Analysts predict that the U.S. will need to address a substantial rise in its budget deficit through short-term borrowing, which could impact money markets and inflation control efforts.

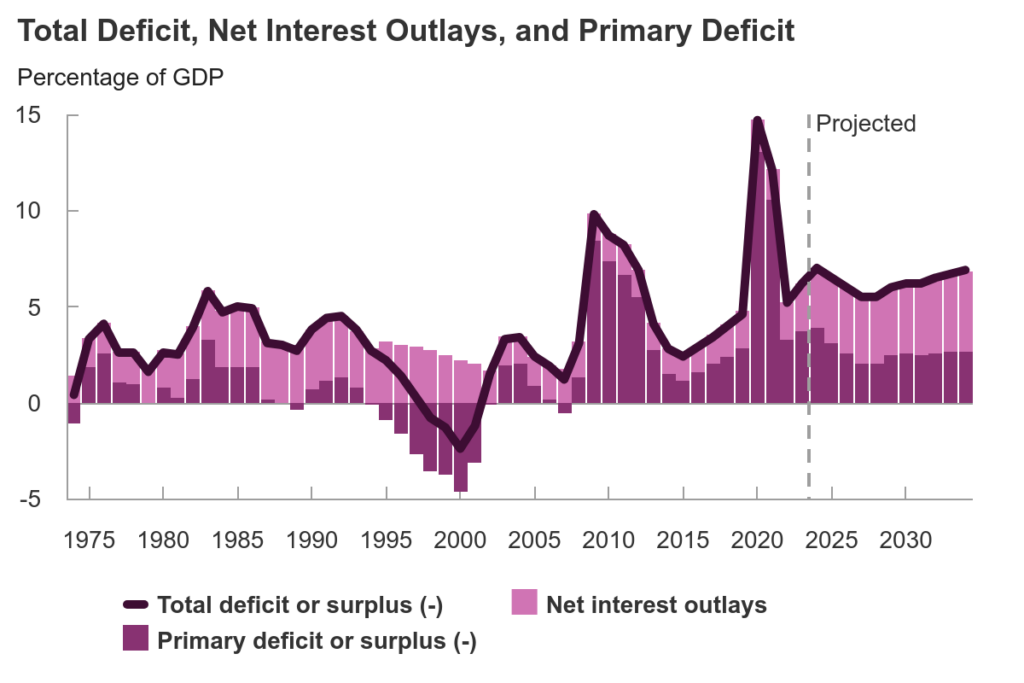

The Congressional Budget Office recently announced that financial aid for Ukraine and Israel will push the U.S. deficit to $1.9 trillion this fiscal year, up from the February estimate of $1.5 trillion, pushing the total debt to an all-time high of $6.2 trillion if the projections come true.

A shift to short-term debt might further disrupt money markets and hinder the Federal Reserve’s inflation control measures.

Picks for you

Over-reliance on short-term debt will test the U.S. markets

Part of the projected deficit increase stems from student loan forgiveness, which won’t immediately affect cash flow.

Torsten Slok of Apollo noted that this surge could strain funding markets. The Treasury market has grown significantly since the financial crisis, indicating a reliance on debt financing.

“It is likely that the share of Treasury bills as a share of total debt increases, which opens up the question of who is going to buy them; this absolutely could strain funding markets,” said Slok in his interview with Kate Duguid at the Financial Times on June 21.

However, relying more on short-term debt may test the market’s limits, especially as the Federal Reserve reduces its holdings of U.S. Treasury debt, shifting the balance between buyers and sellers.

Inflation and the U.S. treasury might make it hard to control the debt

The growing deficit has made it challenging for the U.S. Treasury to finance via long-term debt without increasing borrowing costs. Consequently, the Treasury has relied more on short-term debt, though this approach risks exceeding demand.

Large-scale Treasury auctions have raised concerns among economists and analysts about who will purchase the available debt.

While money market funds remain significant investors in Treasury bills, there are broader concerns about demand as the Federal Reserve, the largest U.S. Treasury debt holder, reduces its market presence.