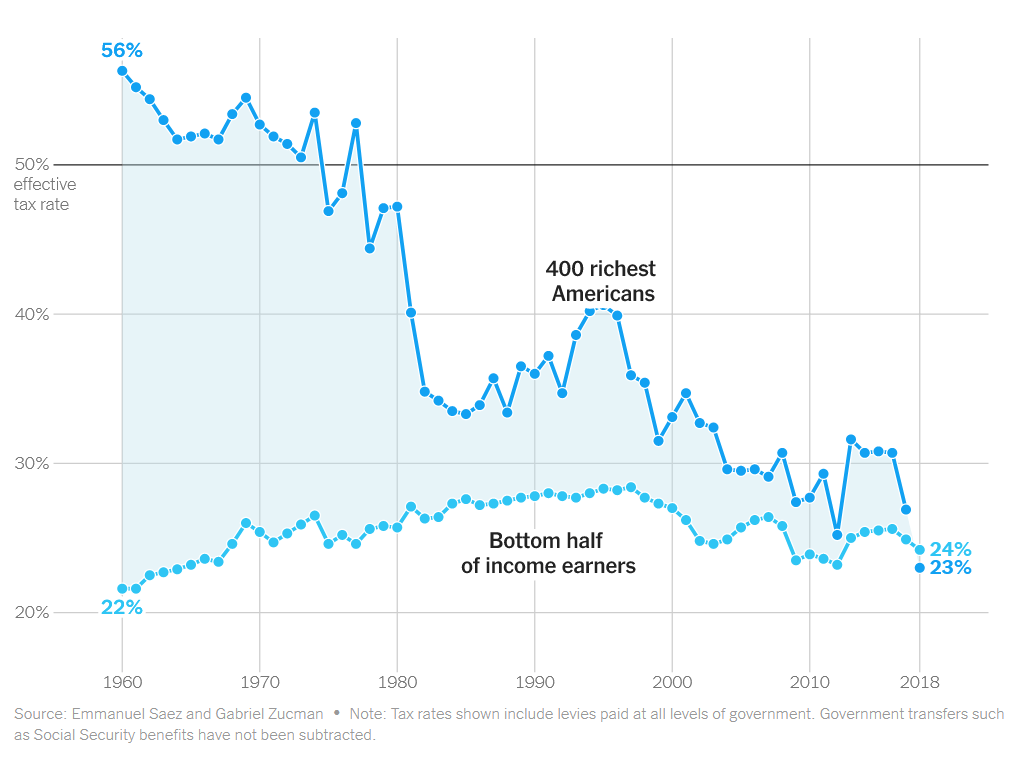

Amid rising wealth inequality and recent changes in the government’s taxation policies, an unprecedented trend has emerged – billionaires in the United States are currently paying a lower effective tax rate than working-class Americans for the first time in history.

As it happens, the effective tax rate for the 400 richest Americans has dropped to 23%, which is lower than the 24%, which is the present effective tax rate for the bottom half of income earners, according to recent data published by The New York Times on May 3.

By comparison, the historical effective tax rates for the US richest in the 1960s amounted to 56%, which was dramatically higher than the 22% that the working class had to pay in taxes. This disparity started to significantly reduce in the 1980s, only to switch places in 2018 completely.

Moreover, the report states that today, “the superrich control a greater share of American’s wealth during the Gilded Ages of the Carnegies and Rockefellers (…); partly because taxes on the wealthy have cratered,” writes Gabriel Zucman, an economist at the Paris School of Economics and the University of California, Berkeley.

Benefits of historical effective tax rates

In contrast, justifying the higher historical effective tax rates on the rich, Zucman argued that they helped keep the wealth inequality in the US under control, as well as allowed the emergence of social protections and safeguards:

“Higher tax rates for the wealthy kept inequality in check and helped fund the creation of social safety nets like Medicare, Medicaid, and food stamps.”

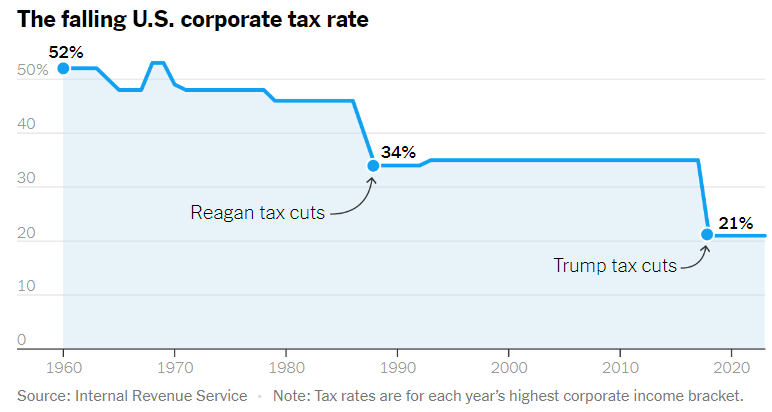

According to The New York Times data, the US authorities have cut in recent decades two hefty taxes that the rich used to pay – the corporate profit tax and the estate tax for their heirs – including Ronald Reagan’s cuts of corporate taxes to 34% and Donald Trump’s policies that further reduced the taxes on the rich to 21% in 2018.

On top of that, many large corporations, especially in the technology sector, are reinvesting their profits instead of distributing them to shareholders, including Jeff Bezos’ Amazon (NASDAQ: AMZN), Elon Musk’s Tesla (NASDAQ: TSLA), and Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A).

Addressing the inequalities

Meanwhile, US President Joe Biden aims to address this imbalance with his newly revealed budget for fiscal year 2025, which, among other proposals, includes a capital gains tax hike set at 44.6% and targeting high-income earners, particularly those earning over $1 million annually, as Finbold reported on April 25.

In Zucman’s view, this would affect a “very small number of stratospherically wealthy individuals – about 3,000 people,” forcing them to “give a relatively tiny bit of their profits back to the governments that fund their employees’ educations and health care and allow their businesses to operate and thrive.”