US Treasury bonds are again on the rise after a few months of cooling down, which has raised concerns. Analysts weighed in after a disastrous nonfarm payroll, far below expectations, and renewed recession fears – with gold standing out.

On November 1, US Treasury bonds of different maturity time frames surged to local highs, raising concerns among analysts. As Finbold retrieved, the 10-year bonds (US10Y) closed Friday at 4.386%. Yet, it reached a 4.39% peak together with a 4.579% US30Y, which The Great Martis warned “is worsening.”

Michael A. Gayed, an award-winning chartered financial analyst (CFA), commented on the matter, opening a discussion on X (formerly Twitter). Other commentators joined the thread, providing insights on the concerning rise in US Treasury bonds, with its causes and consequences.

“What’s going on in bonds is absolutely terrifying and seemingly no one cares.”

– Michael A. Gayed, CFA

Why are US Treasury bonds surging, and why does it matter?

Overall, the financial market is made of complex dynamics and economic events will hardly have a simple single explanation. This is also true for the recent US Treasury bonds surge, which has many possible explanations and causes.

When purchasing these bonds, investors are essentially lending money to the US government in the expectation of a full repayment after maturity plus the pre-agreed-upon interest, which yields the investor a payment every six months.

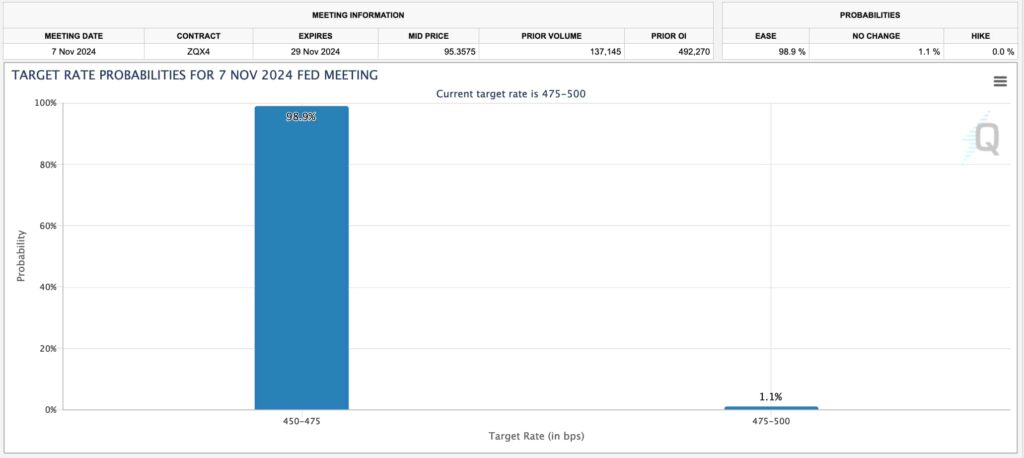

Thus, a surging bond means that investors are demanding a higher interest when measuring the risks and opportunity costs. Expectations of high inflation, high Federal Reserve interest rates, or systemic risks in other markets could cause this. In some rare occasions, surging bonds could also happen amid a growing economy to match other investments’ yield.

Economic concerns and recession fears

The current scenario, however, suggests the rise comes with increased recession fears amid a highly leveraged market under uncertainty. Gold has reached new all-time highs consistently as geopolitical conflicts intensified in a fragile global economy after the COVID-19 pandemic.

October’s nonfarm payroll data came with 12,000 new jobs created, far below the 106,000 expected for the month. Meanwhile, executives of large companies like Nvidia and Amazon have offloaded significant amounts of shares in massive insider trading activities, as Finbold reported multiple times. Suggesting a de-risk movement from smart money players.

Notably, China and other countries have been selling their US debts, highlighting a growing fear of holding this exposure. Conversely, Tether has surpassed Germany, Australia, and the UAE as the 18th largest holder of US Treasury bonds, with over $102 billion of exposure as part of its USDT’s reserves.

As things develop, traders and investors will continue to monitor economic data and make decisions accordingly.