market for profits. In Q1 2025, the biomedical firm reported $13.3 billion in revenue, an 8.4% year-over-year increase.

At the same time, AbbVie has long been criticized for high drug prices, particularly for its Humira, a drug for rheumatoid arthritis.

ABBV stock price analysis

As expected, ABBV stock took a hit in pre-market trading following Trump’s announcement, falling 4% to $177. The stock had closed the previous session down 0.5% at $184, but still maintains modest year-to-date gains of 2.88%.

Indeed, the executive order compounds matters for AbbVie, which is already attempting to improve profit margins, currently down by double digits, with an 11% year-over-year decline for Q1 2025.

Featured image via Shutterstock