Sitting members of Congress — in the House and Senate alike tend to outperform their constituents when it comes to investing — by a significant margin. The practice is, at best, an ethical mire — at worst, it’s an overt conflict between private interests and oaths taken when accepting public office.

The issue has become well-publicized as of late — with many investors and traders copying the trades of U.S. politicians in a bid to close the gap in terms of returns. Unfortunately, disclosure rules are quite favorable to the political class — filings do not exactly have to be prompt, and the exact amounts invested are obfuscated by the fact that reporting is done using ranges.

Little headway has been made in addressing the issue — the STOCK Act, which regulates congressional trading, is violated on a regular basis. The ETHICS Act, which would expand regulations, is seen by many as being ‘too little, too late’ — and since being introduced in April of 2023, it has seen little progress in terms of getting through the legislative pipeline.

Picks for you

Lawmakers have an informational advantage — and these suspicious trades routinely involve companies that do business in industries that congresspeople and senators oversee and regulate.

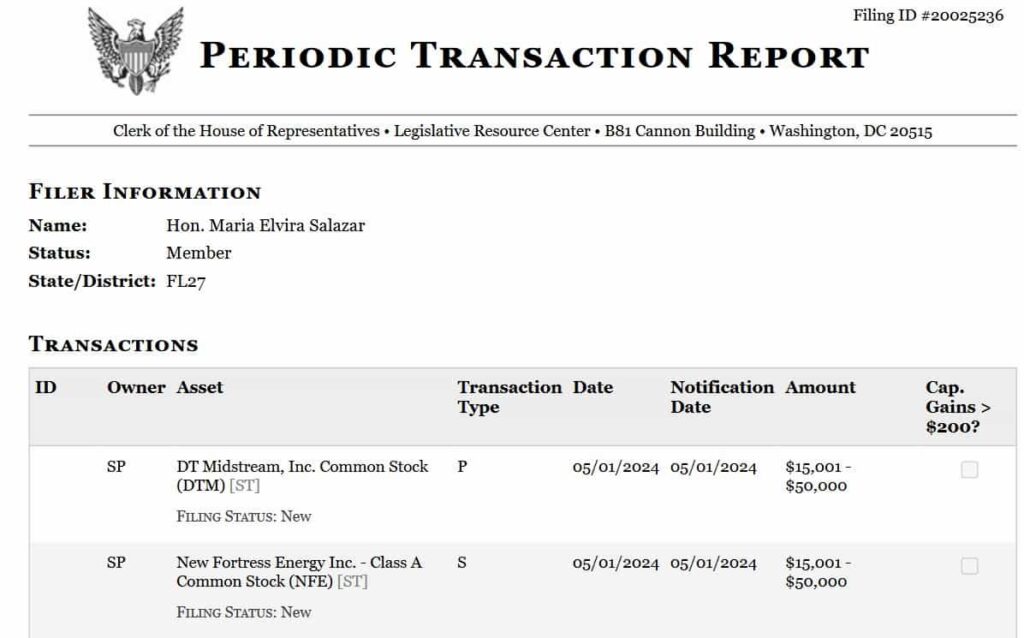

In one such instance, Republican Representative Maria Elvira Salazar, who represents Florida’s 27th congressional district made a significant profit on a low-profile mid-cap stock, per data from Finbold’s congressional trading radar.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Salazar made an 80% return on DTM stock

On May 1, the congresswoman made a $15,001 to $50,000 investment in DT Midstream (NYSE: DTM), a little-known natural gas company. The purchase was made public through a June 10 filing.

At the same time, Salazar closed her position in New Fortress Energy (NASDAQ: NFE). Her timing was certainly auspicious — since the trade, NFE stock has dropped by 62.22% — in contrast, DTM stock has risen by 73.86%. At press time, DTM shares were trading at $107.15 — at the time of her purchase, DTM stock was trading at a price of $61.63.

The congresswoman is a sitting member of the House Committee on Foreign Affairs — a position that is doubtlessly beneficial when making investments in the energy sector. In the worst case scenario, at the lower end of the $15,001 – $50,000 range, Salazar has made a profit of $11,079 on this single trade — in the best case scenario, the figure is $36,930.

Oil also happens to be one of her primary political interests. Salazar has taken an active role in trying to cut off Cuba from Mexican oil shipments, as well as introducing legislation that would stop Venezuelan oil exports. On the domestic front, she has supported measures that would prevent the Environmental Protection Agency (EPA) from being able to set emission standards for new vehicles.

Featured image via Shutterstock